This is going to be an uncomfortable read. Surviving 2023 is going to be very difficult for many people.

As always, there will be many opportunities if you know where to look. But, being able to act on those situations will be very difficult. That makes these opportunities even more lucrative.

In an attempt to keep this post relatively brief, I’ll be skipping over a lot of details. You can dive down your own rabbit holes, to follow up on some of the topics I’ll be bringing up.

I’m also not going to sugar coat some of the stark realities that are coming our way. For the better part of the past decade, our society (mostly in the West) has been obsessed with being sensitive to everyone’s feelings.

To speak of anything that might be offensive to a certain group, would be considered potential suicide for your professional and social life. So, there has been a lack of anyone saying anything that might get themselves cancelled.

Now, the tide is turning. Those who have been obsessed with trying to police the actions of others, instead of worrying about their own housekeeping, are about to have their teeth kicked in. Reality is coming fast, and only those who take the pragmatic path forward will thrive.

Lastly, I’m going to make a prediction and identify specific opportunities for each of the topics below. Only time will tell how accurate my speculations will be for surviving 2023 and beyond.

Let’s jump in…

Surviving 2023 – The Coming Challenges

It’s pretty easy to find problems with the world right now. The topics I’ll be reviewing are by no means a complete list of all the coming challenges. Instead, these are the immediate problems that I see unfolding over the next 24 months. (The second-level opportunities will start to reveal themselves in the coming years.)

Here are the topics that I’ll be reviewing:

- Real Estate

- Consumer Debt (most notably, auto loans and credit card debt)

- Inflation & Interest Rates

- Geopolitical Conflict

Real Estate

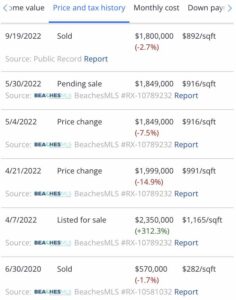

The transformation that has occurred in the real estate market over the past two years in nothing short of absurd. I know that everyone has a story to tell about their local market, myself included. Check out what my neighbor did (this is an actual screenshot of his property listing on Zillow):

To clarify what this says, my neighbor bought in June of 2020 for $570,000. He then spent about $50k in remodeling over 2 years (really he just put in new floors, painted everything with a fresh coat, and added some new landscaping). He sold in September of 2022 for $1,800,000.

Although my example here is extra absurd, this incredible price increase was not uncommon over the past two years throughout most of the United States and other parts of the world.

What caused this? Weird timing with the pandemic, supply/demand issues, artificially low interest rates, blah, blah, blah… The causes don’t really matter any more, because this has all already happened.

So, what comes next?

Now that real estate borrowing costs have surged over 7%, one of two things needs to happen:

- Interest rates need to go back down.

- Housing prices need to decline.

Without either of these two things happening, the housing market will freeze. Buyers simply can’t afford to purchase a home if they aren’t using all cash.

Let me explain…

The Real Estate Affordability Issue

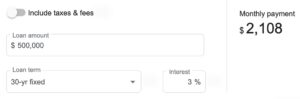

In the past year, mortgage rates have gone from just under 3% to now well over 7%. While a 4% change might not seem like much, let’s check out what this really means…

Assume that you are borrowing $500,000 to purchase a home, which is well below the jumbo loan threshold. Borrowing $500,000 at a 3% rate looks like this:

Now, what if we borrow the same $500,000 at a 7% rate?:

That’s a $1,219 per month difference, which equates to about a 60% increase in the cost to borrow the same exact amount of money.

This is very important to understand, because lenders issue mortgages based on the amount of money the borrower can afford to pay per month. Now that it costs 60% more than just a year ago to borrow money, most home buyers are completely priced out of the market they were originally in.

If you’re in the market to buy a home right now, try to wait. If you can’t wait, submit an offer that is FAR below the current asking price.

Without interest rates significantly declining, sellers will have to start slashing prices very soon.

Predictions for real estate:

- Prices, across the US, will decline by an average of 20% by the end of 2023.

- Some areas will see declines of up to 40% or more.

- Similar to Countrywide in 2008, some lenders will either go bankrupt, liquidate significant portions of their debt portfolio, and/or be bailed out by the government.

Specific opportunities in real estate:

- Luxury and vacation markets, where buyers of the past couple of years have purchased second homes, will likely see some amazing deals.

- Remote and large properties, especially in the western areas of the US, will start to come on the market at fire sale prices (think Idaho, Montana, Wyoming, Utah, etc.). This will likely happen as the city slickers who moved out of major cities to pursue country living, during the midst of the pandemic, realize that they aren’t in fact as hardcore as they once thought.

- Buyers (who have dry powder or access to cheap debt) will be able to work with banks to acquire real estate at once-in-a-lifetime values.

Consumer Debt

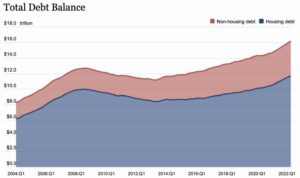

Consumer debt, which is a combination of credit card, student loan, vehicle loan, and other consumer type loans, is at an all time high.

Source: New York Fed

Now, just because consumer debt is at an all time high, doesn’t necessarily mean that there is a problem. However, considering that we are almost certain to be entering a recession, I predict that we’ll see a wave of consumer debt defaults like we’ve never seen before.

Surviving 2023 for those with heavy consumer debt will be very difficult.

Cars, trucks, boats, motorcycles, RVs, and anything you can finance will likely be repossessed and sold off at fire sale prices in the coming 2-3 years.

Furthermore, lenders (both commercial and private) will likely have to write off enormous amounts of bad debt, as consumers default in record numbers.

Those who are in a position to purchase these distressed assets could end up doing very, very well. This will require patience and plenty of dry powder to deploy.

Predictions for consumer debt:

- Large waves of defaults will start by mid-2023, and continue for another 12-24 months.

- Specific markets, like RVs or boats, will see a crash in potential buyers, resulting in a serious decline in prices.

- Some sort of government bail out program will be unrolled to protect many of the defaulting parties from having to go though traditional bankruptcy (perhaps some kind of short-sale system, or loan forgiveness program).

Opportunities arising from consumer debt defaults:

- Ability to acquire vehicles, boats, and other non-real estate assets at fire sale prices.

- Creating marketplaces or brokerages to buy up large portfolios of repossessed vehicles/boats/RVs/etc., for eventual resale. This is a picks and shovels approach. (Which I have done in psychedelics, twice, and am now doing in longevity.)

- Actually purchasing portfolios of consumer loans, to then pursue repossession and/or debt settlements.

Inflation and Interest Rates

Surviving 2023 will be just as much about preserving your personal wealth as it will be about actually increasing it. In fact, if you can just maintain your purchasing power throughout 2023, you’ll likely be in a better position than the vast majority of the population.

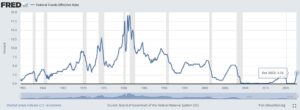

Some perspective, of where rates are and where they could go. Source: FRED

I’m going to skip the complexities of what’s going with inflation and interest rates and jump to my predictions and opportunities.

Predictions about inflation and interest rates:

- Inflation will likely surpass 10% at some point in 2023. (Despite the government’s best attempts to change the metrics by which we measure inflation.)

- Interest rates will stay higher for much longer than is currently being projected. Sometime in 2023, we’ll see the Federal Funds Rate reach 5% and possibly go higher.

- With high inflation and higher rates for the US dollar, we’ll see other nation’s currencies absolutely destroyed. The euro and pound will remain close to parity with the US dollar, and other currencies (especially those not correlated to commodity based economies) will suffer badly.

Opportunities with inflation and interest rates:

- Those who can maintain their wealth outside of fiat currencies (via precious metals, cryptocurrencies, income producing assets, and/or other types of inflation hedging assets) will be in a great buying position.

- Private lenders, who can securitize loans with high valued collateral, will be able to squeeze some yield out of fiat capital (despite aggressive inflation). Defaults, although not ideal, should be easily compensated by the high value (unleveraged) collateral.

- Fx traders and other types of arbitrage traders will see enormous opportunities as global currencies, inflation rates, and central bank interest rates whipsaw.

Geopolitical Conflict (Surviving 2023, For Real)

This is the section where I might lose you when it comes to surviving 2023. The uncomfortable predictions I have to share are neither fun to think about nor easy to believe. I truly hope I’m wrong with what I personally see unfolding in front of all of our eyes.

There are two main trends that I want to identify:

- Recency bias. In short, the last several decades have been relatively great for humanity. Increasing qualities of life, improving healthcare, limited global conflict, and general social and economic prosperity. This has been primarily driven by human capital, access to cheap debt, and increasing digital connection via the internet and other tech driven platforms. This time period of prosperity has created several generations that have no familiarity with truly hard times, and therefore don’t expect any future major challenges (due to their recency bias).

- Clear, factual increasing polarization of global powers. Despite decades of increasing globalization, that trend has distinctly peaked and is currently in reverse. As I write, the EU, US, and other NATO/Western nations are actively disengaging in nearly all relationships with China. The same can be said for Russia, but in the form of sanctions. Simultaneous to all of this, there is a general ‘choose your side’ scenario that is currently unfolding in terms of what global power and agenda to back.

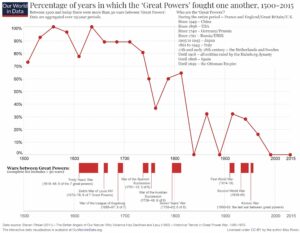

The combination of these two trends suggest that a return to global conflict is likely, especially considering historical data that demonstrate world powers at odds.

Source: OWID

This chart is not to suggest that our world should revert to a mean of almost always being in conflict, but it does demonstrate the relatively long period of time which there has not been globalized fighting.

Over the last century – specifically since the end of World War 2 – the decline in conflict is especially noteworthy.

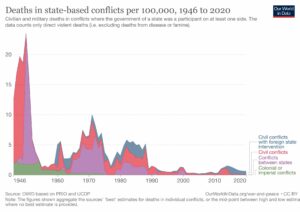

Source: OWID

Interestingly, despite the general decrease in clashes among superpowers, state-based conflicts are actually increasing.

Source: OWID

The charts above paint a picture which represents a down trend of deaths from conflict, but an uptrend in the number of conflicts. Will this culminate to a spill-over point, where large scale numbers casualties will return as a trend?

Surviving 2023 as the World Goes to War

I don’t believe we’ll see traditional warfare unfold in the coming years, as we’ve seen in the past, and as we’re currently witnessing in Ukraine. Large scale attacks and invasions are enormously expensive and are more recently resulting in less success (for both the invading and invaded countries).

As demonstrated in Vietnam, Afghanistan, Kuwait, and Iraq, large scale land based invasions are gigantic undertakings that have limited long term benefits.

The only real result to these wars was the perpetuation of the military industrial complex, which is likely the current motivation for today’s world superpowers to engage in conflict.

Source: PPF

Killing people and ruining infrastructure are the war strategies of the past.

Killing economies and ruining trade routes are the wars of the future.

And that’s exactly what is happening in our world right now.

Predictions about global conflict:

- Much of the warfare that will transpire will be without any blood shed. I previously wrote about this, earlier this year, in regards to what is happening in space. What is unfolding there is almost exactly as I had forecasted.

- There will be a large scale ‘attack’ that may symbolically determine the start of WWIII, but will not be as visually dramatic as an event like Pearl Harbor. This large scale attack would likely effect the financial and/or operational infrastructure of a large economic center.

- Although it may appear that Russia, China, Iran, and North Korea are the main countries which are running out of options, the US and EU are in similarly precarious economic conditions. I would be surprised if we do not see a major event within the next 12 months.

Opportunities arising from global conflict:

- “Want to be a War Dog Investor?” is one of my top trafficked articles, because it tells you exactly how to make money from/during a war. That said, I’d never pursue this strategy and certainly wouldn’t consider this a strategy to surviving 2023. In fact this may be better placed on a list of NOT surviving 2023! (Read the article to find out why).

- As mentioned in previous sections, simply maintaining your current wealth is one of the best opportunities to come out the other side on top.

- Investing and building companies which are completely disconnected to the risks that come with global conflict. Primarily, this would exclude businesses that rely on cross border commerce that may come under scrutiny and/or be banned.

Summing Up Surviving 2023

There are clearly many variables to consider for the next several years. Just like any investment plan, it’s wise to be diverse in how you store your wealth. It’s also necessary to identify opportunities where you can grow your wealth.

Here are some key concepts to surviving 2023:

- Limit your exposure to toxic debt. That would be debt that you currently have, that isn’t going towards paying off a long term valuable asset. Get rid of that debt now, which likely means selling off things that you don’t need, but are paying to own.

- Move some of your fiat currency savings into trusted stores of value. Historically, this has almost always been gold. Perhaps bitcoin is the modern gold?

- Keep some liquidity on hand, so you can be ready to purchase income producing assets at fire sale prices. Be patient. There is always another deal around every corner.

- Start a business now, that you can work on during your free time and has long term growth potential. This is the ultimate insurance policy and will ensure that you have another source of income that you can continue to grow.

If you’re an accredited investor, and would like to participate in investments and companies I am currently building, drop us a line here.