Before we jump into the platinum preservation plan, I want to take a quick snapshot of our world…

Spring of 2022 will be an interesting time period to look back on. Right now, we’re not able to get the whole perspective of what’s going on.

Although we may not understand what’s really going on in our world, it’s certain that there have been very few time periods in history like the present.

Let’s take a look at what is going on globally. This isn’t necessarily to inform you, but instead to have a record of what we know right now. It may be interesting to look back on this information, several years from now, to see how things actually develop.

Here are things we know about our markets:

- The S&P 500 is having its worst start of the year, since WWII, down 13.5%.

- The NASDAQ just had its worst month since 2008, and its worst start of the year ever down 22%.

- Large companies (especially tech) have lost enormous amounts of value. Facebook, now called Meta, lost more than a quarter trillion dollars of market cap early this year. Amazon founder, Jeff Bezos, lost $13.4 billion in a matter of hours after the company’s shares sank. Tesla has lost well over $100 billion worth of value in the past week.

Here are known facts about our economies:

- Inflation has hit many currencies, with the US dollar experiencing its highest rate in over 40 years (8.5%). The Euro is currently at 7.5%, and many central banks are looking at raising rates even as markets begin to falter.

- Global supply chains have been significantly disrupted by both the war in Ukraine and lingering COVID pandemic issues. Although not apparent yet, there are many predictions of major food supply problems around the globe.

- The US GDP declined in Q1 of 2022. This has left many wondering if this is a preview of what’s to come, or a simple echo from pandemic discombobulation.

Geopolitically, the world is sailing full speed into uncharted territory:

- Russia has invaded Ukraine, which is now the largest military conflict in Europe since World War II. Currently, there are no real measures (from any side) to bring peace. In fact, there are only escalatory actions being taken by different nations.

- Russia’s invasion has created a global “choose your side” scenario. On one side, much of the international community, led by the US and NATO, has levied extreme sanctions against Russia. Meanwhile, there are several key countries who have not: China, India, Iran, and others.

- Although there has been no official declaration through any international organization, WWIII is often the discussion in today’s media.

- Putin has eluded to using nuclear weapons on several occasions. Russia state television has even shown simulated nuclear attacks on London, Berlin, and Paris.

- Simultaneous to the Ukraine war, many are questioning if China will invade Taiwan, which would certainly lead the world into global conflict.

Some of the world’s best and most respected investors are sounding the alarms:

- Warren Buffett is calling the current stock market a “gambling parlor” and “he blamed the financial industry for motivating risky behavior among investors.“

- Billionaire hedge fund manager Paul Tudor Jones has said, “You can’t think of a worse environment than where we are right now for financial assets.“

- Ray Dalio, the billionaire investor, recently said, “debt, inflation, internal strife, and a rising China pose grave threats to American prosperity.“

- This list could go on for a while… There are very few successful, experienced investors who see positive gains in today’s markets.

Despite the seemingly endless amount of bad news on the horizon, any great entrepreneur or investor knows there is always opportunity if you know where to look.

For investors and entrepreneurs, I’ll be sharing specific ideas in the near future. I think there will be some incredible areas of opportunity exposing themselves soon.

However, in order to exploit any opportunity in the future, we’re going to need some dry powder. And that’s where the platinum preservation plan comes in.

The Platinum Preservation Plan

Any long time Explorer Report reader knows that I am a fan of investing in precious metals. Although I don’t believe investing in precious metals will make you rich over night, I do believe they are a necessary tool for your wealth building journey.

Sometimes, like right now, there are strange price trends within precious metals. During these times there are opportunities to actually make great returns in addition to preserving your wealth.

For clarity, when I say ‘preserve wealth,’ I am mostly referring to maintaining the amount of money (purchasing power) you have without it losing value through inflation. And considering that the US dollar is experiencing the highest rate of inflation in over 40 years, this principle is all the more important.

If there is an opportunity to preserve your wealth while also positioning yourself for significant upside appreciation, then this becomes an investment worth diving into…

When it comes to an investment that is widely available, has minimal downside risk, and presents significant upside potential… I do not know of anything more attractive than platinum.

If you know of something more attractive, please tell me.

I’m absolutely positive that there will be some kind of cryptocurrency, a random commodity, and certainly many different public stocks that will out perform platinum in the coming years. That said…

Platinum is cheap right now.

Looking at the historical price of platinum, we can see that there isn’t anything notable right now. The price is neither at an all time high or all time low. But remember that the price of platinum, which is shown here in US dollars, isn’t necessarily historically accurate when valued in fiat currency.

Source: MT

Platinum, just like gold or silver, is a precious metal that has shown to consistently maintain its purchasing power over long periods of time.

I’ve talked about this before:

“We all know the story about how an ounce of gold today buys a custom men’s suit. One hundred years ago, an ounce of gold also bought a custom men’s suit. And several hundred years ago, an ounce of gold bought a custom men’s outfit. That should be a good reason for you to own a little bit of gold – to maintain your wealth.”

The same concept can be used for silver and platinum. Yes, the actual purchasing power of precious metals will fluctuate year to year… but in general, they hold their value over long periods of time regardless of fiat currency purchasing power and manipulation.

Additionally, even though precious metals differ from each other in terms of actual price, they typically track the same trend. If gold goes up, so does silver and platinum. If gold goes down, so do most other precious metals.

Sometimes, however, certain metals are left behind or forgotten about. Right now, platinum looks to be in one of those situations.

Platinum has been forgotten.

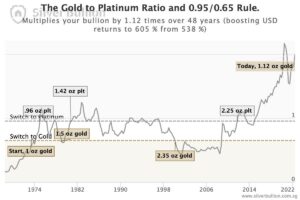

Below you can see the price trends for gold and platinum over the past couple of decades. The price divergence, starting around 2015, is glaringly obvious here:

Platinum (in blue) has lagged behind gold’s (in orange) recent gains. Source: MT

Gold has steadily risen in price while platinum has just bounced around in the same range.

Even if we were to ignore that increase/decrease in price of each precious metal, there is still an investment case based on the relationship between the two. By just looking at the price ratio of the two metals, we can tell if gold or platinum is cheap.

Right now in 2022, platinum is close to the cheapest it has ever been compared to gold. The only other time it has been this cheap is back in 2020 at the start of the pandemic.

Compared to gold, platinum hasn’t been anywhere close to as cheap as it is now.

The below chart shows how you can simply trade between gold and platinum based on this relationship. According to this ratio below, platinum is a screaming buy.

Source: Silver Bullion

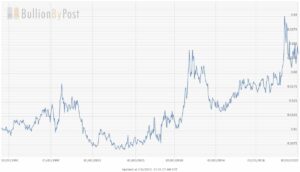

Maybe you’re thinking that just gold has increased in value, which is making platinum look inexpensive? Well, take a look at the silver to platinum ratio:

Source: BullionByPost

As you can see, this trend is very similar. Prior to the past two years, platinum hasn’t been this cheap compared to silver for at least the past thirty years.

What about when we compare the price of platinum to the stock market?

This is where things really look interesting…

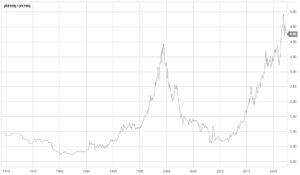

The chart below compares the price of platinum compared to the $SPY ETF (which is an exchange traded fund that tracks the performance of the S&P 500).

Source: Barchart

The blue line above represents the general performance of the stock market while the black line shows the price of platinum.

Notice when platinum was cheaper than the stock market? That’s right… Just before and during the Dot-com bubble. Once the internet bubble burst, platinum went on to increase in price by over 500%.

Today’s stock market valuations compared to the price of platinum, in addition to macro economic conditions, are eerily similar to today (Q2 2022).

The big difference is that the ratio of the stock market (using $SPY) to platinum (using USD priced platinum) is essentially at all time highs.

Source: Barchart

Notice the last time this ratio was so lopsided? That’s right… just before the Dot-com bubble.

Platinum is cheap. What else makes it attractive right now?

Platinum has an incredible amount of industrial uses. The automative industry, electronic manufacturers, pharmaceutical companies, chemical manufacturers, and the jewelry economy all rely on platinum.

I won’t dive into the full backstory of the many uses of platinum, but it’s important to understand that the world is increasing its consumption of the precious metal. This consumption rate isn’t expected to spike in the future, but the use cases of platinum are only expanding.

So even if investors don’t immediately rush in to platinum, to preserve their wealth, various industries will continue to consume the precious metal. And that’s why it’s important to look at the platinum supply and demand situation.

There is an oversupply of platinum, for now.

According to a recent publication from Reuters, “The global platinum market was hugely oversupplied in 2021, the World Platinum Investment Council (WPIC) said on Wednesday as it predicted another large surplus of the metal this year.”

While that may not sound encouraging for investors, there is a deeper story to understand.

If you actually dig into the recent reports published by the World Platinum Investment Council (here), you’ll see that there is much more going on.

For starters, platinum, just like every other commodity in the world, has had abnormal supply and demand trends due to the pandemic.

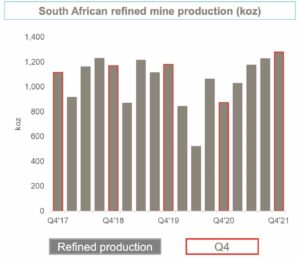

Actual demand from various industries varied throughout most of 2020 and 2021, and the supply side was impacted as well. South Africa, which is the world’s largest platinum supplier, had an abnormally low 2020 Q2 production rate.

Source: WPIC

However, refined production bounced back in 2021. This caused an over supply to the market, which has kept platinum prices down.

But what happened to that oversupply of platinum? China has absorbed most of it…

According to the report:

“This brings us to another contradiction we saw in 2021. While our estimates point to a surplus exceeding 1 Moz, a number of bullion market indicators, as well as anecdotal evidence from our field research, are pointing to tightening conditions in the platinum bullion market…

Feedback from our contacts also suggests that during periods in the second half of 2021 securing physical platinum in the London/Zurich markets was not always easy…

We believe, this conundrum can be explained by strong speculative and quasi-speculative demand for platinum from China. The resulting imports into the country were exceptionally strong in 2021…

Our field research in China suggests that this discrepancy is due to strong speculative and quasi-speculative local demand. The presence of speculative activity is also consistent with patterns seen on the Shanghai Gold Exchange – on a number of occasions price weakness coincided with sharp increases in trading volumes, likely reflecting bargain-hunting by investors. This is not unprecedented – there have been numerous occasions in the past when we have seen such behaviour in China. Nor has it been exclusive to platinum. Our estimates and field research pointed to a build-up of palladium stocks in China a few years ago, again fuelled by quasi-speculative buying. We have also seen similar activity in rhodium in the past.” –WPIC

China is buying platinum. Everyone else is selling.

Well, I don’t know if everyone is selling… but a lot are…

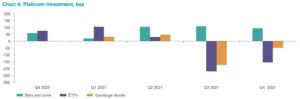

Source: WPIC

The table above shows the investment trends of both physical and ‘paper platinum.’ (Paper platinum is just a slang term to refer to platinum investments that are represented by paper, like a stock or ETF. Some precious metals investors believe that holding physical precious metals are best. However, for many investors, holding physical metals is both expensive and inconvenient.)

The outflows of investment during Q3 and Q4 of 2021 likely represent investors appetite for risk in traditional equities, as concerns from the pandemic started to alleviate. This same trend also correlates to the incredible gains seen in the tech sector of the stock market during this same time.

Although this selling was likely done by mostly institutional investors (who use safe haven investments to hedge their larger portfolios), the end result is that their actions added to the glut in global platinum supply.

Platinum wildcard #1: PGMs

The first wildcard is what will happen with actual platinum consumption going forward. Without going too deep, it’s worth noting that platinum can sometimes be replaced with other PGMs (platinum group metals) such as palladium or rhodium.

Although platinum cannot always be substituted with other PGMs, this has happened most recently with catalytic converters for internal combustion engines (ICEs).

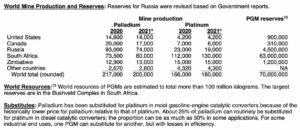

Source: USGS

As noted in the above graphic, palladium has been used as of lately for catalytic converters. However, the price of palladium has recently sky rocketed. If auto manufacturers go back to using platinum, this will add to the demand side of the platinum supply chain.

Platinum wildcard #2: Russia

Russia is currently the number two producer of platinum in the world. (South Africa is by far the largest platinum producer. It’s also worth noting that South Africa has taken a neutral stance on the Ukraine conflict, with some geopolitical strategists suspecting a stronger than normal relationship between Russia and South Africa. Time will tell.)

Although it’s impossible to predict, it’s plausible that none of Russia’s production for 2022 will make it to the global market.

In fact, their platinum production may stay within Russia or go straight to China. Either way, this could significantly impact global platinum trade and cause trickle down effects for many industries.

If we want to speculate even further, there could be an argument made about certain countries stockpiling strategic resources in preparation of global trade shutting down due to large scale international conflicts. As much as I hope that isn’t true, what is happening in Ukraine makes that idea not totally unrealistic.

How to invest in platinum now.

There are three main ways to invest in platinum:

- Buy and own physical platinum (coins, bars, bullion). Although this is the safest, in terms of you actually holding your investment, this is expensive and cumbersome. There are fees to purchase and sell physical precious metals, which can add up to 10%-20% of the total cost to buy and sell. However, if you’re set on actually holding your platinum investments, you can purchase physical platinum from pretty much any reputable precious metals dealer.

- Invest in platinum miners. There are dozens of publicly traded mining companies that produce platinum. It’s likely that you will see much larger returns with an investment in a platinum mining company (versus an ETF), as mining stocks can generate massive returns for investors. The flip side is that mining companies can, and often do, go completely bankrupt. This may be due to mining failures, local government issues, or simply mismanagement. If you’re going to invest in platinum mining companies, understand the risks that come with the possible rewards.

- Invest in platinum funds that hold physical platinum. This is the preferred method for most investors who want the flexibility to buy/sell in a single day while also not having to deal with storage/transportation/security problems. Most of these funds do have fees, but they are often worth the price when considering the alternative of what you’d have to do to own physical platinum.

Although there are a variety of ways to invest in platinum, the easiest and most reputable is through the Aberdeen Standard Physical Platinum Shares ETF ($PPLT). This ETF gives you direct exposure to physical platinum that is stored in vaults in London and Zurich, which is inspected twice per year by a third party auditor. This ETF charges a 0.60% annual fee and has well over $1 billion USD under management.