I’ve put off writing this post for a while.

As in, more than a year. I was originally ready to share a fun story with you… but that story kept going, and going… until I got to here.

Now I feel like I’m at the end of a chapter. I can catch my breath for a second, but I’m definitely moving forward. With a lot more perspective, humility, and confidence.

This past year has allowed me to think about what I’m going to share here… and it’s made me realize that it’s highly likely that you shared a similar story to me. I’m talking about how Covid really turned a lot of our lives upside down.

There were definitely a lot of bad things. I’ve got a lot that I’ll share with you, and I have some bad experiences that I won’t. At least not yet. I’m still working through some of them. It’s been very tough, I’m not going to lie.

But there were some unexpected highs and big wins over the past year for many – me included. We basically had two years where the entire world was living by a new set of rules.

New Rules in a New World

On one hand, we all received a ridiculous amount of new cultural and life style rules and standards. Put a muzzle on your mouth. Wash your hands like a maniac. Rub hand sanitizer oil all over our body like we’re getting lubed up so the virus will just slide off of us. No travel. Businesses subjectively forced to close or stay open. Cannabis dispensaries considered an essential business. Restaurants forced to shut down because people are too close to each other. Airlines, transporting people across countries, remained open while people literally sit shoulder to shoulder. Some of this stuff made sense. Most of it didn’t.

On the other hand, the government was literally giving out free money. It was everywhere. Even if you didn’t receive it directly from the government, it likely trickled down to you in one or two steps.

Most people had no fcking clue what to do – they were literally frozen in place and unable to move. Really, it came down to fear of dying from the virus unknown.

There was another, smaller group of people. This other group quickly figured out how to play by these new world rules. To this group, the rewards looked far larger than the risks.

They were able to notice this opportunity and build devices businesses that sucked the money out of other people’s pockets. I had some good moments with this group over the past two years, but I also learned some important lessons.

I’m going to tell you about that part of my past two years – the business side. It was exciting and stressful, and I learned a ton. I’m going to share with you the exact steps of how I succeeded with several big situations.

Why would I share this all with you?

First off, I’m no longer afraid of sharing great ideas with other people. NDAs are bullshit and execution is everything. If anyone wants to copy an idea I share here, you can try it out on your own or just come work with me.

Everyone has great ideas. I’m sure you’re thinking about your great idea right now. But it doesn’t matter unless you bring it to fruition.

The other reason I want to share all of this with you is because I want to brag about it a little bit. Not really to stroke my ego… I genuinely don’t worry much about what other people think of me anymore. It’s pretty liberating.

I want to brag more so I have a way of looking back on a period of my life that was really fcking hard, but I made it all work anyway. I want to look back over my shoulder, with a smile and the feeling of overcoming a very difficult time in my life.

I’ve learned that it’s important to celebrate your wins, because it motivates you to go do more. Sharing my wins with you forces me to reflect on everything I did… which inspires me to do it again, but even bigger.

Sharing The New Rules of Life

The first rule in the game of life is that there are no rules. There are a bunch of laws, standards, social expectations, and some internal morals that were somehow injected into you by a church, school, or a government messaging service.

But you’re really free to do whatever the fck you want to do. Of course there are variable consequences. It’s just a matter of you navigating risk versus reward, and strategically putting yourself in situations where you exploit your upside and limit your downside.

Once you learn how to do that last part, you just have to swing the bat a bunch of times. Just keep swinging. Just keep swinging. Just keep swimming.

No matter what, you’re going to have failures. All failures suck. No one likes to lose. Some people hate losing so much that they completely stop trying… they don’t put themselves in situations where they have risk. They crave safety and stability. That’s most people.

Other people hate losing, but they love winning. They love the feeling of winning more than they are afraid to lose.

The bigger the win, the bigger the potential failure.

You can try to limit that downside risk as much as possible. You can do clever tricks and get help from really smart people… but that risk always creeps up as the upside grows.

People who are competitive and love winning get to feel the sensation of losing a lot. It’s an acquired taste that few people know how to translate into fuel. Most people spit that taste of losing out of their mount, never to get close to it again.

Losing is embarrassing. It means you’re dumb or weak, or just that something or someone is better than you.

Losing sets a bar that you can’t get over. It’s a benchmark of failure.

Winning builds a foundation under your feet. It’s the starting point. It’s the swimmer’s block that you plunge off of in search of your next challenge.

I Sold Three Companies During the Pandemic

I’m going to tell you about each company. How and why they started, how they scaled, and how I exited them. I’ll try to give as much detail as possible, but I’m going to skip over a lot.

The truth is that the building of any kind of business is literally a series of hundreds of important decisions that need to be made everyday for several years straight. There’s often fun involved, but it’s impossible to learn how to build a business unless you do it yourself – or you work with someone who’s done it before (there’s another pitch to come work with me).

That’s not to say that you can’t learn from others. I hope what you read below will give you lots of ideas and perhaps you can avoid some of the many mistakes that I made. But no matter what, if you set off on an (ad)venture of your own, you’re going to run into a lot of challenges and you’ll need to overcome lots of failures.

This process is exhausting, overwhelming, and just plain scary – especially if you’re funding it yourself, which is what I did with the three companies I’ll be sharing below.

I first mentioned my ‘transition’ in an article I wrote in mid-2020. I called it “Time to Walk the Talk.” Basically, I explained about how I was going to go work on building some businesses instead of just writing and investing passively.

Before 2020, I was mostly focused on investing in early stage companies that were targeting unique trends. Although I had a lot of success with this strategy, I also ran into many frustrating situations that mostly had to do with the entrepreneurs within the investments I made.

So, I decided to stop complaining about those entrepreneurs and become one myself…

***DISCLAIMER: Although the three companies I founded below are still in business, I no longer have control or ownership. Therefore, what you see of these companies today is much different than when I sold them. Some of these changes are great and some are not necessarily what I would have done. Either way, this is one of the big lessons I learned… Whatever you build and then sell, will morph into a new vision of what you started. Sometimes that vision doesn’t align with what you intended. Fortunately, in these circumstances, there isn’t anything major… but it’s something to think about if you ever end up selling a company.

Dissim

The building of this first company, called Dissim, was a very unexpected and unique situation. I wouldn’t consider myself as the main founder, as a very talented designer came to me with this idea.

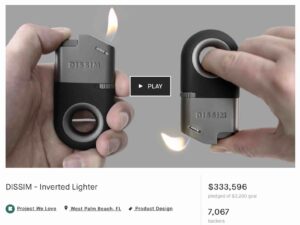

I was originally approached by an industrial designer who had created a unique lighter. His thought was that since I had been an active investor in the cannabis industry, I could help him grow sales because of the lighter design (looking at the lighter, you’ll understand why he wanted to market it to the cannabis world).

Screenshot from the original Dissim Kickstarter campaign.

Although the expectation was to make connections within the cannabis industry, what ended up happening was completely different. Myself and a small team incorporated the business, filed for patents, raised over $300k via a Kickstart campaign (which was non-dilutive funding), established manufacturing overseas, dealt with insane logistics challenges due to the pandemic, and eventually sold to a publicly traded company.

Everything I just mentioned above happened in less than a year. Although the project was a success overall, the experience and process was a complete nightmare. Here are the things that I’ll never want to do again (in no particular order):

- Deal with manufacturers in China. (Whenever possible, try to manufacture locally.)

- Try to fulfill tens of thousands of orders. (Use a fulfillment center early. It’s worth the cost.)

- Manufacture in mass quantities while trying to balance quality control. (Manufacture in batches to ensure that quality continuously improves, and you don’t get stuck with faulty inventory.)

- Focus on customers that are worth serving. (No matter how hard you try, sometimes you just can’t make people happy.)

I’m obviously skimming over a lot of the details here, but I’m sure you can fill in the blanks with how complicated and challenging this company was to build. In fact, for the most part, I don’t ever want to deal with building a company that relies on delivering physical products ever again.

There are certainly enormous opportunities around this business model, but it comes with equally enormous challenges. (Much of which is outside of your control, like getting a shipping container stuck at a port for months, with valuable inventory sitting inside, deteriorating because of temperature issues…).

We ended up selling Dissim because we reached a point where we had enormous interest from buyers and no infrastructure to support the entire sales process. The only way to handle what we were encountering was to either build the infrastructure ourselves (which would have taken a very long time and large capital injections) or sell to a company that could immediately take over and fulfill the demand.

We chose the latter option. I ended up making a deal with a public company in a matter of three days. The deal included a royalty agreement where the founding Dissim team gets a portion of sales far into the future.

Here are some key take aways from building Dissim:

- Kickstarter is an underrated tool to raise capital for your startup. If you follow a well thought out strategy, spend the time (and money) on the little details, and really put some effort into the entire campaign… then you can raise significant money. It’s also worth noting that this money is not for equity in your company… so you’re really not giving anything up in your company.

- Manufacturing is very difficult. It’s especially difficult when you are doing it overseas with a product that is custom and untested. Make sure, if you every manufacture anything, start slow and progress in patient orders. It’s tempting to want to make large production runs, especially when there is big demand, but that can backfire on you big time.

- Building a company that requires large volumes of fulfillment is extremely difficult. Unless you plan on shipping a couple products per day, make sure you partner with a great fulfillment center. Shipping dozens, hundreds, or in our case, thousands of products per day is unbelievably complicated. Once you fall behind it’s nearly impossible to catch up without stopping sales.

Neuly

Neuly was an accidental company. Not as it stands today, but when I first started it.

I’m particularly excited to share the building of Neuly, as I believe that anyone can copy what I did with this company. Although Neuly focuses on psychedelic medicine, the business model, structure, and execution could be replicated for nearly any niche I can think of.

Even though I didn’t start building the company until 2019, I had been collecting much of the content that makes up Neuly today for several years prior. Let me explain…

Around 2016, I started to collect information about the psychedelic medicine world. After reading several books and research reports, I began to sense that psychedelics were about to go mainstream. This was both fueled by trends within the public and some breakthrough studies that were beginning to attract investor’s capital.

I gathered information about scientists, researchers, psychedelic drugs, clinical trials, retreats, and literally anything that had to do with psychedelics. I kept all of this information somewhat organized in over a dozen different simple spreadsheets.

I collected all of this information with the intent of having a clear understanding of what companies I could invest in. However, at the time, there were only a handful of companies that were even around… let alone actually raising money from investors.

So, over the course of a couple years, I just kept collecting information until I got to a point where I had more information than I knew what to do with. Each spreadsheet that I had, with hundreds of rows and columns of information, were essentially useless to me.

In order for all of this information to be valuable, I needed a system where I could compare datasets and search for specific datapoints I was looking for. In very simple terms, it was if I had an enormous pile of random sticky notes with great information, but no real way to make sense of it all.

At this point I realized that I needed technical help – I needed a developer who could take all of my information and organize it all. I needed a database built to make sense of all the content I had collected about psychedelics.

I reached out to a contact of mine, who had helped me build websites in the past. I told her what was going on and what I needed done. She completely understood what I needed and told me she could get something ready in a couple weeks.

In the back of my mind, I thought she was going to make a simple database that was essentially a glorified spreadsheet. Based on my work with her previously, I had assumed that her specialty was simple website building tasks with basic coding capabilities.

I was very, very wrong!

She ended up showing me a polished database that was not only fun to use, but extremely valuable to me as an investor. I could compare companies and their clinical trial progress, look at people and see where they were working, and compare all kinds of datasets.

She had essentially thrown together all of the information I had collected over the previous several years, and then built tools to filter out exactly what I was looking for. It was amazing! Not only had she built a tool that was extremely useful, she also proved how talented she was… which led me to build a lot more with her!

(Side note: If you’re an entrepreneur, you should always have someone in your network that is very technically savvy. As the world becomes more and more reliant on tech, it’s absolutely necessary for any business to have some sort of tech component. So, if you don’t already have a coder/developer as a contact, start searching! It can takes years to find someone that you work well with and trust. Just like any relationship, that trust and ability to have open lines of communication take a long time to develop. Start now!)

Fast forward about a year, and I hired a couple more developers and data analysts to help me build Neuly into what you see today. We launched a variety of “firsts” in the psychedelics world, which included a clinical trial tracker, funding visualization tools, and the largest business (company and people details) directory that exists.

This is the homepage of Neuly, after many, many iterations.

Simultaneous to building Neuly, I was also able to connect with nearly every psychedelics company that was around. This was done by tedious outreach, where I would contact a company to add their information to the Neuly database. When I got in contact with a company, I’d offer help by providing any data that they were in need of. This allowed me to build personal relationships with many of the founders within the psychedelics world, which also gave me access to early funding rounds.

While building Neuly, I was able to invest in early rounds of MindMed, atai Life Sciences, Beckley Psytech, Bright Minds, Gilgamesh Pharmaceutical, Tripp, and many other psychedelics companies (some of which have gone public). These were all great investments and they also expanded my exposure and knowledge of the entire psychedelic medicine ecosystem.

Neuly was acquired by a VC firm in mid-2021 and is still operating and being improved. While I don’t completely regret selling Neuly, I do wish that I had held on for longer.

The reason for selling was a combination of stressful personal things that were going on, in combination with the terrifying process of funding the entire venture myself. Building a company is scary… and when you fund it yourself, it just takes the stress and fear level to a whole ‘nother dimension!

I would consider Neuly as a personal “win,” in the sense that I built something from the group up and was able to exit out of the entire venture with a profit. But, looking back, I know of so many little mistakes I made. For the next company I launch, I’ll have much more confidence (which came from eating a lot of humble pie!).

Here are some key take aways from building Neuly:

- Managing a tech team is very possible, even for someone who isn’t very technical. If you’ve ever thought of building some sort of tech platform (web app, mobile app, website with lots of tools/features, or even software), you should just go for it. Go to a freelancer site like UpWork, start interviewing people, and then just get started. You will no doubt make a lot of mistakes, but I can tell you from experience, that it’s very doable!

- Data is everywhere! Earlier I mentioned that anyone could replicate the business model for Neuly… and I really mean it. If you have some sort of hobby or knowledge in a unique niche, all you really need to do is aggregate lots of data that relates to that niche, and make a database. It could be certain kinds of books, or model planes, or a sport, or literally anything. Chances are that if you’re interested in something, then other people are too… so you can make a database that acts as the hub for your interesting niche. You can then charge a subscription fee to access that data.

- Branding and UI/UX can transform any kind of content. When I first started Neuly, I didn’t even have the name “Neuly.” Instead, I just had a bunch of spreadsheets with data and I bought a bunch of domains like psychedelicdatabase.com (<- which now redirects to neuly.com). Once I created a name – Neuly – and put together some logos, colors, and fun graphics, the entire database experience changed. It became fun to poke around and look at information. So, if you’re ever building something, think of the user and how they will react if you can make their experience more enjoyable.

- Creating businesses that have a data component often means that the business’s value is exponentially increasing. That’s because as the data sets grow, the ability for that data to be monetized and/or expanded also grows. This is one of the regrets that I have about selling Neuly. I wish I had held on longer, to allow the value of the data to grow in the background. I’ll remember that for next time!

- When creating a business in a new industry, it’s best to take a broad approach. Although Neuly is a data play within the psychedelics industry, there are really many ways to monetize that data. It could be jobs, events, B2B data contracts, or really anything that relates to information. When new industries arise, it’s difficult to tell where things will head. So, if you take a broad approach, then your chances of success are much higher.

- There is really far too much to explain about how I built and sold Neuly. But if you ever want an example of a non-tech person (me) who invested well over 6-figures of their own money into a startup, and then sold that startup within a couple years for much more than was invested… you can talk to me!

Psychedelic Invest

At first glance, you may think that this company is almost the same as Neuly. And, to a certain extent, you’d be right. But, that’s not how it first started…

Before I dive into the building of Psychedelic Invest, I want to touch on a simple but important concept when it comes to building businesses. There is no single trick, guidebook, or easy solution when it comes to building a business that will become successful.

Becoming a successful entrepreneur is mostly about patience, consistency, and agility.

This concept is one that I am still learning and I’m finding becomes more important over time. The agility aspect was especially important when building Psychedelic Invest.

I started to build Psychedelic Invest shortly after I started Neuly. I noticed that there was tremendous interest from investors to enter the psychedelic medicine world, but almost zero information about how to do that.

This was evident when I checked out online search terms (meaning, what people were actually searching for in relation to psychedelics). Once I understood that there was in demand, I went out and bought many different URLs, one of which was PsychedelicInvest.com.

After I purchased that URL, I created a website and published lots of different articles about investing in psychedelics. Initially, most of this content was very basic, but accurate and informative. My goal was to build a foundation of content for the website, and then build more once I understood where opportunities were.

Within a matter of several months, the website started to build solid domain reputation for search terms that related to “invest” and “psychedelic.” Today, the competition has increased significantly, but still if you search any word related to “investing” and “psychedelics,” it’s likely that Psychedelic Invest will appear on the first page of Google’s search results.

To be clear, this was the initial intent with the website. Yes, I wanted to provide great information about investing in psychedelics… but I also wanted to establish SEO to ensure that people were actually visiting the site in the first place.

This process (of creating great content, which then brings site visitors) goes somewhat hand-in-hand. However, beyond the original written content I was producing, I didn’t have any specific plans on what to do next.

Sure, a website will grow based on the great content you produce… but if you don’t have anything more than great written content, site visitors will only return if new, quality content is continually published.

I’ve had direct experience with this process through my own blog, where I grew my subscriber list into the 10’s of thousands starting around 2017-ish. However, once I decreased the amount of writing, my website traffic dropped off and my email list shrank significantly.

(For those who don’t understand what I’m talking about, it’s important to have good email list hygiene. This basically means that you want people to open your emails and interact with the content, like clicking links and forwarding/replying to the email. If you have a large email list, but don’t send many emails, then subscribers will lose interest. In my case, I have an email list hygiene automation that automatically unsubscribes someone if they haven’t opened a couple of my emails. So, if I send emails less frequently, then my subscribers start to drop of dramatically.)

When I was initially building Psychedelic Invest, I was OK with producing lots of written content (much of which I had outsourced to other writers). But, I knew that I needed tools and features on the website to keep traffic coming back to check information beyond the simple articles being published.

That’s why I launched the first index for publicly traded psychedelic companies. The intent with this index was to quantify the psychedelic investing world and provide context for potential investors.

(Side note: The index is down significantly over the past year, as the psychedelics industry has been completely wiped out. That said, over the past couple of weeks, the index is up over 25%. I’m sure there is much more volatility coming, but if you’re looking for interesting investments that could be significantly undervalued, then you should check out public psychedelics companies. Biotech in general has been hammered over the past couple of years, but I’m sure there will be a reversal in soon, as many companies are currently trading for less than the cash they have on hand.)

This index, although somewhat basic, was a pretty difficult process for me to build out (compared to what I’m used to!). However it has paid back by being the main driver of traffic to the website. This is important to understand, as the index itself does not need to be worked on daily. Instead, it passively provides information to website visitors who return daily to check the price of the index and the individual index constituents.

The index currently tracks over 60 publicly traded psychedelics companies.

As time went on, I began to realize that a lot of the data that was in Neuly could be used on Psychedelic Invest. In hindsight, it’s shockingly obvious that these two businesses are complimentary (and could’ve even been one company).

Psychedelic Invest was acquired by the same VC firm that also bought Neuly. Both of these platforms, that I founded and grew, are now owned by the same parent company and currently operate symbiotically.

Here are some key take aways from building Psychedelic Invest:

- Websites can grow and become very powerful no matter what topic you focus on. The key, however, is to stay consistent with the quality and frequency of published content. If you’re thinking about launching a website about your favorite hobby/niche, the best time to do it is yesterday. It literally doesn’t matter if you have a bad design, not much content, or even a fuzzy vision. Just start it. The historical track record of the site will matter much more in the future instead of how fancy it was when you launched it.

- Building features beyond daily articles can have exponential returns. We built the index, a legal guide, and many other features that continue to bring website visitors to the site. If you can build a website that generates page views without having to produce original written content on a daily basis, then that is a huge win!

- Don’t be afraid to show people what you’re working on. Throughout the process of building Psychedelic Invest, I constantly showed friends what I was up to and asked for feedback. Much of the things on the site today are from ideas that I didn’t come up with.

- Don’t be afraid to reach out to competitors. I ended up forming a couple of great contacts with people that run websites that are in direct competition with Psychedelic Invest. We were able to each grow individually, while staying in touch and helping each other out. Competition doesn’t always have to be adversary… it can also be complimentary.

Humble Pie Really Does Fuel Confidence

Although I just shared with you three companies that I successfully built and sold, I skipped over a lot of the failures in between. There were so many embarrassing, humiliating, and just plain frustrating situations that I have literally forgotten about some of them.

And never mind the unexplainable stress of building something you’re not ever sure will work. It’s the kind of stress that keeps you up at night and consumes your thoughts. It can get dark and scary as the downside risks start to really pile up.

But, I guess that’s the point. When you’re building and going through hell… you just have to keep going. Because when you look back at what you build you forget about a lot of the shitty things you had to experience.

From the outside, this is even more true. Meaning, when you’re building a business, most people on the outside have no idea what’s going on internally. They have no clue about the little day to day chaotic mini-crises going… they have zero understanding of the stress and fear that a founder goes through… and they sure as hell don’t think about all the failures that go into creating something of value.

So whatever personal fear you have about starting a venture, I can assure you that all of that will go away once you push forward and just get things done. And once you complete something, you gain confidence… and you eventually become a confident person.

What’s Next?

I’m already started on my next venture and I’ve already gotten to the stressful and scary part of the process… which means that I am in the right spot!

If you want to follow on with my new journey, check it out here. This time, I’m going to make lots more mistakes, but hopefully none that I’ve made in the past. I’ll continue to write here (hopefully more frequently, like the olden days…).

Ok, after this post, I need to go eat some more humble pie!