Looking for the best hurricane investments seems a little callous, right? I mean, shouldn’t we be helping the victims of a major hurricane, instead of trying to find ways to make money from the weather event?

Well, making investments can often be the best ways to help people. You could fund a company that directly assists with the clean up of a hurricane or buy up distressed assets that no one else will purchase.

I won’t dive into the economic justifications for why investments help stimulate recovering and productivity. If you’ve been reading my reports for long enough, you know my opinions. Efficient markets with level playing fields are usually the solution for getting economies started and running successfully.

With that said, let’s jump into the best hurricane investments.

Public Market Hurricane Investments

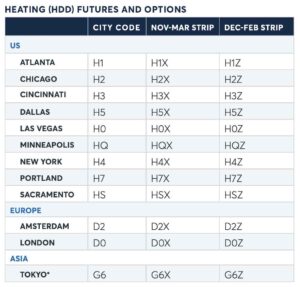

As crazy as it sounds, you can actually trade the weather. The Chicago Mercantile Exchange (CME) has developed a sophisticated way to make trades based on temperatures in different cities.

“From heat waves to arctic cold outbreaks, weather often has a significant impact on business. CME Group’s temperature-based index futures and options provide the tools to help you manage weather-related risk.” –CME

“From heat waves to arctic cold outbreaks, weather often has a significant impact on business. CME Group’s temperature-based index futures and options provide the tools to help you manage weather-related risk.” –CME

While I’m not recommending the CME’s weather trading products, I am pointing out that there are established methods to invest in weather events.

Timing is the obvious challenge when it comes to making trades based on the weather. Similarly, making investments based on hurricane activity requires quick action.

The best hurricane investments in public markets are made right before, during, and shortly after catastrophic hurricanes. That’s because lots of other investors will pile into obvious plays after the results of the hurricane are known.

Companies like Home Depot ($HD), Lowes ($LOW), Generac ($GNRC), Walmart ($WMT), or Target ($TGT) are all clear to benefit from a major hurricane. Although they may lose some stores or inventories, the longer term benefits could be very profitable.

Of course, you could just buy and hold these stocks as hurricane investments. Or you could buy short dated calls on these stocks, starting and finishing during peak hurricane season.

Insurance companies and oil companies (that operate drilling rigs in the Gulf of Mexico) would be obvious losers. Avoid or short these companies.

A big advantage to using public equities for hurricane investing is that you have liquidity to exit your position quickly if things go wrong.

Private Hurricane Investments

Making private investments, based on a hurricane event is much more difficult. But, if you can help fund the right company the profits could be enormous. Here is an example:

A food catering company raised a small amount of funding to purchase larger mobile kitchens. These new kitchens allowed them to get a large federal contract in Puerto Rico. This contract ended up going on for over a year, as the company provided food for the linesman repairing their electrical grid. The food catering company went from several hundred thousand dollars in annual revenue to tens of millions, in just a year. The private investors, who provided funding for those mobile kitchens, got to share in the success of the massive growth.

Although this example is quite unique, what’s common is private companies benefitting from hurricanes. Here are some businesses that could boom after a major hurricane:

- Local home builders

- Fence companies

- Dock repair services

- Landscaping

- Painting

- Roofing

- Plumbing, electrical, & HVAC

- Rubbish and recycling removal

- Heavy equipment rental

Many of these listed businesses could receive much of their revenues from insurance company pay outs, or through government contracts. (Although a little off topic, this explains how you can get a hold of those lucrative government contracts.)

Finding great entrepreneurs who know how to operate small private businesses can be a great find for a private investor. This is especially true if you’re looking to make private hurricane investments.

Arbitrage Opportunities After a Hurricane

I’m calling these arbitrage opportunities because of the unique situation a hurricane creates. There is a short period of time, right after a hurricane, where there are fire sale prices on valuable assets. For an investor, there isn’t much work to be done, other than the initial timely purchase and eventual sale (perhaps a year later).

Ranging from real estate, to boats, to vehicles, many valuable assets are insured. But, as some of us know, actually getting an insurance company to pay out on a claim can be quite frustrating.

In addition to the tedious process with lots of paperwork, an insurance reimbursement can take a long time. This is even more true if it applies to rebuilding a home. Let’s look at an example:

A home owner has a million dollar piece of real estate. Their land is worth $500,000 and their home is worth $500,000, for a total value of $1 million. They lose their house in a hurricane and the insurance company gives the home owner a $500,000 check to replace the loss. Left with $500,000 in cash and a piece of land of equal value, the home owner then gets approached from a buyer (you) who offers $300,000 for the land. The home owner is now left with a choice to rebuild their home with the $500,000 in cash (which would take at least a year), or take $800,000 and buy a new home and start over. This exact example happens all the time in California, where brush fire victims prefer to move on (literally and emotionally), instead of rebuilding.

A similar situation exists with cars and boats. Although it’s a risk to purchase a vehicle that has sustained damage, boats can be a different story. I wrote about this back in 2017, explaining exactly how you can profit.

Some cars and boats will be cheap for a reason. They’re damaged beyond (profitable) repair.

Some cars and boats will be cheap for a reason. They’re damaged beyond (profitable) repair.

Are Hurricane Investments Worth It?

Just like any investment, there are real risks when it comes to investing based on a major weather event. Passive investments and trades (using public stocks and futures) is likely the easiest and least time consuming.

More involved investments, such as private companies or arbitrage opportunities, require significantly more time and come with more risk. However, the potential profits could be huge and the competition among other investors will be lower.

When it comes to making a hurricane investment, the keys to success are preparation and readiness to act. Likewise, the best opportunities will be available when the fewest number of investors are paying attention.