“Animal Spirits” must be the most ridiculous investment term in the world of finance.

Of course, just like any phrase in the investment world, the definition of Animal Spirits is fancy and over-the-top. I have found that to be a common trend in finance: over-complicating simple concepts.

I talked about this back in 2016:

Former Fed Chairman, Alan Greenspan, is famous for talking in circles and essentially speaking long enough to confuse listeners. Once his audience is thoroughly lost, few people ever question his actions because they feel intimidated by his ‘intellectual authority.’

John Maynard Keynes, who originally discussed Animal Spirits in his 1936 publication, The General Theory of Employment, Interest, and Money, also over-complicated the term.

Animal Spirits = The actions investors take during volatile times.

It’s during volatile times where human unpredictability and irrationality can really shine. From a high-level and academically focused perspective, there is a temptation to over-analyze human behavior.

But the reality is that when we feel threatened, we become defensive. We forget about any kind of offensive move and switch to preserving our life and safety.

So, while investors may make unpredictable moves in the financial world during volatile times, we are really just defending ourselves. And it’s impossible to understand each individual’s situation. It’s impossible to know what defensive action is best for each person.

However, if we all switch to defense at the same time, the market and our entire economy can be severely impacted.

Animal Spirits are showing themselves.

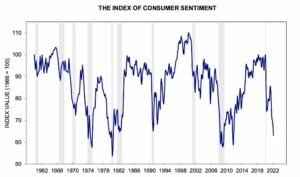

The change in market player’s sentiment has shifted drastically over the past several months. The University of Michigan publishes a variety of “surveys of consumers,” and the data is alarming…

Source: UoM

Consumer sentiment is what drives actual behavior. If someone thinks something is going to happen, they will prepare for that thing to happen. Clearly, as shown in the above chart, consumers don’t think good things are going to happen.

The reasons for this negative sentiment are obvious. Covid, war on Ukraine, record high inflation, and mind-boggling mismanagement by global central banks are some of the key reasons.

But at this point, we’re beyond the reasons. We want to know what’s coming next…

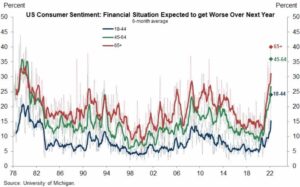

Source: UoM

As you can see in the above chart, we’re certainly not at all-time consumer sentiment lows. But it also looks like we’re headed straight for a recession… That is, if we were to look at the historical data.

According to propaganda an article from last week in The New York Times, “There is little sign that a recession is imminent.” If you actually dig into the article, there is little to substantiate that claim. Instead, the article itself brings up many concerning data points, including a quote from a former Fed executive who says that a recession is “virtually inevitable.”

If we dive further into the data, things look even more concerning. Broken down by age group, older generations expect worse economic conditions over the next year.

Source: UoM

It’s expected that older generations will be more vulnerable to higher inflation and other economic uncertainty. That’s because their wealth is more likely to be correlated to fixed incomes and/or investments that could be negatively impacted.

Younger generations, on the other hand, are in their growth stage and have much more time to make up for uncertain economic conditions.

What’s probably more notable is that younger generations have never even experienced a time period with high inflation. So, the elevated concern in the older group may be more justified, as they have already lived through an inflationary period (the late 1970’s through the early 1980’s).

This is supported by Dr. Richard Curtin, who is the chief economist of Surveys of Consumers. In a recent report, he wrote:

This situation has been termed “inflationary psychology.” Consumers purposely advance their purchases in order to beat anticipated future price increases. Firms readily pass along higher costs to consumers, including the future cost increases that they anticipate.

We’re already seeing this with multiple different companies. Reuters recently reported, “From Hershey to Clorox and Kleenex maker Kimberly-Clark, major consumer-products companies have announced plans to boost U.S. prices further or more broadly than previously proposed this year, signaling that the fastest inflation rate in a generation may not ebb soon.”

Dr. Curtin also explains:

That’s what happened in the last inflationary age, which started in 1965 and ended in 1982: Expected inflation became a self-fulfilling prophecy. Many commentaries assert that the current situation is nothing like the situation faced in 1978-80. That’s true, but irrelevant. The more apt comparison would be to the five to ten years prior to that period, when inflation had not yet reached crisis levels. Government officials claimed they had the policy tools that could easily reverse inflation, just as they claim now.

While Dr. Curtin is specifically talking about inflation here, the broader idea here is that consumers are adjusting their habits. As much as we’d like to believe that bad times aren’t coming, Animal Spirits will likely take over.

There are already some interesting investment plays that are popping up (platinum? or space?), and there will certainly be many more in the near future.