“Adapt or perish, now as ever, is nature’s inexorable imperative.”

-H. G. Wells

How do you reconnect with people you haven’t spoken with in a while…?

Well, if you’re good enough friends, you just pick up exactly where you left of… so let’s get to it!

One of the last articles I published was about how “creative destruction” is changing our world. The general idea is that innovative developments can drastically change the way that we live.

For the past several generations, this rate of change has been exponentially accelerating. I explained this last year:

There are obvious disruptions of the past, like railways and electricity, that have entirely changed the way we live. But most innovations of the past took many decades for the majority of the population to adopt.

Today, in the beginning of the 21st century, we have innovations that were not only invented recently, but have also been completely adopted and integrated into society. While this is exciting, in terms of the pace of innovation, it also requires all humans to keep up with these rapid changes… Or get left behind.

This is blatantly obvious with our use of smart phones. The world, and all of its services, are now at our fingertips.

For consumers and creators alike, advances in technology have completely changed our economies for the better. Products and services for anything you can think of are accessible for nearly anyone… And for entrepreneurs, there are countless tools available to build and scale ideas into successful companies.

All of this change has made many of our lives much better…

But change also scares the hell out of people, because it makes the future uncertain.

Humans crave structure and routine. Predictability allows us to plan and make decisions that will ensure our survival and future success. Anytime there is uncertainty, that future we envision is at risk.

Today, in the first half of 2022, our world is on the cusp of some of the biggest changes we’ve seen in a century.

In addition to the Innovation Cycles that I’ve previously discussed, we are also encountering a period of time where a variety of enormous changes are already underway. These include:

Each of the above bullet points are also interconnect with each other. It’s these combinations of changes which are causing much of today’s global conflict.

Let’s move past the challenges and changes the world is going through… Let’s look at some opportunities that are starting to become very interesting…

In the past I have talked about all kinds of different investing ideas. From psychedelics to uranium, I’ve been very early in many of these big investment ideas.

Unfortunately, being early isn’t always a good thing. But, if you’re prepared to act upon opportunities that you know will happen in the future, you give yourself an advantage when the time does come.

With that in mind, I’m going to be sharing some ideas over the coming weeks. I’ll start with the easiest-to-enter investment idea – meaning that pretty much anyone can get involved with even small amounts of money.

Commodity Prices Will Ride the Rollercoaster

This is obvious right now. Every financial news outlet is warning about the impending crunch on commodities. This is mostly due to the coming global supply chain crisis, which is likely to get worse with the war in Ukraine and sanctions put on Russia.

My friend Patrick recently sent me a chart that KKR published that shows what commodities, coming from Russia and Ukraine, could be impacted:

Source: KKR

Given that there are some very smart professional commodity traders with billions of dollars to trade, I wouldn’t necessarily recommend going all in on sunflower oil.

However, there are some interesting things to take note of, and some ‘second level thinking‘ type trades that look interesting.

Here are two of them:

- Neon is used to make semi conductors. According to Reuters, “Some 45% to 54% of the world’s semiconductor-grade neon, critical for the lasers used to make chips, comes from two Ukrainian companies, Ingas and Cryoin.” So, while the price of neon is likely to go much higher, the trickle down effects to semi-conductor manufacturers may be even more worrisome. I’m not going to dig too far into this one, but if you have any great ideas, shoot me a message.

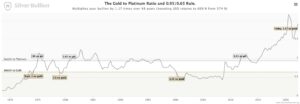

- About 15% of the world’s global platinum exports come from Russia. I’m not sure how the price of platinum will be effected by any supply interruptions coming from bans on Russian platinum exports… but it’s likely to be bullish for the rare metal. In addition to that, there is another price indicator which makes investing in platinum look very attractive right now: the gold to platinum ratio. The idea behind this ratio is that you should be investing in gold or platinum depending on how their respective prices correlate to each other. Which ever precious metal is cheaper is the one you should invest in… and right now, platinum is historically much cheaper than gold. Check out this great chart that Silver Bullion publishes to help you keep track:

Source: Silver Bullion

While the above two investment ideas are likely to be successful in the long run, I expect there to be MANY other investments and trades within commodities that could be extremely profitable.

We recently saw the price of nickel explode higher, which could be a preview of what’s to come for other commodities. BTW, I wrote about the nickel idea four years ago.

Although the changes that are happening around the world are scary for most, savvy investors and entrepreneurs may be entering a golden era of opportunity. Much more coming soon…