We all want the secret map that leads us to success, riches, and pleasure. It’s one of the oldest desires that is consistent with nearly every culture throughout the world.

This desire that we all share, to have access to secret information which will lead us to success, is just as pertinent today as it was thousands of years ago.

Think about how societies operated long, long ago. Essentially, there were tribes of humans roaming the earth looking for food, shelter, and community. These tribes were ruled over by leaders, who made decisions on everything from where they’d get their food to how punishment was ruled out.

Fast-forward to today, and we can see very similar examples with political leaders and CEOs of major companies. Whether the specific leader is voted in, hired by a company, or rises to the top on their own, the similarities are very obvious.

In a nutshell, these leaders are responsible for noticing trends and opportunities, and then acting upon them in the most strategic and efficient way possible. The results of those actions then reflect directly upon that individual leader.

If a tribal leader was able to provide food, security, and a generally good living environment, the people of the tribe would do everything possible to keep that leader in place.

If a CEO is able to make a company profitable, expand, and effectively navigate difficult challenges, the investors of the company will do anything possible to keep that CEO in place.

If a president of a country is able to keep its citizens well fed, safe, and prosperous, then the voters will continue to vote that president into office.

How do these leaders successfully maintain their reputation and success?

There are three main characteristics that enable these leaders to be successful. And these same qualities also translate to successful investors:

Personality. This is especially true with political leaders. Those who are very like-able often have success in leadership roles, as they tend to attract other positive and forward looking people. Conversely, those who are negative and difficult to be around drive potential supporters away.

Their team. Truly successful leaders can’t do it on their own. They surround themselves with advisors, subject matter experts, and confidants that they can utilize to best understand what is happening around them.

Ability to forecast. Anyone can guess what’s going to happen in the future. But, very few people can consistently and accurately forecast what’s going to happen, and even more importantly, create and execute successful action plans based upon their forecast.

The first two characteristics above are very difficult to learn. Really, someone’s personality and the ability to surround themselves with valuable people comes down to the type of person that you are. Some of us are introverts or just don’t have the DNA… some people just aren’t natural born leaders.

However, the ability to forecast is something that anyone can do. The most important part of forecasting is leaving your emotions out of any decision making process. Looking at future opportunities in a constructive manner without clouding your decision making process with irrational emotions is the key to future success.

So, where do you start exploring for investment opportunities that require you to do some forecasting?

Start with a set data points that have been recorded over a time period that spans many years. That way you can look at past trends, which should give you an idea of what the future may hold.

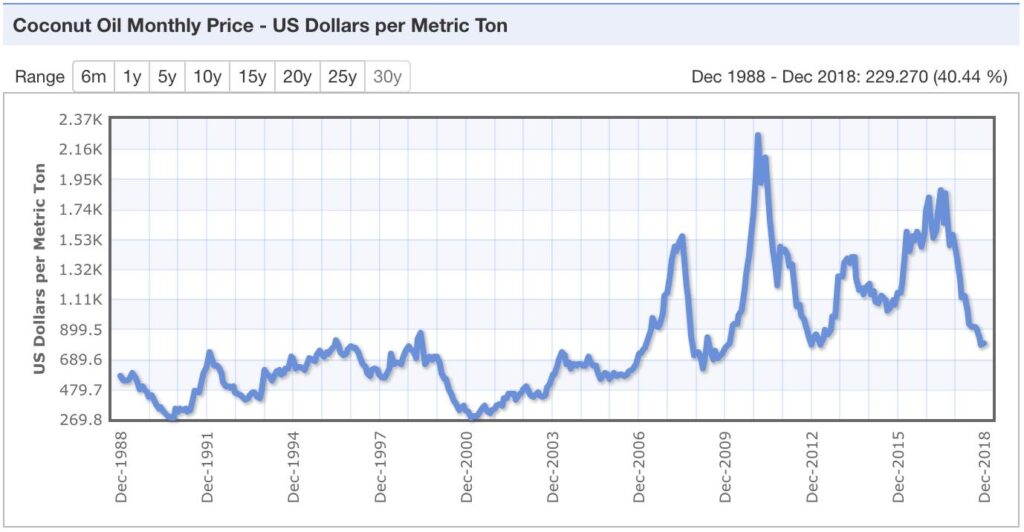

A great place to start is to look at the historical price charts of commodities. There are many websites out there that you can find this information on, one of which is Index Mundi.

Commodities are interesting to look at because generally prices are cyclical. In other words, you don’t have to worry about the value of a commodity going to zero, whereas a company can absolutely go to zero.

Let’s look at coconut oil as an example. In the past 12 months, the price of coconut oil has declined by over 45%. That is a huge price swing for a commodity that is used worldwide.

The obvious investment opportunity here is to somehow invest in coconut oil so you can enjoy huge profits as the price recovers. However, investing in coconut oil is much more difficult than investing in other commodities, such as oil or gold.

Gold, silver, oil, and other major commodities are easy to invest in through the futures markets, ETFs, and even buying the physical commodity itself. Coconut oil, on the other hand, is not so simple.

The best ‘pure play’ on coconut oil is to invest in a farm that is growing coconuts. This is an excellent investment because you end up owning land that grows a cash flowing crop. But, investing in a coconut farm is not as simple as buying a publicly traded stock. Not only does it take an enormous amount of time to find an actual farm to invest in, but once you invest, your money is extremely illiquid. Also, you’re going to have to invest a significant sum of money ($50k+) to make the investment worth while.

Investing in a coconut farm to gain exposure to coconut oil is first level thinking. We looked at the steep decline in the price of coconut oil, so our immediate thinking was, “Let’s invest in coconut farms now while the price is low!”

But that is way too obvious. We need to be second level thinkers. We need to identify opportunities that will be available because of the price decline in coconut oil.

So, we need to dig in and do much more research. We need to out-work and out-think the first level thinkers. We want to look at investment opportunities that others are ignoring.

The majority of the world’s coconut oil comes from Indonesia and the Philippines. That means the the local economies that produce coconut oil are probably negatively impacted, as they are not receiving high prices for the product they are growing. This could result in lower real estate prices in that area.

But, what about the companies that process, export/import, or consume coconut oil? Don’t you think they’d be tremendously impacted by the price fluctuation?

The United States is the largest importer of coconut oil, with many US based companies using the oil for things such as natural food products, make-up, and shampoos. Any of the companies that use coconut oil will have higher profit margins when the price of coconut oil is down.

Now, the example with coconut oil is just one of literally dozens of other commodities you can use the same thinking process with. And, you can also think of investment ideas when prices of commodities are extremely high.

One last idea…

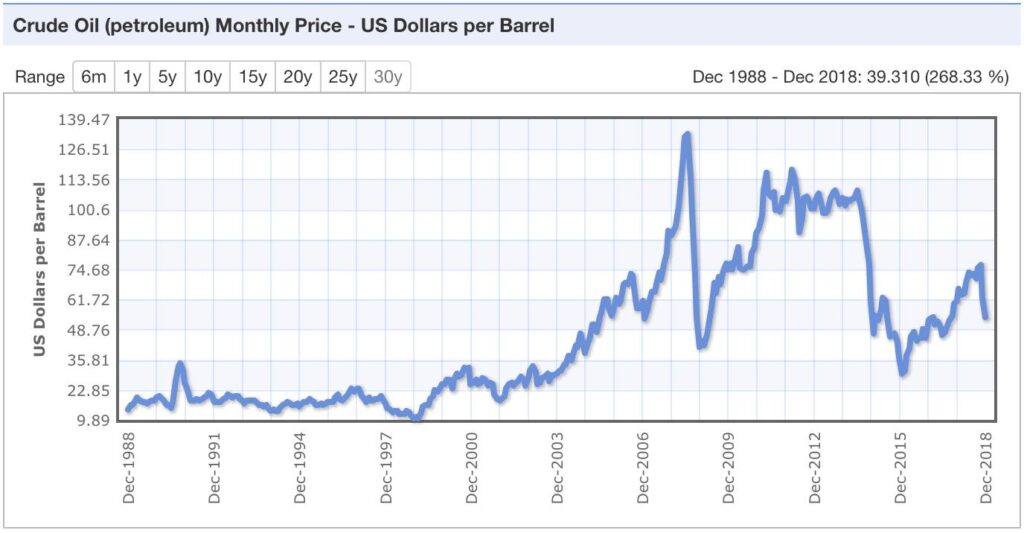

Oil. Most of us are very aware of the price of oil because we see it everyday at the gas station. Gas prices high? Well, oil must be expensive. Gas prices low? Oil must be cheap.

Clearly, that’s an over generalization, but most of us remember how expensive gas was several years ago. Especially around 2008.

Keep in mind that this chart shows the price of oil in US dollars. Part of the reason why oil was so expensive in 2008 (from a US perspective) is because the US was in the middle of a financial meltdown. The dollar was weak and real estate prices were plunging. That resulted in oil becoming more expensive for those holding US dollars.

Conversely, major oil producing countries were doing great! The currencies in those countries were strengthening and they were receiving large amounts of US dollars for their oil exports.

Fast-forward to today and many countries that are major oil exporters have suffered over the past several years, as their local currencies have weakened significantly. Mexico, Indonesia, and Colombia are just a few examples.

Real estate in those locations have also softened as the local economies have declined with the price of oil. Additionally, their currencies have decreased in purchasing power while the US dollar has increased in purchasing power.

This has resulted in an enormous opportunity for US dollar holders to purchase real estate in those countries. Colombian real estate in particular is extremely attractive for anyone holding US dollars.

That’s why we’re going there at the end of May this year. And you can join us as a guest if you reserve a spot now. (This trip will for sure sell out.)

E/P members: Your spot is already saved.