Delayed gratification versus immediate reward.

This concept I something researchers have studied for years. They have tried to understand why our brains desire different rewards based on a time frame. Really, the only reasonable explanation is that people are just programmed differently. It’s literally embedded in our DNA.

As a quick example, I’m sure we’ve all seen the experiment where children are offered one piece of candy immediately, or they get two pieces of candy if they wait ten minutes.

Obviously, two pieces of candy are better than one. But, for most kids, waiting those ten minutes is agonizing and not worth the wait… they MUST have the candy, so they opt for the one piece immediately.

Meanwhile, a minority of children will wait the full ten minutes for the two pieces of candy. They are able to have the patience to delay their gratification for a larger reward.

Jay Kim, who is my partner at Explorer Equity Group, recently wrote about this by saying, “there are numerous academic studies that have proven that people who choose to delay their gratification (have lower time preference) end up being more successful vs. people who prefer instant gratification (have higher time preference).”

To take the other side of the argument, many people will argue that you need to be paid upfront for ANY work that you do. The rationale is that you must value yourself to the market, or else people will take advantage of your free work and never pay you back in the end.

This is certainly true. There are many people out there that will take advantage of your hard work and never compensate you.

But, ask yourself this question: “Is it the fault of someone who takes your work for free? Or is it YOUR fault for negotiating a situation where you work for free and never get paid?”

I’d argue the latter, that the most successful people in the world are able to create massive value, but are rewarded much later for their efforts. They are able to position themselves in a way that they are guaranteed to be paid later with a much larger sum.

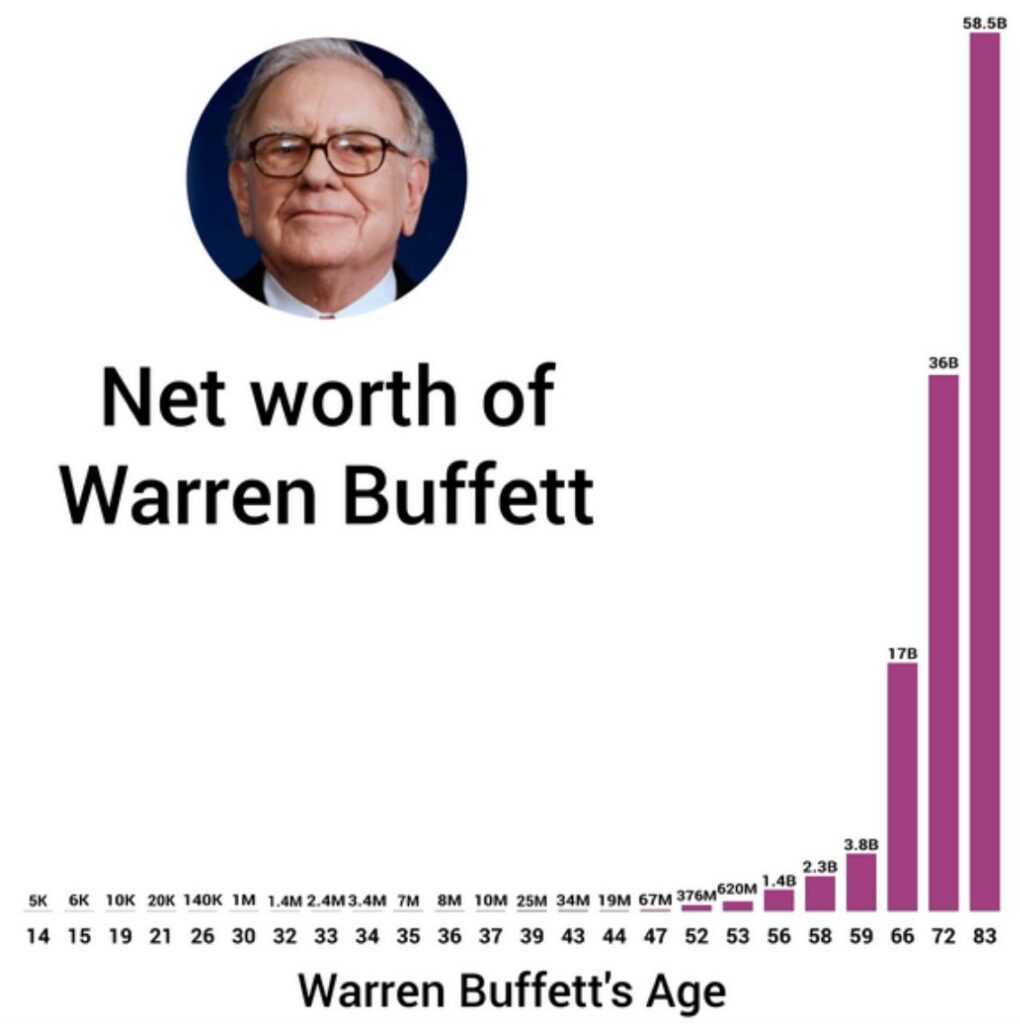

Just look at the world’s most famous investor’s track record:

If this isn’t the most glaring example of delayed gratification, then I don’t know what is!

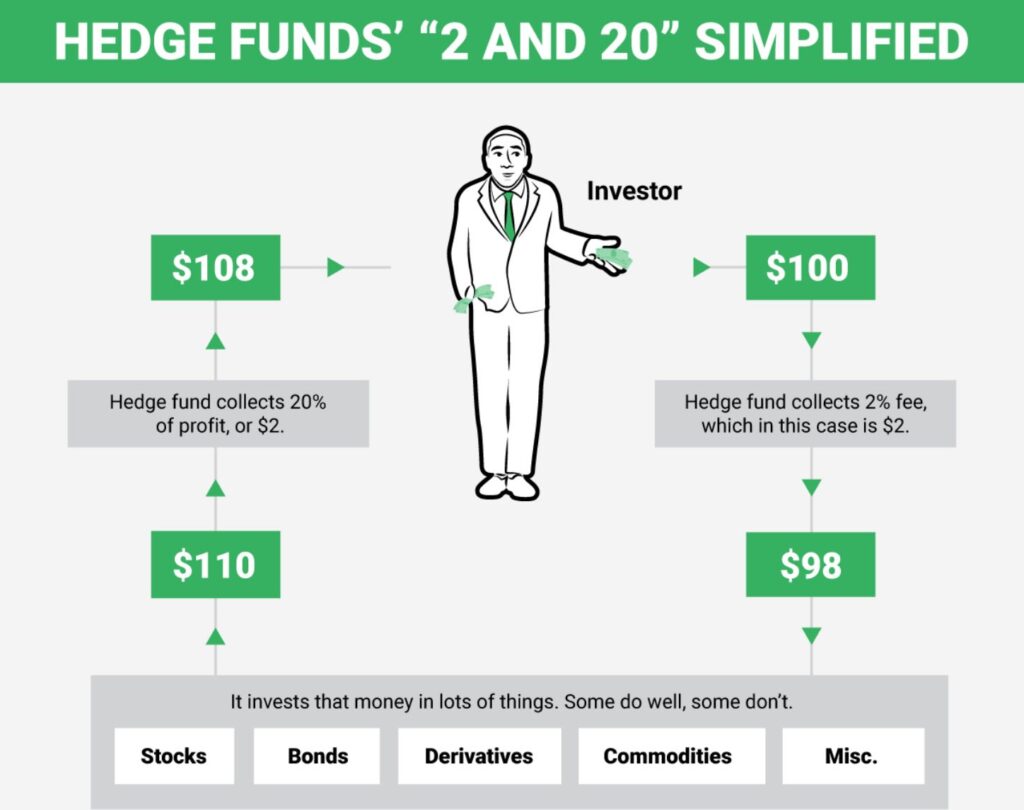

Another example of delayed gratification is the fee structure for many investment funds. If you look at hedge funds or venture capital funds, the standard fee is 2 and 20.

The ‘2’ is the management fee of 2% that investors pay the fund managers each year. For example, if you invest $100 into a fund, then you’d pay $2 every year. This is a relatively small amount of money which the fund managers use to pay for operating expenses. (It’s VERY expensive to operate a fund.)

The ‘20’ is the carry fee of 20% that investors pay the fund managers AFTER they have been returned their initial investment. That means that fund managers collect 20% of the profits after investors have had their initial investment paid back in full.

From a fund managers perspective, the 2% management fee is almost meaningless. Many fund managers actually spend more than 2% of the fund size every year to keep things going. Or in other words, some fund managers pay out of their own pocket to operate a fund in addition to the 2% they collect.

They are so dedicated to making a fund successful that they are willing to lose money in the short term. And that’s because the 20% carry can end up being a HUGE pay day.

From the investors perspective, the 20% carry aligns the interests of the investor with the fund managers. Remember, the 20% carry fee doesn’t get charged until investors receive their initial investment back. This makes fund managers VERY incentivized to not only get their investors initial money back as soon as possible, but they are also incentivized to get the biggest return for their investors.

If their investors get a BIGGER return, then their 20% fee will be BIGGER. Everyone wins in this scenario. In fact, some of the best fund managers charge a 30% fee, but can justify this fee because of their track record of exceptional returns.

(With the Explorer Partnership, we charge ZERO management fees on our investments and charge a 20% carry. That way we literally do not get paid anything unless our investments are successful.)

So, as an investor, I encourage you to do two things:

- Figure out what kind of person you are. Do you have the patience to delay your gratification in order to get larger future returns? If not, how can you change your thinking?

- Ensure that whoever you are investing with is in it for the long run. If you are investing with someone who is trying to get as much reward as possible upfront, then they probably are not aligned with your interests. Try to find people who will profit only if you profit.

Are you and those who you do business with in for the short game or the long game?