Most of 2020 felt like a bizarre time warp, mixed with dramatic emotional ups and downs.

Perhaps I’m being a bit dramatic. But, for me, it felt like one day I was stuck in the movie Groundhog Day, and then the next week I was living in some sort of sci-fi 1984-esque film.

While I’m tempted to dive into the whole COVID-19 debacle, with the varying government reactions, I’ll keep this high level with a focus on what is happening in our world from a macro perspective… And, of course, how we can invest in these massive changes.

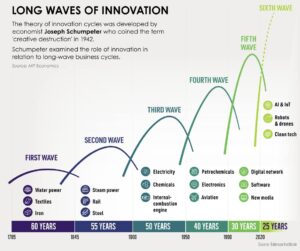

One of the best ways to visualize what is currently going on in our world, is to look at an infographic that Visual Capitalist recently published. If you’ve read the Explorer Report over the past years, you know that I am a big fan of this company and the info they put out.

Source: Visual Capitalist

The idea behind these innovation cycles is that ‘creative destruction’ occurs within many parts of our economy. Essentially, when there is an important innovative development, there are repercussions that ripple throughout our economies and societies.

There are obvious disruptions of the past, like railways and electricity, that have entirely changed the way we live. But most innovations of the past took many decades for the majority of the population to adopt.

So, while it’s true that railways enabled transport of goods and people much faster and consistently than ever before, the actual effect to the broader world took an entire generation to realize. This allowed humans to adapt their life to these changes in a somewhat patient manner.

Today, in the beginning of the 21st century, we have innovations that were not only invented recently, but have also been completely adopted and integrated into society. While this is exciting, in terms of the pace of innovation, it also requires all humans to keep up with these rapid changes… Or get left behind.

From a societal standpoint, this is creating a divide between the haves and the have-nots, which goes far beyond tangible wealth.

Someone who is keeping up with the newest trends in innovation is much more likely to have work opportunities in higher paid jobs. Meanwhile, someone who has never been exposed to new innovations, or has chosen not to expose themselves, is at an extreme disadvantage. This is mostly applicable to tech innovation, which has infiltrated nearly every industry on earth.

Tech proficiency has essentially become a language on its own. And those who cannot ‘speak the language’ are going to be at a severe disadvantage. Furthermore, as the waves of innovation increase in amplitude, but decrease in elapsed time, this issue will only be exacerbated.

The amplitude of change is increasing, while the timeframe is decreasing. This is causing more extreme change within a human’s lifetime.

A company that made horse drawn carriages one hundred years ago had plenty of warning that they should pivot when the automobile was introduced. Today, if you aren’t completely transforming your product or service every couple of years, the crowd will fly right past you.

The flip side of this entire situation is that there are massive opportunities for entrepreneurs and investors. In fact, I’d argue that there has never been more opportunity today, than ever before in the history of mankind. Here are three reasons:

- No complications. This is the number one reason why someone doesn’t start their own business or start investing… It seems too complicated. But there are free resources and how-to guides about anything and everything, all absolutely free online. Just follow the instructions.

- Inexpensive. For less than one thousand dollars, you can structure a business, create a web presence, and start selling things (products or services). There are an infinite number of businesses you can launch online, which don’t require anything beyond what you can download and build for free. WordPress, Shopify, PayPal, and others have given willing entrepreneurs the keys to drive whatever car they choose to build.

- Extremely efficient. We can process transactions, ship products, outsource jobs, and essentially perform any task you can think of by using the Internet. Although we like to complain about certain services, the reality is that the flow of commerce and information has never been more efficient.

Although there are many more reasons why our world is filled with opportunity today, the above three are responsible for the millions of successful innovative businesses that have launched over the past decade.

These three reasons are also why I was able to start, build, and sell two separate businesses in just about eighteen months (with a seven-figure value).

Admittedly, I ‘cashed out’ pretty early by handing over the reins of these two companies to the buyers. I certainly didn’t make any f-you money, but my personal life was getting far to complicated for me to continue to spend time on these businesses. Plus, it’s always good to know your limits and let others take over when your talents are exhausted.

I know I am dancing around naming both of these companies that I started. And, I promise you that I will tell you the whole story about each one in the near future. (I touched on this recently here.)

Right now, I want to focus on the fact that things are moving so fast these days, that the best opportunities are in extremely early stage companies and industries.

For investors, that means you should be looking almost exclusively at private companies that are targeting cutting edge innovations. These private companies will be the investments that will return massive multiples, and make real meaningful returns for you personally.

This is a tough pill to swallow for many people. The idea that the best investments are not available in traditional assets like stocks, bonds, or real estate, feels very unfamiliar.

Yes, it’s true that real estate, the stock market, bonds, precious metals, or even commodities can eventually make you rich. But all of these investment types take time… a lot of time.

You’re just not going to see explosive returns in traditional investment opportunities. Our world is moving too fast and the best opportunities have not made their way to widely available public markets.

For years, this has been a problem, where some of the best investments are only available in the private markets. And now with our fast paced innovation cycles, this situation is even more of an issue.

Blackrock released a report comparing a $100 investment across 5 asset classes, starting in 1980 up to 2019. As you can see in the chart, private equity far outperformed other traditional investments. As our world continues to experience massive innovation progress, I expect this trend in returns for investors to not only continue but actually accelerate.

Fortunately, there has been significant changes in the US investment regulatory environment that now allow investors access to these early stage companies that have massive growth (profit) potential.

There are a lot of details to learn about, but the main point is that non-accredited investors now have access to some of the most interesting and innovative early stage investments on earth.

That means that regardless of your income or net worth, you can now access investments that were previously only available to wealthy individuals and major private equity firms.

I’ll be diving into all of this in the very near future. For now, know that currently I am personally only investing in private companies and I am working on finding new private companies that we can all invest in together.