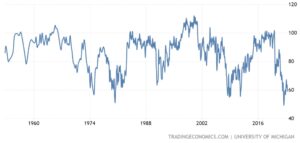

Despite ‘the progress‘ that has been advertised, the impending economic crisis seems to be palpable within society. Consumer confidence – which indicates household’s future planned consumption and savings habits – is near record low levels. Similarly, confidence from businesses has been in decline for the past two years.

Expectations for the next six months, from a recent survey, aren’t looking any better:

- Over 80% of consumers expect business conditions to get worse

- 81% of consumers expect less jobs to be available

- 84% of consumers expect their incomes to stay stagnant or decrease

US Consumer Confidence. Source: Trading Economics

News about the US dollar is even worse. China has been encouraging many nations throughout the world to ditch the US dollar and use the yuan instead. Russia has already hopped on board, while India and Brazil could be close behind. Meanwhile, countries in Africa and Asia are looking to ditch the dollar all together.

Finally, as I’ve discussed several times over the past year, inflation is a problem that won’t go away quickly for the US economy. The Fed is still unhappy (as of May 2023), and is now likely to hike rates again this coming June. Additionally, mortgage rates have surpassed 7% again, which could cause even more problems for the housing market.

How Much Worse Could it Get?

A lot worse. In ways that we haven’t seen in more than a generation.

The war in Ukraine continues to grind on, with billions of dollars in aid and military equipment flowing from the west to support Ukrainians. Where is the end to this war? Will it spill over more borders and involve even more countries around the world? Perhaps.

Over in the South China Sea, the US has significantly increased its presence with training drills involving Japan, South Korea, the Philippines, Australia, and more. China and Russia are also flexing their muscles with displays of their newest weaponry in the seas and skies. Will China actually attempt to invade Taiwan? (Buffett sold his entire stake in Taiwan Semiconductor, referencing geopolitical tensions as the reason.)

Add in the constant friction with North Korea, Iran, Syria, and now parts of Africa, and things don’t look any better.

Contrarian Reality

Over the past 12 months, investors have pulled over $350 billion from the stock market. Both a majority of institutions and individual investors agree that the future doesn’t look bright for traditional stock investing.

But could the opposite be true?

There is a famous saying that stocks climb a “wall of worry,” suggesting that when a majority of investors are doing one thing, the opposite is likely the better play. This is better articulated by Warren Buffett’s famous saying, “be fearful when others are greedy, and greedy when others are fearful.”

So, when it comes to a weakening dollar, inflation, and geopolitical conflict, are a majority of investors getting it all wrong?

US Dollar vs. Who?

I know it, you know it, and everyone else knows it. There will be a reckoning one day that will annihilate the US fiat currency Ponzi scheme. But, for now, let’s kick the can down the road and party on! (Cough, get your bitcoin, gold, and shark teeth.)

The US government is addicted to debt and conjuring cash out of thin air. Instead of cutting spending, paying off debts, or stimulating growth, the US continues to dig a deeper and deeper hole.

The endless money printing and mismanagement of all federal budgets is terrifying. The US seems to be getting to a point of no return. Bankruptcy, economic collapse, or societal breakdown (or all three) seem to be more and more possible.

Inflation Compared to What?

It’s very possible that inflation could continue to rise in the immediate future, and stay around for many years. That’s what can happen when you inject an economy with too much free money. Asset prices get inflated, currency loses purchasing power, and wage earners get demolished.

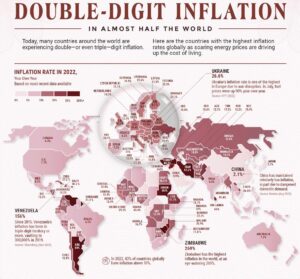

In 2022, the US experienced the worst inflation in over 40 years. But relative to other global currencies, the US dollar still maintained strong purchasing power.

Source: Visual Capitalist

The US experienced three consecutive years of double digit inflation from 1979-1981, but the economy roared back and the US dollar survived just fine. Could history repeat? Maybe we’ll look back at this time and blame it all on the pandemic – just a weird blip on the historical line chart – which has been a great scapegoat for everything else.

But It’s Different This Time!

It might actually be different this time. Most people alive today have never lived through a global war (WW2 ended in 1945), major economic depression (The Great Depression ended in 1939), or a true global crisis (1918 flu, where 90% of some towns died).

Or, it could be that when you’re surrounded by trees it’s hard to see the forest…

It’s easy to get wrapped up in the narrative of “the US dollar is going to fail, inflation is going to kill everyone’s savings, China and Russia are disrupting the world order, and the US is a dying empire.” It all makes sense on paper. The math checks out. Things do look to be headed that way.

So, are you willing to bet real money on that outcome?

You could try shorting the stock market, converting US dollars to Chinese yuan, or put yourself in a position to benefit from the fall of the United States. Some people are doing that… but most aren’t.

Here’s why:

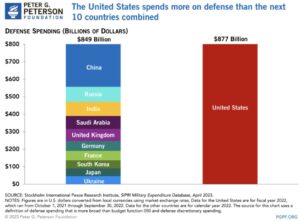

Source: Peterson Foundation

Yes, the Chinese and Russians have serious tech that could really hurt the US. Hypersonic missiles, stealth submarine fleets, and, of course, biological warfare. There are even some serious threats in space that could soon come to fruition.

However, other than nuclear threats, the US has been able to outfox its adversaries (despite recent stumbles from the current and past administrations). The truth is that the US military has extreme influence over most countries, and any enemies would have a near impossible time flipping the world order.

Most people know this. The petroyuan is mostly a myth. The US dollar will survive as the world’s reserve currency for decades more to come.

The story of the US dollar failing makes sense on paper, but when you look at the bigger picture, it just doesn’t add up. From a corruption standpoint alone, there is no other country or currency that is even close to what the dollar symbolizes. (Of course there is corruption in the US, with the Fed and Treasury being in cahoots just scratching the surface… but have you ever traveled to Russia or China? Have you ever done business there? Get back to me and let me know how that went.)

The US dollar, the US economy, and the US investing market is, for lack of a better term, the healthiest horse in the glue factory. There is no other nation, no other economy, and no other currency that really comes close to being a legit contender.

That doesn’t mean there aren’t problems. That doesn’t even mean that things won’t change in the future.

It just means that betting against the US right now, which many investors are positioning themselves to do, would be a very risky bet. The odds would not be in your favor.

How to Invest Now…

Now, just because I made an argument that you should be wary about investing against the US right now, doesn’t mean you should take the exact opposite stance. I would not be going long with the stock market right now. I would not be aggressively purchasing real estate right now. And I certainly wouldn’t be doing any speculative investing right now, that depends on short term economic strength (sorry angel investing*).

Instead, for the short term, you should be focused on preserving wealth while generating income from safe sources. If you can do that for a couple years, you’ll be positioned very well. A couple years from now, there will likely be some incredible opportunities to pursue.

…And in the Near Future

Here are some of the things I’m thinking about:

- Foreign Investing: Yes, I know, I just talked this entire time about how great the US is and how you shouldn’t bet against the country. However, when the US goes through tough times, other countries often go through worse times. It’s an unfortunate trickle down effect that occurs, but can lead to unbelievable opportunities for experienced investors. Do not invest in other countries unless you have experience or you have some other unique connection to that other country. Having invested privately in over a dozen different nations, I can tell you that most of the time it is not worth it. Unfortunately, I have the battle scars to prove it.

- US Real Estate: If real estate prices come back down in the US, you should not be afraid to act. There is no other real estate market on earth that is as liquid, able to use financing, and tax friendly as US real estate. I can’t wait to start another creative real estate project in the coming years. (Something with some wilderness, combined with exclusive community, all blended with privacy. Basically a rural cult.)

- US Equities: Right now US equities are overvalued by pretty much every measure (Market cap to GDP ratio currently at 156%). But the US stock markets host the best companies in the world, have incredibly easy access, are extremely liquid, and have extreme transparency (compared to all other global stock markets). Start doing your research on your favorite industries, so you can become well versed in the top companies that will become attractive buys.

- Private Companies: Specially, there will be a huge opportunity to acquire small businesses in the services industry. This opportunity will be fueled by retiring baby boomers who operate successful skill based companies (plumbers, electricians, janitorial services, etc.) that print cash, but have trouble selling their company due to low interest and few buyers. The ability to modernize, scale, acquire, and consolidate is massive.

Reality for Contrarians

Typically, contrarian investors are looking for hidden opportunities or questioning traditional investor narratives. The reality, today, for contrarian investors is that the most obvious and traditionally loved investment destination is still the place to be. That is, despite the doomsday narratives that are surrounding the US economy, currency, and global influence.

*Although I stated that angel investing is not a good idea right now, I would like to clarify. There are few people who should be investing in angel investments right now due to the high risk with early stage companies. However, because funding is becoming very difficult to come by, angel investors will be able to back companies are very favorable terms. This could set up for enormous windfalls, if you’re able to find and back the right teams.