In November of 2022, I wrote an article about how to survive this year and beyond. Although we’re not even mid-way through 2023, many of the predictions I made are already coming to fruition. Things like:

- Fed Funds rate hitting 5%

- Real estate declining (I predicted 20% by the end of 2023, so still 7 more months to go; San Francisco has already fallen 14.5%)

- Further deterioration of relationships between the US and Russia, China, Iran and North Korea

I’m not particularly proud of being ‘right’ about those forecasts. That’s because they were mostly negative, and I wasn’t personally able to financially exploit any of these situations (so far). Saying something and doing something are completely different, and I’ve mostly been all talk about 2023’s outlook.

But even though I didn’t see any huge profits, I have been able to follow my “key concepts to surviving 2023.” Those concepts were:

- Limit your exposure to toxic debt

- Convert some of your cash to gold and bitcoin

- Keep some liquidity on hand

- Start a business, now

I still stand by the list above, but I want to add one more extremely important concept: value preservation.

In fact, I would prioritize value preservation over any other value creation strategy right now. For the next couple of years, simply preserving the wealth that you have will be safer and easier than chasing returns.

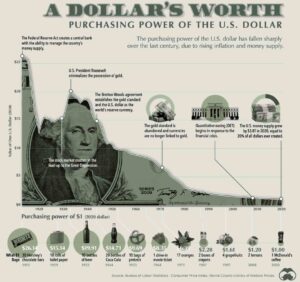

If you’re holding cash right now – especially US dollars – you should be very concerned. The US Federal Reserve has no long term plan to reign in undisciplined policy and cyclically speaking the US dollar is positioned to decline in value (which is why the world’s best investors are already shorting the US dollar).

Holding onto cash over the long term always has, and always will be a sure way to lose your wealth.

Source: Visual Capitalist

Other than announcing that that US dollar is redeemable for gold or bitcoin, this downward trend is likely to continue, and possibly accelerate over the next several years. Some of the worlds best investors, like Warren Buffett and Ray Dalio, have recently come out with similar forecasts.

So what do you do with that big (or small) pile of cash you’re holding onto right now?

Bitcoin, Dinosaur Bones, or Shark Teeth?

Throughout history, there have been some bizarre ways to exchange and store value. For example, there are human sized Rai Stones in Micronesia, squirrel pelts in Russia, cheese in Italy, and even mobile phone minutes in Zimbabwe.

Although it may seem strange to pay for something with an animal skin, it’s really no different than paying with paper fiat currency. In fact, there is probably a stronger argument that an animal’s hide will maintain it’s value much longer than a piece of paper printed by a central bank… especially if that central bank is completely mismanaged!

That’s why the super wealthy have been investing in all kinds of weird stores of value for the past several years – including dinosaur bones (Apeiron Investments actually set up a fund to invest in dinosaur fossils and fund new exploration!). But what if you can’t afford to purchase multi-million dollar T. rex skeletons? How about collecting shark teeth?

Shark teeth, especially those from prehistoric megalodon sharks, can be worth thousands of dollars. You can buy them from collectors, or get out into the wild yourself and find some. Here is what I found in about an hour last month in Florida:

If physically storing dinosaur bones or shark teeth sound like too much work, then you should absolutely be dollar cost averaging into bitcoin right now. Actually, you should be DCA-ing into bitcoin now matter what investments you have.

Bitcoin (and other cryptocurrencies) are becoming the only asset which you can anonymously own, transact virtually with counterparties, and avoid any potential government imposed capital controls. Furthermore, bitcoin is starting to become an asset that preserves wealth over time and is hedge to fiat currencies (despite its volatile past).

Dollar Cost Average into Bitcoin Now

By setting up an account with a crypto brokerage, you can set up recurring purchases to DCA your way into bitcoin (or any other cryptocurrency you choose). Whether it’s a daily, weekly, or monthly recurring purchase, by DCA-ing your way into crypto you can:

- Reduce your risk of buying during price spikes

- Limit the amount of upfront capital your supplying

- Give yourself some time to learn about crypto and how to handle it

- Allow yourself to sleep well at night knowing that you’re passively diversifying your wealth

Whatever you end up doing to preserve your wealth, start right now. The writing is on the wall when it comes to the dollar’s worth… just make sure that whatever you decide to diversify into doesn’t go lower than the dollar!