It’s no secret that inflation, high cost of living, and government debt are all major issues. Nearly every country in the entire world is struggling to keep their currency strong, their citizens happy, and their country’s budget solvent.

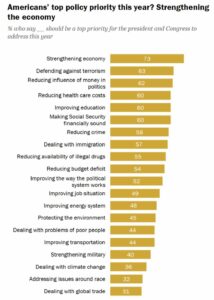

With an upcoming election in the United States, voters are prioritizing the economy and inflation over everything else. Polls from every single major research firm indicate that voters from all parties agree. (Pew Research, Gallup, Statista, DFP)

Source: Pew

I know this doesn’t surprise you. I’ve been writing about it for a while now. People are afraid their wealth is going to inflate away due to government mismanagement and insane monetary policy.

It’s wild how the decisions of others can impact your personal life so much…

Recently, I’ve talked about crypto, gold, and high yielding stocks. But, today, I have something even more interesting that you should start to learn about.

It’s a way to preserve your wealth that hardly anyone is talking about.

Out With The Old

I’ll start by saying this first: This is related to crypto, and for that reason, most of you will either stop reading here or never actually try out what I’m about to share…

I’m going to keep this as simple as possible. Not because there is anything to hide, but because I want to focus more on the larger idea, rather than the tedious details.

The big picture here is that our global monetary system is archaic, subjectively controlled, and inefficient.

Consider sending a wire transfer. In order to send your own money to somewhere of your choosing, you have to:

- Get permission from your bank to send your own money

- Pay a large fee to send a payment

- Only have the payment sent during bank working hours

- Ensure that the counter-party can receive your payment (and they usually have to pay a fee to receive!)

- Receive confirmation of the payment from a centralized source

In the world of cryptocurrencies, pretty much all of these issues are solved. And that’s where the world of DeFi comes into play.

DeFi is Coming

To be clear, I am not saying the crypto world is perfect, and I am also not saying that our current banking system is useless. Instead, I am explaining that our current financial system is due for an enormous overhaul and upgrade.

And, while we wait for these coming changes to happen, there are incredibly lucrative opportunities for early adopters.

This is where DeFi (decentralized finance) comes into play. DeFi, in basic terms, relates to making financial transactions without centralized control or third parties.

Imagine how trade worked thousands of years ago. Trading an otter pelt for rare spices would purely depend on the negotiation happening in real time, face-to-face, without any outside control. It was sort of a decentralized finance environment.

Fast-forward to today, and decentralized finance has the same concept. However, instead of having only a few counter-party otter pelt traders to do business with, you now have the entire WORLD to negotiate trade. And… you can do it in real time, across decentralized platforms, all while viewing transaction data in completely transparent terms.

Sound confusing? Let me give you an example…

Banks Are Terrified of DeFi

As usual DYOR (do your own research), nothing here is investment advice, all investments involve risk, and I have no connection, involvement, or financial stake in what I’m about to share with you.

With that out of the way, what kind of yield are you earning with your cash right now? If you’re in a money market fund, you’re probably in the 5-6% range, while most traditional banks are still yielding well below 1%.

Check out these rates below…

As you can see above, those rates seem unbelievable. What’s especially notable is the return on USDC, which is a US dollar pegged crypto currency. On the above platform, it’s currently yielding over 24%. Even better, it’s a completely liquid lending platform and compounds interest daily.

But, wait, there’s more!

Now check this out:

If you look above at the bottom row, you’ll see that you can borrow Ethereum for 5.39%, and then you get “borrowing rewards” of 50.06%, which nets you about a 45% return.

You’re probably thinking that this is all some sort of a magic internet money scam. But it’s not.

What you see above are called liquidity pools. Not only is everything fully collateralized (meaning, if you’re lending to someone, they have to put up over 100% of the capital being borrowed), but the lending structure is fully automated (which means that any default immediately results in the lender receiving their full principle).

To be clear about what I’m showing you here: These are decentralized lending platforms that provide lenders AND borrowers double digit yield, in fully liquid and collateralized accounts.

What you are seeing is what goes on behind the scenes at banks. This is how banks make enormous amounts of money. And now, these lucrative yield situations are available to anyone who is ready to take a leap into the world of DeFi.

You’ve been warned…