My friend David and I used to play in his grandfather’s bomb shelter everyday after school. We had no clue what it was originally built for, and frankly, never gave a second thought to why it even existed.

David’s grandfather, who was a WWII veteran and successful Hollywood executive, had the bomb shelter built half way down a cliff, below his house, which was over looking the Pacific Ocean. David and I liked to pretend we were playing in an abandoned James Bond retreat.

Today, in the United States, having a bomb shelter in your house is almost unheard of. In fact, if you even mention that you’re building a bomb shelter, you’d be met with raised eye brows and perhaps some mumbling of how you’re a conspiracy theorist.

It’s hard to explain how insulated the average American is from the realities of the world. But it wasn’t too long ago that bomb shelters were actually encouraged in American society.

In fact, during the 1950’s and 60’s, hundreds of thousands of underground fallout shelters were constructed across the US. President Kennedy encouraged Americans to build their own bomb shelters and even allocated public funds to build enormous underground retreats.

However, since the end of the Cold War in 1991, the US population has dropped their guard. The idea of hiding underground from a nuclear threat seems like a yesteryear concern.

This has created a new generation of Western nation citizens who are completely oblivious to the threats of global conflict.

Gold’s Warning (Forget About Price)

Although today’s younger generation is unfamiliar with the threat of war, they are becoming very familiar with financial mismanagement. Specifically, I’m referring to artificially manipulated interest rates, extreme government spending programs, and unsustainable budgeting.

All of this is seen through sky high prices for housing, education, and food – all of which younger generations need to consume the most of.

This trend can’t last forever. Eventually, the general public will catch on and choose to preserve their wealth through alternative methods. I mentioned this a couple months ago in regards to bitcoin:

“They’re losing control of the narrative – you know it, I know it, we all know it… something has got to change. I’m talking about all of it. Global debt, central banks, the mainstream media, the pharmaceutical industry, the military-industrial complex, and the deep state… they are all losing their ability to control and manipulate.”

And that’s exactly what is going on in the gold market right now.

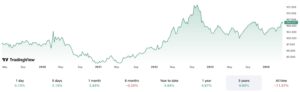

Over the past six months, the price of gold has skyrocketed. This has resulted in gold outperforming the NASDAQ over the past two years:

Blue = Gold ; Green = NASDAQ

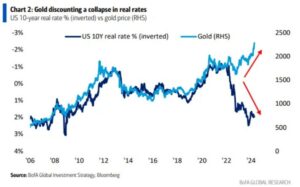

This is even in the face of a reversal in interest rates. Typically, investors will opt to hold yield generating assets, like cash, instead of gold. This is a trend that has held up for the past couple of decades, until recently:

What we’re seeing in the gold market right now should be a warning signal. Many investors may be sensing a gold bull run (which may be occurring), but the bigger picture is a break down in currency and market confidence.

So, is it time to climb into the bomb shelter and stock pile gold?

Bomb Shelters or Cash?

As I write this, the global war drums are banging loudest since WWII. Iran has just attacked Israel and Russia is still fighting Ukraine, all while multiple other countries are having regional disputes.

It may be tempting to dump all of your cash in favor of assets like gold, silver, or crypto. These are all supposed to be ways to preserve your wealth and ensure that third party actors can’t steal your value through inflation or confiscation.

This strategy, of preserving your wealth in hard (or digital) assets has been a sure way to protect yourself through times of conflict and fiat currency mismanagement. So, if we assume that there is more conflict and fiscal irresponsibility to come, you should be ditching cash… right?

Not so fast…

Even though all signs point to the US dollar (and all other fiat currencies) continuing to lose value, it may be a good idea to hold onto cash for the short term. Here are three reasons:

1. Inflation

Yes, inflation is likely to drag on for quite some time, and possibly get much worse. However, if global conflict continues to expand, many people will rush to safety… and believe it or not, most people still think that the US dollar is the safest haven.

That’s because, as I mentioned last year, the US spends more money on its military than the next ten countries combined! As difficult as it may be to admit, currencies ultimately possess power by their ability to rule the world… and the US dollar still does that (for now).

If you look at history, this has played out almost exactly how I just described. At the outbreak (or serious threat) of war, US dollar inflation is nearly flat. This happened when WWI started, when WWII started, and even through most of the Cold War. US dollar demand increases when the world feels unsteady.

2. Dollar Strength

Two years ago at a private conference, I got up on stage in front of a couple hundred wealthy investors. At the time, inflation was running at nearly 10%.

I proceeded to tell the audience that holding US dollars would be very strategic for the next 12-24 months. Not because inflation wasn’t real or that the US dollar was the best investment available… but because the US dollar is the healthiest horse in the glue factory.

Since then, the US dollar index is up around 10% while most other currencies around the world have been obliterated. The yen, pound, yuan, euro, Canadian dollar, Australian dollar, and many others are down compared to the US dollar – and that’s even though some of those other currencies have recently had arguably better policies.

3. Liquidity

Although liquidity is easy to understand, it’s very difficult to quantify. In addition to there being game theory type variables (i.e. When will investors sell risky assets in favor of fungible currency?), central banks can, and will, step in to provide extra liquidity when there is demand. Interventions by governments, treasuries, and/or central banks effectively moves the goal posts for investors planning on certain outcomes.

Despite the many unknowns, a liquidity crisis is nearly certain during a market selloff. This will result in investors off-loading risky assets at fire sale prices. So, those with liquidity (cash) on hand will be able to gobble up once-in-a-lifetime deals.

Cash is King?

As a sound-money, pro-crypto, gold-loving, fiat-hating, freedom-first-investor, it pains me to say most of what I mentioned above.

I still believe investors should own physical gold and silver. I still believe that everyone should be dollar cost averaging into bitcoin on an ongoing basis. I’ve been writing about this for the past decade, which has paid off enormously.

But you’ve also got to play the game that you’re in, not the one you wish existed.