We are probably witnessing one of the more epic run-ups in stock market history. Although we’ll only know the next chapter of this AI-fueled rally in the future, there are currently some incredible hidden opportunities that are being completely ignored.

Before I dive into some of those undervalued investments, that seem to be just sitting in the corner, let’s take a quick look at what’s going on today (mostly for documentation purposes).

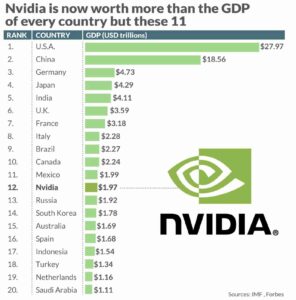

The Magnificent Seven are a group of stocks that are currently valued at over $13 trillion. These seven companies are made up of NVIDIA, Apple, Microsoft, Meta, Tesla, Alphabet, and Amazon. Collectively, they would be the third largest GDP in the world. Individually, most of them rank higher than many countries. Just look at NVIDIA:

There’s no denying that these companies have been incredibly successful. They each provide an enormous amount of value to customers and the economy at large. But their rise in valuations, compared to the rest of the stock market, are alarming. Many economists are deeply concerned that this trend will lead to a bust.

Most of the companies in the Magnificent Seven are worth more than the ENTIRE energy sector. For example, at the beginning of this week, “the 23 stocks that make up the S&P 500’s energy sector had a combined market capitalization of $1.585 trillion. That’s 8% less than Nvidia’s market cap of $1.712 trillion.” –IBD

Let me dive a little deeper, to put more context into what’s going on.

NVIDIA:

- Trailing 12 months EBITDA: $35,583,000,000

- Market cap: $1,970,000,000,000

ExxonMobile:

- Trailing 12 months EBITDA: $74,273,000,000

- Market cap: $412,349,000,000

This means ExxonMobile has more than twice the amount of earnings, but is valued 80% less than NVIDIA.

Of course, you can argue that NVIDIA has much more growth potential than ExxonMobile, and that AI is the future while oil is the past. This argument is what fuels the current valuation of NVIDIA, and most of the Magnificent Seven.

Now, it’s entirely possible that this mismatch in valuations will continue, and perhaps even distort further. But at some point, this trend will reverse, leaving many investors caught with their pants down. And when that happens, it will be too late.

Cheap, Hated, and High Yield

In November of last year – about four months ago – I sent out an Explorer Report while on my way to Portugal. I mentioned that Portugal’s formally largest colony, Brazil, looked very interesting:

“The short story is that Brazil is CHEAP right now… and producing YIELD. For example:

- iShares MSCI Brazil ETF ($EWZ) has a P/E of 5.5 and is yielding 9%

- Petróleo Brasileiro S.A. – Petrobras ($PBR) has a P/E of 3 and is yielding 24%

That said, Brazil puts the “B” in BRICS… so there’s plenty of reason to be hesitant here…

…I haven’t really formed an opinion yet, but I think the whole BRICS concern is mostly overdone…

…Brazil‘s inexpensive valuation is definitely interesting, but I’m not sure how long those high yields will hold.”

Today, in late February 2024, those valuations and yield are pretty close to the same. The main difference, however, is the sentiment and attention that this area of the market is receiving.

Not only is no one talking about investing in emerging markets, but fossil fuels, metals, and raw materials are completely out of trend right now. Without a doubt in my mind, this will reverse course at some point, and right now is probably the time to start building a position.

But I’m not alone in this thinking. In fact, there are several very high profile investors who are already starting to exploit this situation in unsexy Brazilian companies. Here are several examples:

- Ray Dalio’s hedge fund, Bridgewater Associates, just disclosed a new ~$100 million position in the Brazil ETF ($EWZ).

- Scott Bessent, former CIO of Soros Fund Management and current founder of Key Square Group, also just opened an $EWZ position.

- Howard Marks, of legendary Oaktree Capital Management, has added to his position in Brazilian metals and mining company Vale S.A. ($VALE).

- Steven Cohen, founder of Point 72 Asset Management and owner of the NY Mets, also opened a position in $VALE.

$VALE, by the way, is currently trading with a P/E of 7 and yields nearly 10%.

Zig While Others Zag

Investing in cheap, hated, and high yielding Brazilian equities is certainly not what the majority of mainstream retail investors are pursuing. Instead, they are piling into high flying tech stocks that have seen incredible gains as of lately. But how much longer will that trend last?

Of course, no one knows for sure. But when you look at some of the world’s best investors repositioning their portfolios to exploit out-of-favor equities, you should probably take a closer look.

If cheap Brazilian equities aren’t your thing, then just look at what Warren Buffet is doing right now. With a record amount of cash, he has started to trim his tech exposure. Simultaneously, he has upped his stake in oil giants Occidental ($OXY) and Chevron ($CVX).

Neither cheap nor expensive valuations last forever. Adjust your course accordingly.