In 2022 I wrote about how my neighbor, who’s a public school teacher, made a million bucks in two years. He timed the market perfectly, bought in the ideal location, and made his graceful exit with impeccable timing.

Since his once-in-a-lifetime real estate trade, the market has been on a slow but steady decline.

This comes as no surprise to me. In fact, I wrote about this almost exactly one year ago. I explained what would be happening to the real estate market, in 2024, in detail.

I recommend you go back and read, “2024 Real Estate is Gonna Be Lit,” as it’s just as accurate today as it was last May.

However, since it has been a full year, there is new data available to help us understand where we’re headed next. If you’re a buyer, it could be great news!

The Cracks are Forming

As I’ve been discussing for the past two years, it’s my belief that rates will stay higher for longer than most are forecasting.

This isn’t just a guess, but instead based on historical interest rate trends and averages. The truth is that low interest rates are actually the anomaly. Instead, rates of 5%+ are the norm.

Another truth is that prices are inversely correlated to interest rates. Bond traders understand this principle like water is wet. If it costs more money to borrow, then you have less money to spend.

That’s why, with high interest rates, you cannot have high prices… something will have to give. Eventually prices must come down, or rates must come down.

So, why hasn’t either really happened?

Because there is still an ungodly amount of cash circulating around the US economy, most of which was injected during the pandemic. Remember, in 2020 alone the Fed’s balance sheet grew by 30%.

As an individual investor or consumer, this is a hard statistic to wrap your head around. But the end result is that many individuals still have record amounts of cash in savings. That’s why over a 1/3 of home buyers are closing with cash, which is higher than it’s been in over a decade.

With mortgage rates still over 7%, it’s no wonder than borrowers have stopped applying altogether. Applications are now at a three decade low.

And still, home prices remain relatively high. In the US, prices would still have to come down another 15% to reach their average. Regionally, prices could come down even more. And that’s just assuming that prices revert to the average.

If the US economy has a hard landing, prices in some areas could drop by 50% or more.

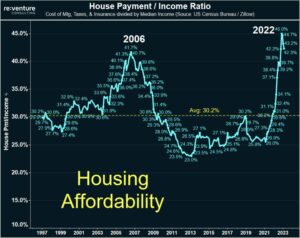

Regardless of what percentage prices may decline, housing affordability is still near all time lows (or highs, if you’re using the house payment to income ratio as a benchmark).

High Prices for How Long?

Again, when it comes to high rates and high prices, one of them has to break. It’s my bet that prices will break, even if rates are held flat (or slightly lowered in an election year political stunt).

That’s because inventory is steadily increasing, as the delayed supply is finally coming to market driven by the past couple of year’s demand. Supply and demand economics, just like interest rate fluctuations, nearly always have a lagging effect.

The interest rate lagging effect is driven by the fact that real rates typically take longer to hit the real market (think car loans, home loans, consumer credit).

That’s in contrast to how stock/bond traders position their portfolio based on interest rate projections from the fed. So, although traders may be positioned for higher rates, consumers haven’t really felt it yet (because they’re locked into their 30 year mortgages at sub 4%, and/or they haven’t had to buy a new car yet).

Investors are proactive. Consumers are reactive.

Meanwhile, inventory supply takes a while to come to market, especially when it comes to real estate. Houses can only be built so fast. That’s why it makes sense that inventory levels are increasing now, a couple of years after overwhelming housing demand.

It’s the classic boom-bust cycle that exists in any supply/demand industry. That’s why the price of commodities can have wild swings. Corn prices go up, corn growers plant more corn, market gets flooded with more corn, corn prices go down, corn growers stop planting corn, corn supplies go down, and so on.

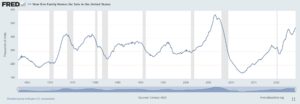

Source: FRED

As you’d expect, the timing of increasing housing supply coincides with the decrease in housing demand. The previous shortage of housing supply is now transitioning to a glut. Dismissing seasonal house buying trends, home sales have been on a clear decline since the pandemic era housing boom peak.

Although there are still many buyers in the market now, there are even more who have already made their move and have no motivation to refinance out of their sub-3% mortgage (and why would they!?).

Source: FRED

A Patient Buyer’s Dream Scenario

When it comes to purchasing real estate, especially for your personal residence, it’s very difficult to separate the emotional component. That’s because no matter how much you want to get a “good deal,” you still need a roof over your head to live.

Having the patience to wait for the perfect financial situation, while your life (which might include a spouse and kids) continues to push forward, is hard!

But if you can wait, it’s very likely that time is on your side.

High prices, combined with high(er) interest rates, combined with increasing inventory, combined with a decreasing buyers pool, will eventually result in outstanding opportunities for patient real estate investors.