Sixty Percent of the Time, it Works Every Time

“…there is s a 60% probability for a recession inside the next 18 months.” – Steen Jakobsen

“UBS said there is a 40% chance that there will be two rate hikes penciled in for 2019 instead of three moves seen in March.” –Marketwatch

“There’s always a 1 in 3 chance that the market goes down 10 percent and a 1 in 5 chance the market goes down 20 percent, but yet over the long term the stock market goes up 10 percent a year about 70 percent of the time.” –MarketRealist

Or… in the words of Anchorman’s Brian Fantana (who is referring to his cologne called “Sex Panther,” which is illegal in 9 countries):

I hope you’re scratching your head, just like I am.

We can invest based on odds, probabilities, and chances… or we can make it much easier:

Buy low, sell high.

Sounds simple, right? Well… there are two problems with this strategy:

#1 It’s extremely difficult to invest in things that others are avoiding. If you are buying things that others are selling, and selling things others are buying, then you feel as if you are not part of the group.

#2 Hindsight is 20/20. Often times we only know when things are high or low after the fact.

But, here’s the thing… even though it’s tough to go against the crowd, we can still do it. And yes, hindsight may be 20/20, but there are some obvious market highs and lows we can see right now.

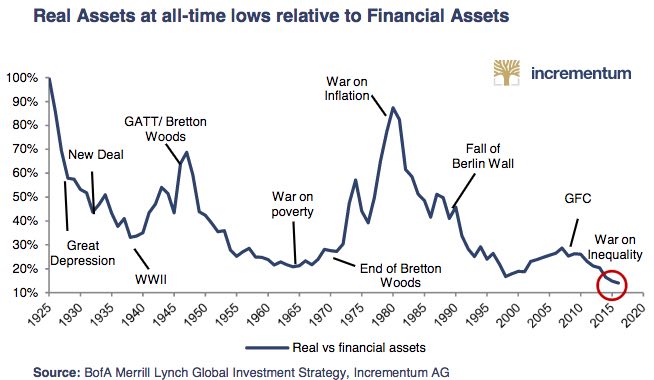

For example, we know that real assets are at all-time lows compared to financial assets.

Source: Incrementum

“In a historical context, the relative valuation of commodities to equities seems extremely low. In relation to the S&P 500, the GSCI (Goldman Sachs Commodity Index) is currently trading at the lowest level in 50 years. Also, the ratio sits significantly below the long-term median of 4.1. Following the notion of mean reversion, we should be seeing attractive investment opportunities.” – Incrementum

Source: Incrementum

Of course, it’s completely possible that this ratio becomes even more distorted, with financial assets becoming more expensive and commodities becoming even cheaper.

But, where would you like to put your money to work?

Would you rather have massive downside risk? Or would you rather have massive upside potential?

The answer is easy for me. (Same with everyone who joined me in Colombia.)

We want to invest in areas that cheap. We want to buy low and sell high. Simple.

There are many commodity ETFs out there that are trading at historical lows (like $JJG).

However, the biggest returns are in private deals. I’m talking about investing in private farms, private companies, and private investment opportunities that you’d never see… unless you’re with the right group and have the right connections.

(For those who joined us in Colombia, we will have some information coming out this week about our next trip.)