Is This How Our Market Will Crash?

“Managers and investors alike must understand that accounting numbers are the beginning, not the end, of business valuation.”

Only 10% of stock trading today is based on fundamentals, according to research from JP Morgan.

That means that 90% of trading in the stock market is based upon something other than looking at a company’s intrinsic value.

So, how the heck are people deciding which stock to buy?

Stocks are also being traded purely upon forward potential (see FANG, Tesla, etc.).

In other words, investors are simply buying stocks with no regard to real value.

This will end in disaster.

I’ve spoken about the ETF issue before.

“Instead of investors picking stocks with reasonable valuations, they are doing the complete opposite. They are piling money into ETFs and index funds which directly buy expensive stocks.

“In this year alone $135 billion dollars have flowed into ETFs. “If inflows continue at this torrid pace, total 2017 inflows will reach almost $540 billion, blowing past last year’s record $287.5 billion.”

Investors feel safety in a diversified ETF, but what if that diversification is among a variety of expensive equities?

The risk is still there!

And ETFs aren’t the only issue.

Investors are still buying companies with crazy valuations.

As you know, I am a huge fan of Elon Musk and Tesla cars… BUT, I think the company is massively overvalued.

Sure, Tesla has all kinds of patents, future plans, and secret strategies that we don’t even know about.

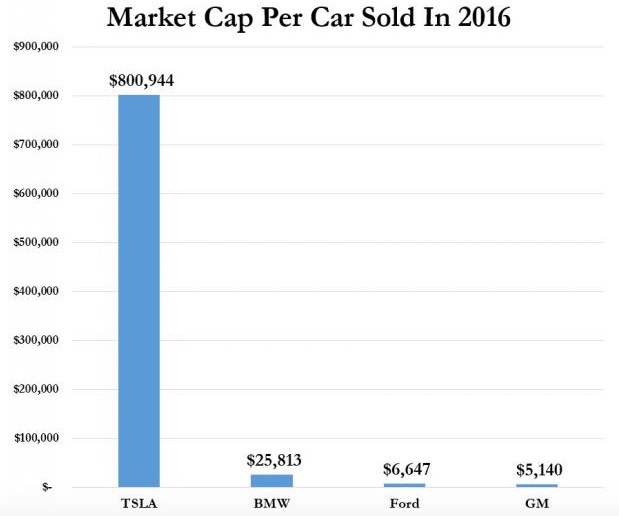

However, there comes a point where reality meets valuation. Here is how the company is currently valued:

Source: ZH

Do you think BMW, which is valued at 1/32 of Tesla buy the above metrics, has zero plans of driverless cars? Do you think BMW has absolutely zero electric propulsion technology? Do you think BMW is simply going to roll over and pee on itself?

Me neither.

And Tesla is not alone. Here are some other interesting valuations:

– Netflix = worth $490 per streaming subscriber

– Facebook = worth $26.6 million per employee

– Apple = worth $6,600 per iPhone sold in 2015

I am super excited about the future. I’ve used my iPhone to watch Netflix and check Facebook while driving in a Tesla (that had WiFi!).

In 20 years I think we’ll all be riding in driverless cars, interacting through virtual reality, streamlining our lives with artificial intelligence, and I also think we will live well over 100.

But it appears that we are putting a valuation of all of that happening tomorrow.

For now, I’ll focus on investments that are out of favor. Things like agriculture, commodities, and foreign real estate. Because I want money so I can afford all of those awesome technologies in the future.