Should I Invest After DOW 20,000?

Nearly all investors will tell you to put your money in the market anyway.

Historically speaking, you will do just fine over the long term. So, it doesn’t really matter when you enter the market. It just matters that you invest with a long term vision.

However, I believe that logic is CRAP.

So, let me show you why your concerns are legit, and why you may be better off just holding your money in a bank (or under your mattress!).

Let’s look at the DOW, as of January 27, 2017:

Quite an upward trend, right?

Will it collapse tomorrow? Probably not.

Will it keep going higher forever? Definitely not.

Let’s say you bought in September of 2007, the peak right before the GFC (Great Financial Crisis). How long do you think it would take to get back to where you started?

Seems like a long time waiting just to get back to where you started, right?

That’s six years of waiting just to break even.

Now, let’s say you waited until February of 2009 to buy.

You’d have a 100% gain, making for 25% annual returns. That’s excellent!

Obviously hindsight is 20/20. This is very easy to look back and make these observations.

But… here is what we do know today:

- If we assume that all markets are cyclical AND we know that this bull market is the second longest in modern financial history… then we’re probably due for a correction.

- By a variety of measurements (P/E, EPS, P/B, etc.) the current stock market is NOT cheap.

- Our low-interest rate environment has made for a distortion in how companies (and people) borrow money. This has resulted in massive amounts of borrowed money that can only be paid back with future profits. What happens if profits decline substantially?

So, to answer your question. There is nothing wrong with being patient.

You can also look at Warren Buffett’s two investing rules for more advice:

Rule # 1: Never Lose Money.

Rule # 2: Never Forget Rule # 1.

–

And there’s more data that should make you cautious.

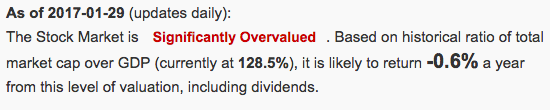

I like to look at the stock market capitalization to GDP ratio.

Here is what the US market looks like today:

Source: GuruFocusI could go around and cherry-pick all kinds of data points that indicate we are in for a major market correction.

Source: GuruFocusI could go around and cherry-pick all kinds of data points that indicate we are in for a major market correction.

But, I could also point out things like Trump’s corporate tax rate reduction plan that could boost our economy even more.

Whatever the near future holds for us, we can’t deny that many areas of the market are expensive. We need to look for assets that are cheap and allow ourselves to be exposed to massive upside with little downside risk.