The Best Stock of 2017?

The best stock of 2017? I think so.

But, looking at its track record, you’d want to run away from it – and that’s exactly what most investors have been doing.

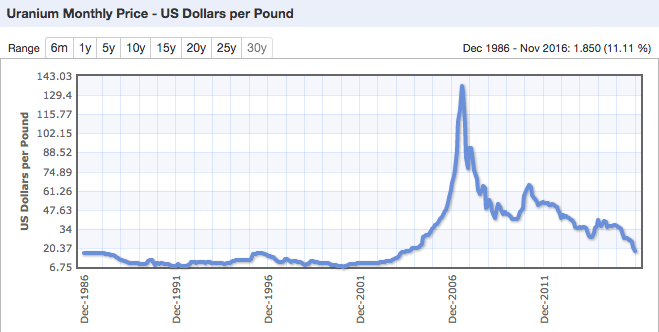

Uranium has been in free fall for the past year, without having a single month of gain. In fact, uranium is trading at prices not seen since 2004.

I’ve been keeping my eye on this sector for several years now, waiting for a time to buy. I think that time is now.

As most of you know, I look for investments with minimum downside risk with lots of upside potential. I look for ways to make huge returns, but I am even more concerned with avoiding big losses.

This is why I buy real estate in areas that are selling for less than the cost of construction. I don’t know when prices will rebound, but I do know that there is not much room for any more price decline.

This is also why I avoid lots of high-flying tech stocks. Do I think the big tech companies have great products? For sure. I use their stuff every day and I believe they’ll be around for a long time.

Will those popular stocks go up in the future? Probably. They may even double over the next couple of years.

But, I also know that they are trading at huge multiples. They have a lot of upside potential AND downside risk.

I want huge upside risk with minimum (ideally zero) downside risk.

And that’s where I see uranium today.

Uranium is trading today for about $20 a pound, down from its 2007 high of nearly $140 a pound. At current prices, most mines have either shut down production or are literally spending more to mine the metal than they are selling it for.

Source: IndexMundi

This is very similar to my comparison of real estate selling for less than the cost of construction.

Could prices stay low for a while? Of course. But, I know that eventually, things will turn around and we will make a profit.

Additionally, uranium demand is projected to increase by 50% by the year 2030, as nuclear reactors are coming online around the world. Currently there at least four under construction in the US, 3 in the UK, and many more in China.

And that’s not including the ‘old reactors’ that have been taken off line for retrofits and upgrades. Ever since the Fukushima disaster in 2011, nuclear power has carried a bad reputation. Many reactors worldwide were taken off line because of concerns that similar catastrophes could occur.

Instead, coal, solar, wind, and natural gas produced power was ramped up in an attempt to make up for the loss of nuclear power plants.

Of course there are many environmental concerns that apply here, but the reality is that nuclear power is the most efficient (and cost effective) form of energy that we humans have access to.

That is why many nations throughout the world are shifting back towards nuclear energy.

But, there is a problem. Because of the multi-year price slump, many uranium producers have either reduced or shut down production. In addition, there has been an oversupply of uranium because of the reduced use throughout the world. This has further crashed prices, causing many producers to cut back production even more.

This is a classic boom and bust cycle. When uranium is selling for high prices (like in 2007), miners ramp up production to create larger profits. Once the market gets oversupplied, prices decline, so miners have to shut down. This eventually causes a reduced supply in the market and will eventually drive prices back up.

We are approaching this moment now when production is decreasing but consumption is increasing. Eventually something has got to give, and the first thing will be an increase in uranium prices.

Miners will eventually ramp up production, but this will take years. You can’t just flip an “ON” switch at a mine.

I’ve dug into the books of a variety of different uranium miners to determine which ones are the best buy. I’ve identified at least five that will do great over the next boom cycle.

However, I have an even easier way for you to add exposure to the uranium market, and that’s through the Global X Uranium ETF ($URA).

$URA’s top holdings include Cameco, NexGen Energy, Uranium Participation, Denison Mines, and a variety of others. These companies are the exact companies I would have recommended if this ETF didn’t exist.

So, instead of making multiple purchases and chasing around different information about individual companies, we can buy $URA to spread our investment across a broad mix of companies.

$URA also gives a 2% dividend, which only sweetens the deal.

Uranium stocks have seen a huge bump this week, with a couple of companies seeing 50% gains this week alone. I wouldn’t be surprised to see a quick correction, but the larger story is still in play.

If you haven’t bought into uranium yet, don’t worry. You’ll have plenty of time. You can start to buy a position now and then increase over the next year.

We may see a bit more pain in the uranium sector, but I see a lot more upside potential than downside risk, making for an excellent investment.