We recently invested in a property with a ridiculously low price per square meter.

M2 is what ‘price per square meter’ is usually referred as. You’ll find this measurement system pretty much everywhere, except for the United States.

Property values internationally are quantified by price per square meter (m^2), just as the US uses price per square foot (ft^2). A square meter is approximately ten square feet, or 10.764 to be exact.

Why is price per square meter so important? It’s the easiest way to compare apple to apples, especially when you take into account the underlying value of the property itself in a specific market.

Now, just like any real estate market, it’s all about location. There’s a reason why location is the three most important words in real estate. And take it from me – someone who has tried to outsmart the location theory (I’ll have to tell that story later!) – it really is all about location.

If we just take price per square meter into account when we’re looking at investment real estate, you can quickly categorize the spectrum of property prices in a certain location. Any major city in the world has a certain range of prices, with a bottom end and an upper end.

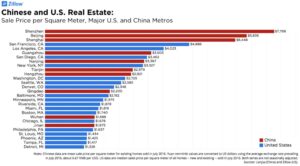

Price per square meter is also how you can compare international cities to each other.

Using price per square meter is especially important when shopping for apartments or real estate that have consistent layouts. In other words, using price per square meter to compare properties with large amounts of land doesn’t really work. Properties that have unique qualities and strange layouts (especially custom homes) have values that are far too subjective.

Apartments that have similar floor plans, are located in a similar area, and have similar building amenities can be compared much more fairly. Also, the building costs are usually close to the same because the actual builders know how to efficiently and economically build at scale.

Using price per square meter is especially valuable when you’re looking in a market where you already know the actual building costs and the actual land value. Say, for example, you know that land values are $500 per square meter and that building costs are $2,500 per square meter. That would mean your total value of a single story home would be $3,000 per square meter, in extremely rough estimated terms.

Of course there are all kinds of variables, but for an investor, this is a quick way to scan through multiple properties and do quick math in your head. It’s pretty easy to find an outlier while doing this mental math, which allows you to efficiently sort through many real estate deals.

Let’s say you find a house for sale that is $100,000 and it’s 100 square meters. You’d be looking at a cost of $1,000 per square meter. If you then compared the total land value and building costs, you could make a determination if the property as a whole is fairly valued.

We (Explorer Equity Group) use this exact method when looking for attractive real estate investment opportunities, and we recently acquired a property with a ridiculously low price per square meter.

In fact, the price we paid was so low, I can’t share the exact number here. But, if you look at the chart above, I can tell you that we paid significantly less than the cheapest city on that list (Detroit). And I can say that Denver is priced at over ten times what we paid.

Now, to be fair, just because you buy cheap property doesn’t mean you’re getting a great deal. Sometimes real estate is cheap for a reason. Sometimes rental rates are extremely low, which means property prices have to be low in order for the property owner to actually make money.

Other times, real estate is cheap because the seller just wants to get out and there are not any buyers. Or there is a special situation that enables the buyer to negotiate great terms.

Either way, finding real estate with deep value usually involves searching for properties that are not advertised widely or that aren’t listed at all. Just like any great investment, the best ones are usually the most difficult to find!

Currently we are working on projects in South America that offer extremely attractive returns to investors, diversification, and tangible collateral. Please reach out if you are interested.