Mania Phase – Another Asset That is Getting Into Nosebleed Territory

A couple of years ago, I was fortunate enough to spend a day at Porsche’s test track in Atlanta with The Atlas 400. I am definitely a car guy, but I’m mostly into off-roading vehicles (Baja racing specifically).

I am definitely a car guy, but I’m mostly into off-roading vehicles (Baja racing specifically).

But, after we spent the day at the Porsche track I thought to myself, “Damn! I’m impressed! I want one of these!”

Well, fast forward a couple years, and I still don’t have one.

But… I have a good excuse. And it’s one that you can use too!

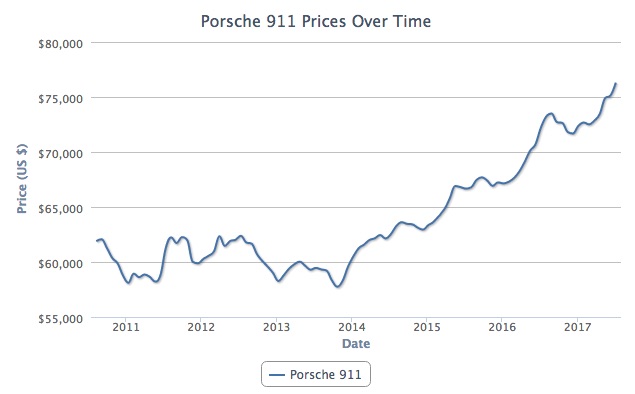

Check out what has happened with the prices of USED Porsche 911’s:

Source: CG

]Yes… that line is going up. These cars (depreciating assets) are actually increasing in value.

And those are just the average prices.

My neighbor, who is a retired airline pilot still owns a Porsche 911 he bought brand new in the mid 1970s. It’s baby-diarrhea-brown and was just appraised for over $250,000!

Now, if you are a car person (or a Porsche-nerd) you’ll immediately say something like, “But those are Porsches… they aren’t regular cars!”

And, I would somewhat agree.

However, take a look at that chart above, again.

Does it remind you of anything? (Think cheap money and a stock market that is getting into the mania phase.)

In a nut shell: People are able to buy expensive things because they can borrow money at cheap rates. This results in a variety of things increasing in price. Just take a look at real estate, the stock market, or Porsches.

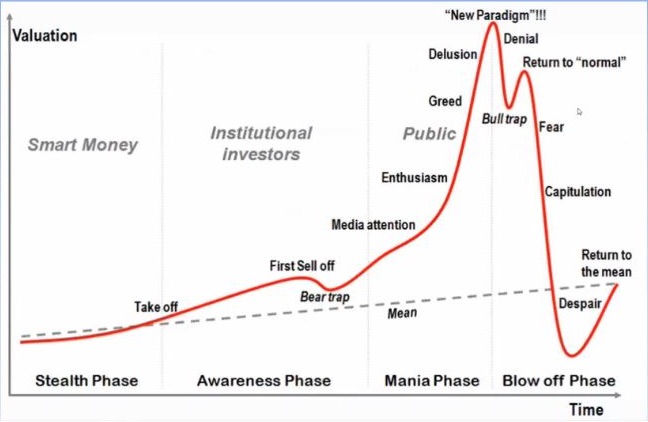

But, this isn’t some secret conspiracy. This is how it plays out every time, like clockwork.

Source: FC

So where are we on the above chart?

Only time will tell.

However, I’d estimate that we are somewhere in the later stages of the Mania Phase.

Smart investors are taking profits and building up their cash reserves in preparation to buy things when they become cheap again.

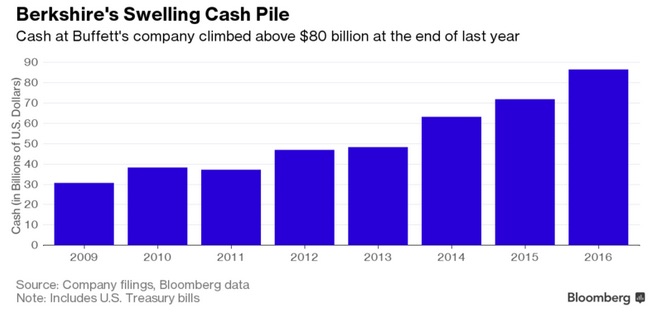

This is what Warren Buffett had to say two months ago:

“I hate cash… I mean we are investing. But [cash] is a holding position until you find something else. But the very fact that interest rates are that low makes it hard for us to buy other things because other people buy things with borrowed money, and borrowed money is so cheap.” –Bloomberg

With nearly $100 billion, Berkshire Hathaway is currently holding its largest cash reserves ever.

Source: Bloomberg

]You can see as time goes on and assets get more expensive, their cash reserves have increased. They are building up ‘dry powder’ to deploy when prices become reasonable again.

They’re not buying Porsches.