This is the third part to the ‘cheap money’ crisis.

I talked about what cheap money is here.

I gave couple ideas of how to take advantage of cheap money here.

And now, I’m going to show you several indicators we can look for to help us determine when this whole thing is going to unravel.

If we break up the three categories of people, companies and governments, we can look at indicators for each.

So… first… people. What indicator will show us that consumer debt is in trouble?

Ultimately, we’ll begin to see loan delinquencies. Whether it’s auto loans, student loans or just regular credit card payments – people will stop paying back their debts. This is a somewhat hard statistic to track because the Fed usually reports this quarterly and private institutions often only report their specific industry.

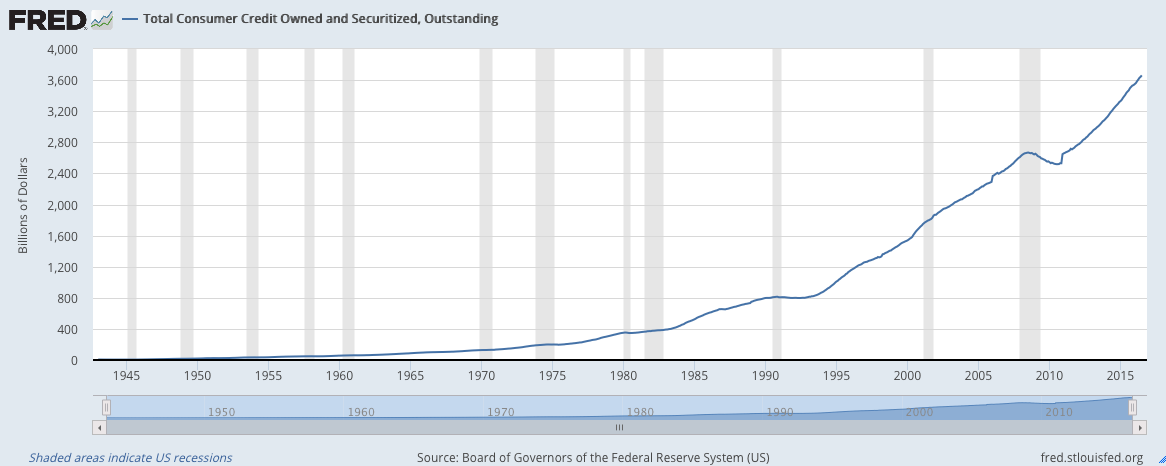

However, we can look at consumer credit and where it is heading. It’s heading up. Way up. People are borrowing more and more money to purchase all sorts of things. You might be thinking, “Great, the economy is working!” In reality, all this means is that money is easier to borrow for cheaper prices, so people can buy more expensive stuff. This is obviously not an economic policy that has a long life.

It’s heading up. Way up. People are borrowing more and more money to purchase all sorts of things. You might be thinking, “Great, the economy is working!” In reality, all this means is that money is easier to borrow for cheaper prices, so people can buy more expensive stuff. This is obviously not an economic policy that has a long life.

There are many delinquency statistics that the Fed reports on here. There are currently no specific areas that make me alarmed, but there are several that raise my eyebrow.

Second is corporations. What indicator will show us that corporate debt is in trouble?

The easiest indicator is to look at the stock $HYG. This is an ETF of high yield bonds – better known as junk bonds. We can look at the previous link of loan delinquencies to see when/what corporations are paying back, but the true result in the market will reflect through $HYG. (There are other similar stocks out there, but I’m picking $HYG as it’s the most popular.)

We can look at the previous link of loan delinquencies to see when/what corporations are paying back, but the true result in the market will reflect through $HYG. (There are other similar stocks out there, but I’m picking $HYG as it’s the most popular.)

If we see $HYG start to waver, or decline significantly, we know what is happening. Corporations are not paying back their loans. These are high risk loans (junk bonds), so they will be the first to fall – and will serve as a good indicator for the wider market.

Third is governments. What indicator will show us that government debt is in trouble?

This one is tough. Really tough.

The problem here is that governments can manipulate policies. Basically governments can change the rules of the game – consumers and corporations cannot.

BUT, there is one glaring indicator that I am waiting to see…

When governments start to buy equities on the stock market, then I will become extremely concerned.

Japan is already doing this. Europe is talking about doing this.

Basically, this means that governments are taking stakes in private companies. It’d be like the US Government buying shares of Apple. Conflict of interest, anyone?!

Japan is currently doing this in their country, but may start to buy US equities.

Any government buying equities on a stock exchange is essentially nationalizing the market. It would mean that the government owns a portion of the companies they are investing in.

—

Ok… I understand that a lot of this sounds like ‘doom and gloom.’ Honestly, it’s because there is a lot of really negative stuff going on out there.

We just have to keep in mind that the more conflict and volatility there is, the more ways we can do well. Additionally, even if you and I don’t act upon any of these issues, we can simply avoid exposure to these problems, which is almost the same as profiting.