3 Investments in a Trump Economy

First, and most importantly, just take a calm and rational view.

I see all kinds of people talking about how the world is going to end and that Trump is going to do all of these horrible things.

Will they happen? Maybe. But I don’t think so.

The left is melting down thinking that Trump is going to ruin everything.

The right did the same exact thing when Obama was elected in 2008.

Guess what happened? Pretty much nothing.

Here are a couple realities:

- Most politicians will say anything to get elected.

- Most politicians have a very hard time executing any of their ideas because we have a checks and balances system in our government. Yes, the house and senate went republican, but there are many republicans who despise Trump just as much as the left.

- There is tremendous corporate pressure on our government. That is one of the reasons why big money despises Trump, because he can’t be bought off. But, just because he can’t be bought off (which we still don’t know), that doesn’t mean that corporations don’t have influence. That means that most businesses will continue to operate, just like they have for many years.

Anyway, I’m trying to avoid leaning one side or the other… my point is that if you look back in history at any successful investor, you’ll find that the ones who made the most money were the most calm and rational.

The people who didn’t make money, or even lost a ton, were the ones running around like a chicken with their head cut off.

All that said, let’s look at three money making opportunities!

#1 Interest rates. This is a hot topic right now. Are rates going up or are they going down? What will Trump do? What will Yellen do?

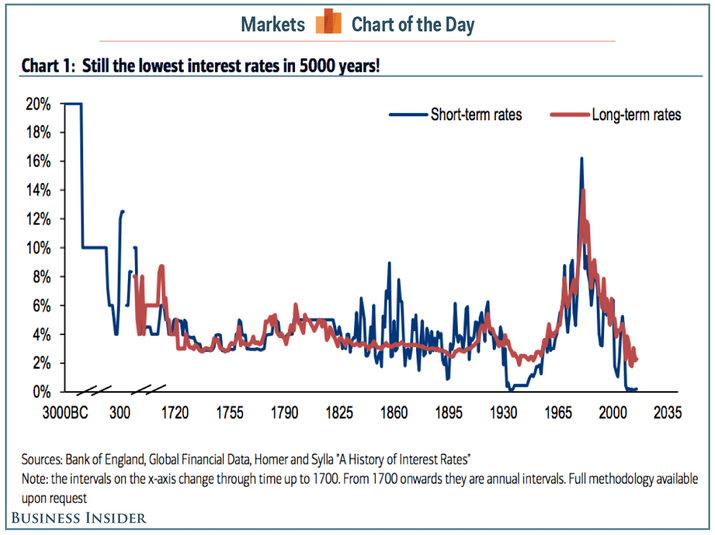

Well, we don’t know what they’re going to do. But, we can look at historical trends to see where rates are going.

As you can see from this chart, it looks like rates are bottoming. This doesn’t mean that rates are going to shoot back higher, but it does mean we have at least one set of data to refer to.

Source: The 5,000-year history of interest rates shows just how historically low US rates are.

An even better source of data is to look at our credit cycles. (If you have never seen Ray Dalio’s video HERE about the credit cycle, you should definitely watch this.)

We are on the precipice of one of those huge credit cycles (again, watch the video). This means that cheap credit is probably ending, which means rates will be going up.

In other words, it will cost more to borrow more.

There are all kinds of ways to profit from this. The easiest is to just buy a stock like $TBT, which has already seen gains of about 20% in the past month or so. But, don’t take that as a recommendation. The market is already pricing the stock out of value territory. (You shoulda bought it two months ago when I talked about it here!)

#2 Gold and precious metals. This is a bit controversial right now. One side says that gold prices are going to crash, while the other side says that gold prices are going to spike.

Gold is normally a safe haven asset when interest rates and inflation go up (as shown in example number 1 above). So, this is a simple investment to hedge against inflation.

But, right now, the US dollar has been getting stronger and stronger which has depressed the price of gold. Some think that the US dollar will go way higher and some think that it will crash downwards.

If you think the US dollar is going to lose value soon, gold would be a great buy.

If you think the US dollar is going to keep going up, then you should wait.

Remember these two things: Everything is cyclical AND it’s very difficult to time the market. (That’s my secret suggestion that I think gold is a great buy right now.)

#3 Emerging markets. Ok, now we’re getting a little more in the weeds. I’m going to attempt to keep this simple, but just realize a couple things:

When the US dollar is strong, commodities are usually cheap.

When commodities are cheap emerging markets often suffer.

When emerging markets suffer, people run from them and then become even cheaper.

So, what I’m saying is that there are a lot of emerging markets out there that are very good buys.

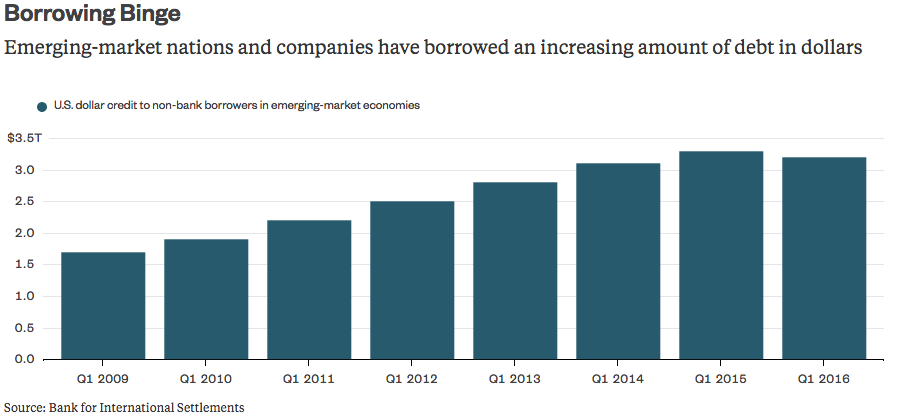

***One tiny caveat, which has to do with the first opportunity I listed – interest rates going up. Lots of foreign companies have taken on a whole bunch of debt. They are up to their eyeballs in debt!

Source: The Emerging Markets’ Dollar Problem

If rates continue to climb, then their debt is getting more and more expensive to pay off. This means that there could be many companies that will go under because they won’t be able to pay back all the money they borrowed. So, be careful what you buy.

If you’d like to know what to buy, you can read here.

–

So, there you have it. Three things to look into as Trump’s presidency develops.

Just remember not to get wrapped up into the craziness.

AND, most importantly, realize that there is always an opportunity around every corner. Never feel desperate to invest – that’s how you get burned!