Do You Have An Investment Quiver?

Do you have a quiver? You know, a bag of tricks up your sleeve?

In the surfing world, a quiver is a collection of surfboards. A surfer’s quiver is like a toolbox. Each board is a different tool for a specific type of wave.

You can have a 10 foot single fin longboard, known as a ‘log,’ to surf small surf.

Big fat boards, like logs, are better for gutless waves. Like Waikiki, or anywhere the waves break in a crumbly fashion. A bigger, fatter board provides more float, so the surfer can go slower without sinking the board.

At home, in Malibu, the waves are usually smaller. A longboard is often the best choice.

Small boards, known as ‘shortboards,’ are for fast surf. Waves that break top to bottom. Like Pipeline in Hawaii, or Uluwatu in Bali. Shortboards are easier to maneuver and allow the surfer to get into better positions on the wave.

If you were to take a log and try to surf Uluwatu, you’d be asking for trouble. A big log is difficult to turn quickly and the wave would run past you, resulting in a ride over the falls and onto the reef.

Uluwatu, Bali a couple years back. One of the most terrifying waves I’ve ridden (not this exact wave shown here, as this was a small day). It’s a fast left, and I’m regular foot, so my back is to the wave. This makes it a bit tougher to ride, especially because the consequences are so severe. On this same trip I met the reef with my back on a larger wave and still have a nice scar to prove it!

If you were to ride a shortboard on a slow wave like Waikiki, you’d be frustrated. The wave wouldn’t be fast enough and you’d basically be sinking the board.

Just like waterskis, you need to go fast in order to stay above the surface of the water. If you go too slow, you’ll just sink.

A true surfer – a waterman – has a complete quiver. All kinds of boards to surf all kinds of waves.

Unless you’re constantly traveling the world in search of surf, waves are very cyclical. In Southern California there are many days when the waves are chest to head high. But, there are many more days when the waves are less than waist high.

If you only waited until there was head high waves to surf, then you’d spend a lot of time waiting.

In order to stay in the water to get your daily dose of vitamin sea, a surfer must adapt to the waves. Because it’s very difficult to make the waves adapt to you.

Investing is exactly the same. If we could control the markets to accommodate our needs, we’d all be rich. But, that’s not how it works.

We have to react to what the market gives us. We have to use the tools in our quiver to create profits so we can continue to build our wealth.

If we can continue to build our wealth, then we can create freedom. (Freedom to chase perfect waves, for me!)

And that brings me to today’s market. I’ve been rummaging around in my quiver of investing tools to find the right solution to get maximum returns.

Truthfully, I’ve had to look much harder than I usually do.

For example, last year was easy for me. There were a variety of signs that were telling me to buy mining stocks. Companies like Pretium Resources ($PVG), Gold Resource Corp. (GORO), and Seabridge Gold ($SA) were great buys. They carried low debt and offered huge upside.

I ended the year very well. My best year ever, actually.

But things have changed this year. There are lots of conflicting signals that I’m getting. It’s hard to find a ‘no-brainer’ investment, like those mining stocks in 2015.

However, I do know of one area that I am very confident in. I know that I’ll eventually see 100% gains, or even more. But, I’m not a buyer yet.

This area of the market is probably the oldest traded asset in the world. I know it’s not going out of style anytime soon, and I know that there will be a time when it becomes much more expensive.

Just like anything in our world, this asset is cyclical.

I’m talking about agricultural commodities. Corn and wheat most specifically.

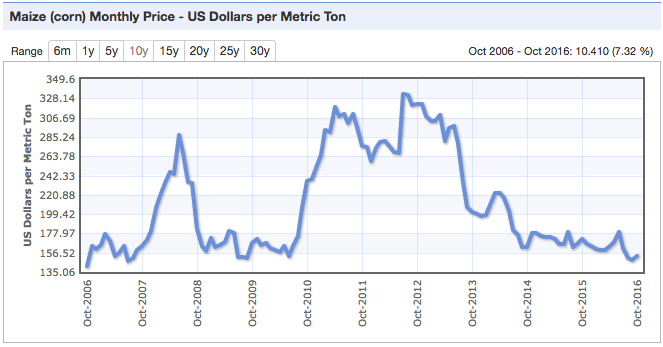

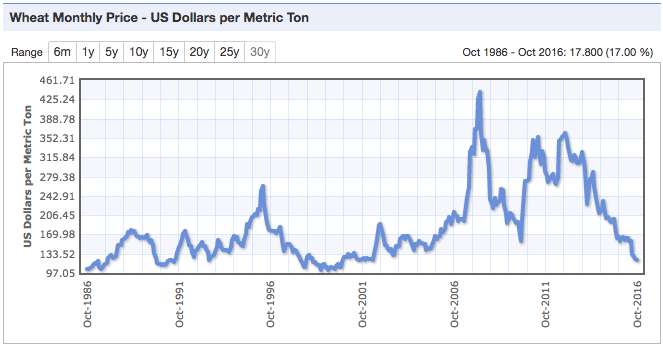

You see, if we look back at historical prices for corn and wheat, you’ll notice that we are touching major lows.

Now, this doesn’t mean that corn and wheat are destined to rocket higher next year. But, I do know that there is far less downside than there is upside.

Now, this doesn’t mean that corn and wheat are destined to rocket higher next year. But, I do know that there is far less downside than there is upside.

Still… I’m not a buyer yet.

Commodities are highly influenced by the strength of the US dollar. When the US dollar becomes stronger, commodities become cheaper. And right now, the US dollar is on top of the world.

But commodities aren’t only influenced by the US dollar. Seasons, droughts, and major weather events also effect food prices. A major drought in a corn growing region can ruin an entire year’s harvest. This will deplete supply and drive up prices. Simple supply and demand economics.

Regardless of what is impacting the prices of wheat and corn, I have my eyes on these two foods. Again, I’m not a buyer… but I’m getting close.

The easiest way to give yourself exposure is through the Teucrium Corn ETF ($CORN) and the Teucrium Wheat ETF ($WEAT). An even simpler option is to buy the iPath Bloomberg Grains SubTR ETN ($JJG).

As soon as I start to see the dollar strength decline, I’ll move into these assets. Remember, you always buy low and sell high.