Last November I got up on stage in front of hundreds of successful investors. My good friend Keith had invited me to speak about building businesses and unique investing ideas. What I shared with his audience was not traditional investing advice…

I started my presentation off by sharing how I had built and sold several businesses over the past decade. My main message was that building businesses can be a fantastic way to grow your wealth, instead of passively participating in traditional opportunities like real estate.

I’m not against traditional investing (stocks, real estate, etc.), I just know that building businesses has the most potential upside, by far. Just look at the world’s wealthiest people – most of them are founders.

Of course, there are enormous risks with being an entrepreneur too. At Keith’s event, I explained that there are many small business opportunities that have significantly lower risk than traditional VC-backed startups. A small business might not be the next billion dollar opportunity, but it could easily turn you into a millionaire.

The audience I was speaking to was very financially literate. I mentioned that their experience as an investor could easily translate into running a small business. The required skills of discipline, consistency, and patience to be a successful investor are the same qualities needed to run a business.

I received lots of head nods and interest about building businesses, but my next topic on investing was met with a different reaction…

Cash is Trash, But Liquidity is King

“Hold onto cash,” I said, as the room looked back at me with blank stares.

At the time, inflation was hovering around 8%, which was the highest in over 40 years – something that nearly every investor in the room, including myself, have never experienced.

“I’m serious,” I continued, “With inflation running hot, you’d think that cash is the last place you’d want to be. But, right now, being in a liquid position is going to be extremely strategic going forward. Cash and cash equivalents are where you want to be.”

Even though I’ve never been through an inflationary period like we’re currently in, there is something I knew last year, and still know today: There is no way that real estate prices, company valuations, and leveraged asset prices can remain high when credit becomes more expensive.

Note: In the shorter term, investors may choose to ‘hide out’ in areas that hedge inflation, which would in turn make certain assets increase in price. However, as time goes on, many of these hiding places will decline in price due to expensive credit. Unless the Fed drastically drops rates in the very near future, corporations and governments will start to feel real impacts in late 2023 and into 2024. In other words, we’re still in the twilight phase.

Simple Economics

Just like supply and demand economics, interest rates and prices are elastically correlated. I recently talked about supply and demand basics in relation to copper, if you want a review.

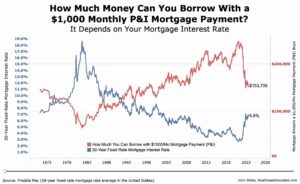

Interest rates and prices are similarly related in that one affects the other. When a buyer can borrow money at an inexpensive rate, they can afford to spend more. Conversely, if a buyer borrows money at a higher rate, they can afford less. This idea is based on a buyer having a relatively static income.

If a borrower has a monthly paycheck that is based on an annual salary, the future earning potential of that buyer is predictable. Lenders, who want to limit their risk, will only offer credit that can be reasonably paid back by the borrower.

For consumers with a fixed income, purchasing power declines as interest rates rise. This interest rate to purchasing power relationship is most noticeable when financing a home. Home buyers are familiar with the debt to income (DTI) ratio, which determines how much home a purchaser can afford.

Most lenders want to see a DTI of 35% or lower. That means that no more than 35% of a buyers income should go towards housing costs. As interest rates go up, a buyer’s DTI ratio increases, which in turn lowers the value of home they can afford.

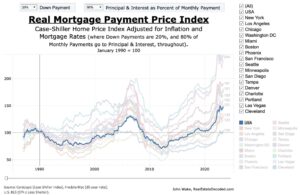

As shown in the chart above, the payment price index is now at all time highs – even higher than 2006/2007 right before the housing collapse. This doesn’t necessarily mean that the real estate market will collapse. That’s because this data indicates the situation for current buyers, not owners (many of who are locked in at sub 3% rates).

Still, we are in a situation where prices compared to a buyer’s ability to make a payment are at all time highs.

Wen Crash?

There’s a popular “wen moon” saying in crypto, which is slang for “when are crypto prices going to the moon?” Now, normal investors are wondering “wen crash?” Nearly every asset class seems to be overvalued now that Federal fund rates are over 5%, yet we haven’t seen any meaningful declines.

How can this be?

As mentioned earlier, interest rates and prices, just like supply and demand, are elastic. That means that although there is action and reaction (similar to Newton’s third law), the timing and magnitude are not exact. This is especially true when we consider that changes in credit terms (for consumers, businesses, and governments) can take months or even years to work their way through the system.

What’s certain is that the cost of capital has exponentially increased for borrowers. What’s not certain is when our economy will start to reflect these changes in a real way.

Although the housing market has already essentially frozen, major corporations, small businesses, and consumer financing hasn’t seen large impacts, yet. But it is highly likely that there is much more to come.

Those with liquid capital to deploy will see some incredible opportunities in the coming years. For now, we patiently wait…

Finding Yield While We Wait

I’m not exactly sure what will be the next big opportunity. It could be real estate, stocks, bonds, collectibles, or some other unique situation. However, unless interest rates come down drastically, it is a certainty that leveraged asset classes will decline in price. (I actually have some investment ideas coming up, based on distressed assets, that I’ll share in the near future.)

In the meantime, while we wait for asset classes to decline, there is a huge opportunity right now that anyone can take advantage of: yield.

In the private markets, I am personally seeing many double digit return opportunities with outstanding collateral. These opportunities are mostly with home builders and developers, in similar situations to what I wrote about back in July. Although these private market deals have excellent yield, they are not very liquid (plus they require significant minimum investments).

Fortunately, there are many other opportunities available to the general public that you can take advantage of right now. In no particular order, here are three opportunities that I think are very interesting:

- Schwab Value Advantage Money Fund (SWVXX) – Most banks and brokerages have their own money market products, but Schwab’s is currently the highest yielding I have seen. The fund is highly liquid and has been in operation since 1992. Although there is a 0.35% management fee, SWVXX currently has a 5.20% yield. You need to have a Schwab account to invest and there is no minimum investment or lockup period.

- Staking Crypto – Starting at a 4% yield, staking Ethereum is a unique way to diversify into crypto and earn real yield. There are some downsides here, with the main issue being that you need a minimum of 32ETH to make this happen (about $60k). However, once you start staking Ethereum, there are many ways to bump your yield up to the mid-teens. My buddy Alex explains it best, with step-by-step instructions, in what he calls “Crypto’s #1 Yield Opportunity.” There’s also many different staking options on Coinbase, if you want to go the easy way.

- Energy Sector – There are too many options to go into detail here, but the average yield across public energy companies is currently 5%+. Many companies are even yielding well over 15%! I went into detail about this opportunity a couple weeks ago in an article titled, “Do As Old Money Does.” With low valuations, attractive yields, and known future demand, the easiest way to play this opportunity is through $XLE. Although this investment is attractive right now, make sure to protect your downside losses by setting a stop loss. Fortunately, there is plenty of liquidity.

- Banks – I’m not even going to mention any bank names, but most major banks are offering short term CD’s and/or checking accounts with rates just over 4%. Like most people, I don’t have many great things to say about major banks, which is why I try to avoid them as much as possible. That said, if your money is sitting in an account with zero yield, you’d be crazy not to move it to an account that offers at least the rate of inflation (or at least what the Government says the inflation rate is…).

Wen Pull Trigger?

When will we know it’s time to spend all of our hard saved dry powder? That question is better answered by looking at historical average market valuations. In addition to the real estate data shown above, the stock market is still “significantly overvalued,” which makes it appear as if there are no ways for investors to prosper.

But sometimes the simplest solution is the best strategy. Patiently waiting on the sidelines, while collecting passive yield may pay off big time in the near future. Highly leveraged assets and companies will likely be exposing themselves as the tide goes out over the next couple of years.

Then, we can buy our Rural Cult.