In the evenings, I take my kids to the beach to let them burn all of their energy before bed. I bring a bunch of soft top surfboards, shovels, and toys for them to have fun with. We spend over an hour surfing, digging holes, and searching for sea life.

Over the past year, more kids and their parents have joined us for this evening ritual. While the kids run around and jump in the water, the parents join in the fun and talk amongst themselves. It’s been a great way to spend quality time with my kids and connect with parents going through the same, and often times challenging, phase of life.

I’ve become close friends with one family in particular. They live right next to me and our kids play together almost everyday. Although our backgrounds are completely different, we’ve been able to build a friendship that goes beyond child-wrangling.

It turns out that this family is one of the wealthiest in the world (yes, they are on this list). But, unless you’re an investor nerd, you’ve probably never heard of them. That’s because they run a private family office, with no website, and don’t take on any outside investors.

Last week, while we were at the beach, I learned about their most recent investment which was made in 2020. It seemed odd to me that this family manages billions of dollars, but hadn’t made a new investment since 2020. But, once I heard the details of their strategy, it all made sense.

Patience for Deals

There’s a certain kind of patience that wealthy families possess. I don’t mean families with ‘new money.’ I’m talking about the ‘old money’ families that pass down their wealth from generation to generation, while continually compounding value.

New money is always looking for a quick trade, a short cut to make big returns. New money usually has a fear of scarcity, thinking there aren’t enough deals or opportunities out there for everyone. Ironically, new money also ends up usually back where they started. That’s because the discipline to keep and grow wealth is just as hard as the work to make it in the first place. For example, over 70% of lottery winners end up losing it all within 5 years.

Old money is patient and knows how to avoid risk. Old money can wait for the right opportunities to present themselves… even if that takes a very long time. Most importantly, old money knows how to be in a position of power when others are weak.

How Old Money Seizes Opportunity

In April of 2020, oil prices cratered to less than $20/barrel. It’s hard to imagine now, but during this time the entire world was in total disarray due to the pandemic. In addition to huge declines in the stock market, commodities, real estate, and all kinds of other assets saw wild price swings.

While most of the world was in a state of panic, my neighbor was on his private jet flying all over Texas making deals with oil companies.

Private oil companies were in big trouble at the beginning of the pandemic. In addition to oil prices plunging, lenders were nearly impossible to find. Traditional lenders and investors were tied up in their own drama of the pandemic, and/or they were wrapped up in ESG mandates that prevented them from entering new oil and gas deals.

Many private oil and gas companies either had to close up shop, or make deals with the few private investors around, like my neighbor.

How Old Money Structures Deals

My neighbor’s trip to Texas during the pandemic to search for oil investments is impressive. But, what’s even more impressive is how he structured these deals.

He told me that the majority of deals he closed were 10 year loans, at a <10% rate, all collateralized by land and equipment. These terms, on their own, were much better than what other lenders were offering. However, there was one big difference…

In addition to the normal loan terms, my neighbor also required the borrowers to agree to split profits 25/75 when oil traded above $80/barrel. So, my neighbor would receive 25% of all profits of any oil sold for over $80/barrel… for ten years.

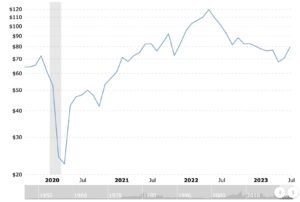

Oil prices dipped, and rebounded, like nothing ever seen before.

Remember, these deals were agreed upon in 2020, when oil never went above $60/barrel.

2021 and 2022 were different stories, with oil never going below $80/barrel, meaning that his returns were far above the coupon rate of the loans he issued. 2023 hasn’t been as favorable, but he is still receiving a great return on his capital. The coming years will be interesting.

Now, anytime you see oil go above $80/barrel, just know that my neighbor is making even more money than he already has!

How You Can Invest Like Old Money, Now

My old money neighbor has hundreds of millions of liquid dollars in the bank, a private jet, and connections like you wouldn’t believe. Trying to replicate his exact investment is impossible for basically everyone. But that doesn’t mean there aren’t similar opportunities in the market right now.

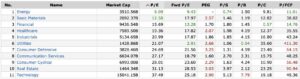

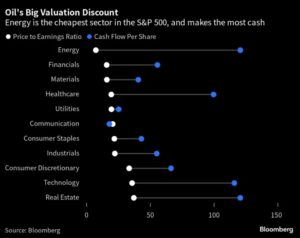

The energy sector, which is what my neighbor invested in, is one of the best positioned sectors from a value perspective:

Although making private debt deals is likely out of your wheelhouse, there are a variety of stocks you can buy right now that present similar upside opportunities. In addition, they are yielding annual dividends that make it easier to wait on future capital appreciation.

Here are a variety of examples:

- Alliance Resource Partners ($ARLP): Yes, Alliance’s main business is in coal mining, but the company currently has a P/E of 3 and an annual divided yield of nearly 15%.

- Energy Select Sector ETF ($XLE): This is a well diversified energy ETF with a very low 0.1% annual management fee. $XLE is currently trading with a P/E of 8 and yields about 4% annually.

- Occidental Petroleum Corporation ($OXY): If you want to follow Warren Buffett, ease your way into $OXY. He just upped his stake in the company and now owns over $13 billion worth of $OXY, which is trading with a P/E of 7.

- Chevron ($CVX) and/or Exxon Mobile ($XOM): Both of these oil behemoths are trading around a P/E of 8 and are likely to be in business for a long, long time. The Wall Street Journal just called both of them “cash gushers.” Exxon is even looking at lithium deals right now, which I recently dove into.

There’s a reason why some of the best, and wealthiest investors in the world are investing in oil… and it’s the same reason why they are considered old money.

Acting Like Old Money Can Be Scary

Zig when others are zagging… Be greedy when others are fearful… Buy when there’s blood in the streets… These are all the sayings that investors know by heart, but rarely pursue in real life.

The truth is that the best opportunities are realized in hindsight, and usually present themselves when there are extreme amounts of distraction. Is it possible that right now, in mid-2023, we are in a similar situation?

Between AI, China’s preparations, and the ongoing Ukraine war, there are no shortages of complex events to keep track of. Should investors go all in on the tech led stock market bull run? Or should investors become bearish, to prepare for a world of conflict slow downs?

For old money investors, they’re avoiding all the noise and sticking to the strategies that have kept wealth in their families for generations.