The pub was dangerously overcrowded, with men in stuffy suits standing shoulder to shoulder like a bunch of penguins. From the street, where I stood, these pub-penguins were overflowing onto the street in the trendy Shoreditch district of London.

As an American who’s already lacking the natural style of a Londoner, I stuck out even more because of my (ab)normally casual attire. That’s what happens when you grow up in California – you try to avoid anything that symbolizes the antithesis of freedom. (That’s an ironic statement, considering the current trend of California.)

A couple hours earlier, I had been attending an investor event on the other side of London. During the event, I somehow got entangled with a small group of private investors who convinced me to join them at the pub in Shoreditch.

Stepping into the pub, I swam through the penguin mosh-pit toward the bar. My new investor friends were already throwing back pints of Guinness and glasses of red wine while they yelled at each other in a British accent about some rugby match. I could barely follow what they were debating. It was the most stereotypical London scenario you could possibly imagine.

From Rugby to Engineering a Lithium Deal

Eventually the conversation evolved to what these guys were planning for their next investment. Obviously, as the title of this post suggests, they were structuring a deal around lithium. Not so obvious was the location they were targeting, especially considering that all five of the gentlemen involved in the deal were from the UK.

To be clear, these guys are financial engineers. They have zero experience mining for any kind of metal and they certainly don’t want to get their hands dirty in a far away land. Instead, their strategy is to first establish a holding company (HoldCo) in the UK. Then, create an operating company (OpCo) that owns and operates the actual on-the-ground assets. Finally, the HoldCo, which normally owns all or a majority of the OpCo, goes public and creates an enormous windfall event for all of the insiders involved.

This strategy, which can be a legitimate way to get an OpCo off the ground, is often the most common way small investors get fleeced. Nearly every single new industry – from cannabis to psychedelics, and crypto to AI – experiences this trend. Dozens of companies in hot and trendy industries tend to go public based on big dreams and tall tales, only to go bust a couple years later.

Anyway, I invested in their lithium deal. (This is where you laugh.)

Before I share any more of the lithium deal that these Brits engineered, let’s review the general lithium industry.

The Lithium Industry

Although discovered in 1817, it was not until later that century that lithium was used as a mood stabilizer. Starting in 1923, when discoveries in commercial production were perfected, lithium began to be used in industrial applications. Then, in 1970, the FDA approved lithium as a medicine.

Despite lithium’s medical applications, its industrial uses are far more widespread. From glass and ceramics, to nuclear fission and rocket propellants, lithium is a very important industrial element.

Lithium’s most well known use is now in lithium-ion batteries, which accounts for well over 70% of worldwide consumption.

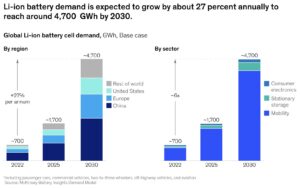

By 2030, the worldwide lithium-ion battery market is expected to grow by a factor of 5 to 10. This will be driven by the growth in electric vehicles and the increased consumption of electrical devices by all humans.

Source: McKinsey

Just like any industry that experiences dramatic increases in demand, supply usually catches up. However, when it comes to increased lithium production, there is a bit of a mystery of where these new supplies will come from.

Investors who can back companies located in regions that will contribute to future production will likely do very well. So, where will lithium be coming from? That’s the lithium mystery.

The Lithium Mystery

First, it’s important to understand the difference between production, reserves, and resources.

- Production: the amount of a resource that is extracted from the ground.

- Reserves: natural resources that have already been discovered and can be exploited for profit immediately.

- Resources: deposits that are known about (or believed to exist), but are not immediately exploitable.

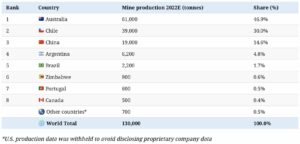

Around the world, the top producers of lithium by country are as follows:

Source: VC

Australia and Chile dominate worldwide production. Three of the four most productive lithium mines in the world are in Western Australia, which is why Australia tops the above list.

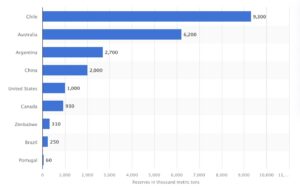

Although there are many conflicting ‘official statistics,’ the general assumption is that global reserves look something like this 2023 estimate from Statista:

Source: Statista

There are two problems with the above estimates:

- Reserves are estimated based on the ability to get lithium out of the ground, which hinges on government policies, mining technologies, and companies’ ability to actually perform.

- Reserves are estimated based on areas that have already been explored and are known.

As lithium becomes more valuable – both in monetary terms and as a key element for manufacturing – governments will be more incentivized to open exploration areas, mining technologies will be improved, and companies will become more efficient and motivated.

This is not to say that the current lithium industry is going to completely change. However, for investors, there are have been a variety of recent changes that are worth digging into.

The Lithium Mystery Unfolds

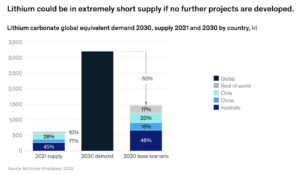

There’s no denying that lithium demand will continue to increase in the future. Even the most conservative forecasters agree that consumers will only increase their consumption of lithium-ion powered devices. And with the transition to electric vehicles around the world, lithium consumption is sure to accelerate.

Source: McKinsey

The big lithium mystery is where all of this metal will come from. At first glance, it would appear that Chile, Australia, Argentina, and China hold the keys to most of the future lithium production. But, the past couple of years have uncovered many new sources that were previously never even considered. For example:

- Mexico recently announced (June, 2023) the discovery of more lithium deposits, after the country claimed it had the world’s largest deposits several years ago.

- Bolivia just announced (July, 2023) that its lithium reserves are even larger than their initial estimate. Bolivian President Luis Arce said, “We are the largest lithium reserve in the world, and we have to know how to manage it intelligently to exploit and transform this resource.”

- Iran says it just discovered (May, 2023) the world’s second largest lithium deposit. The discovery is being called a game-changer, as it disrupts strategic mineral access for the Middle East region.

- In the United States, Exxon-Mobile is planning to build one of the world’s largest lithium processing facilities, which would produce about 15% of all finished lithium produced globally in 2022. Some estimates states that the US has the 4th most reserves of lithium in the world. California even has enough lithium to serve all domestic demand for the US.

As the demand for lithium increases, it’s likely that there will be even more lithium discoveries around the world. The question for investors is where and how to invest.

Where to Invest in Lithium

The next several years will likely see extreme volatility in rare-earth and strategic metals, as the world’s geopolitical structure is in transition. For example, China recently announced export bans of gallium and germanium (used in semiconductors) beginning on August 1, 2023. Considering that China processes 2/3’s of global lithium production, there is a real threat to future lithium supply chains.

China’s hold over the world’s minerals gives it the power to potentially disrupt the West’s energy transition, chip manufacturing and defense industries as its great-power rivalry with the U.S. heats up. A Chinese move to restrict exports of, say, lithium or cobalt would hit non-Chinese automakers hard, throwing the production of electric-car batteries into disarray. –WSJ

Making the right lithium investment now requires you to take into consideration geopolitical situations – something that many investors haven’t had to think about for a very long time. For those located in the west, it’s probably wise to only allocate capital to companies or funds that are managed and based in the west.

Still, even with possible global turmoil on the horizon, it’s highly likely that the need for lithium will weather any storm. In fact, the disruption of production, supply chains, and manufacturing could increase lithium prices dramatically.

Easy Lithium Investments

The easiest way to invest in lithium is via an ETF. Currently, there are three lithium themed ETFs:

- Global X Lithium & Battery Tech ETF ($LIT) – fee of 0.75%; not all holdings are lithium specific

- iShares Lithium Miners and Producers ETF ($ILIT) – fee of 0.47%; low trading volume

- Sprott Lithium Miners ETF ($LITP) – fee of 0.65%; low trading volume

Although these ETFs will give you exposure to lithium, they come with fees and some are not focused specifically on the metal ($LIT invests in companies that use lithium, like Tesla, Panasonic, and BYD).

If you want to invest directly in the top lithium mining company, go with Albemarle. Albemarle is headquartered in the US, has been in business for over 100 years, is the world’s top producer of lithium, and is listed on the NYSE. Currently, the company has a P/E of 6 and has paid dividends since the early 1990’s.

Difficult Lithium Investments

There are many analysts speculating that lithium could be the next explosive investment opportunity. Some are saying that lithium today (in 2023) is like uranium in 2007. For context, uranium went on a several year bull market in the early 2000’s. In one year alone the price of uranium tripled (2006-2007), which resulted in small cap uranium miners experiencing 1,000%+ gains. Many private investors made an absolute killing during this time period.

Personally, I don’t believe lithium will see the explosive returns that uranium saw. However, I do believe that investing in lithium is a much lower risk compared to other speculative commodity trades. As I explained earlier, the demand for lithium is nearly certain to increase and it’s highly likely that producers and supply chains will see disruption in the coming years.

If you want to try your hand at investing in small cap lithium miners, there are literally dozens of companies that you can sort through. Furthermore, as lithium investments trend upwards in the future, I expect even more companies to pop up. Be aware that many of these new companies will be intentionally engineered to benefit the financiers who own significant amounts of shares. Do your homework!

If you’re not going to immerse yourself into the world of lithium investing, just go with an ETF or major miner. You’ll see smaller total gains, but you’ll reduce your risk significantly. Although some small lithium miners may see huge returns, there’ll likely be a lot who go to zero.

My Lithium Mystery

In case you were wondering about that private lithium investment that I mentioned at the beginning…

Well, the company ended up going public about a year ago and I still own all of the original shares. Although the HoldCo is domiciled in the UK, the OpCo now owns mineral rights throughout the SouthWest of the United States. If those mineral rights end up yielding large lithium production, then the company could do very well.

However, another scenario just presented itself, which I did not anticipate when I first made the investment. US based companies, who have historically relied on foreign imported lithium, are now considering acquiring domestic lithium producers. Ford and Tesla are already investing billions of dollars into US based lithium operations, and other companies are likely to follow.

Speculating on US based lithium companies may turn out to be very interesting in the coming years.