I have an extended family member who won’t use Uber. He thinks it’s weird that some stranger will come pick you up anywhere, in their own car, and then you’re supposed to trust them to safely transport you to your destination.

“What about getting picked up at your house?” He asks. “You’re basically showing a stranger exactly where you live, and then letting them know that you’re leaving.”

If you think about it that way, I guess he has a point. Letting a complete stranger know that you are leaving your house does put you in a vulnerable position. Maybe the driver that picks you up could then tell a friend to come rob your house while you’re gone.

“But what about if you just need to get picked up at a restaurant and then taken to a hotel? That doesn’t allow the driver to know much about you,” I say to him.

“Yeah, that’s a better way, but still, why would you trust someone to drive you? You don’t know what their driving record is and their car could be unsafe,” he responds.

“What about a taxi?” I ask.

“With a taxi, you can trust the driver and the car, because they come from a reputable company and have to pass safety tests that the city requires.”

“Ummm, ok…” (Really?!)

At this point of the conversation I just stop. There is no reason to debate a topic when there is a fundamental misunderstanding, or lack of willingness to think about new ideas.

Don’t get me wrong, I respect where he’s coming from, I just think he doesn’t understand how Uber works. Using Uber, or any other transportation service, is essentially the same risk. It doesn’t matter if it’s a taxi, limousine, bus, or whatever. They’re all basically the same.

But, that doesn’t matter to him. Uber is the new thing, and it is weird and untrustworthy. So he doesn’t use it.

This example of not wanting to use Uber reminds me of so many other trends of the past couple of decades.

Think about the internet. Do you remember how resistant people used to be about using the internet?

Typing your credit card information into a website so you could get a book delivered to your house? Never! Why would anyone ever share their financial information? You’re just asking to get robbed!

How about Facebook? Why would anyone waste their time chatting to people on a social network site? What a waste!

The list of similar examples could go on and on. The point is that the largest demographic of late-comers to any new technology are older generations. Right now, that’s the baby-boomer crowd.

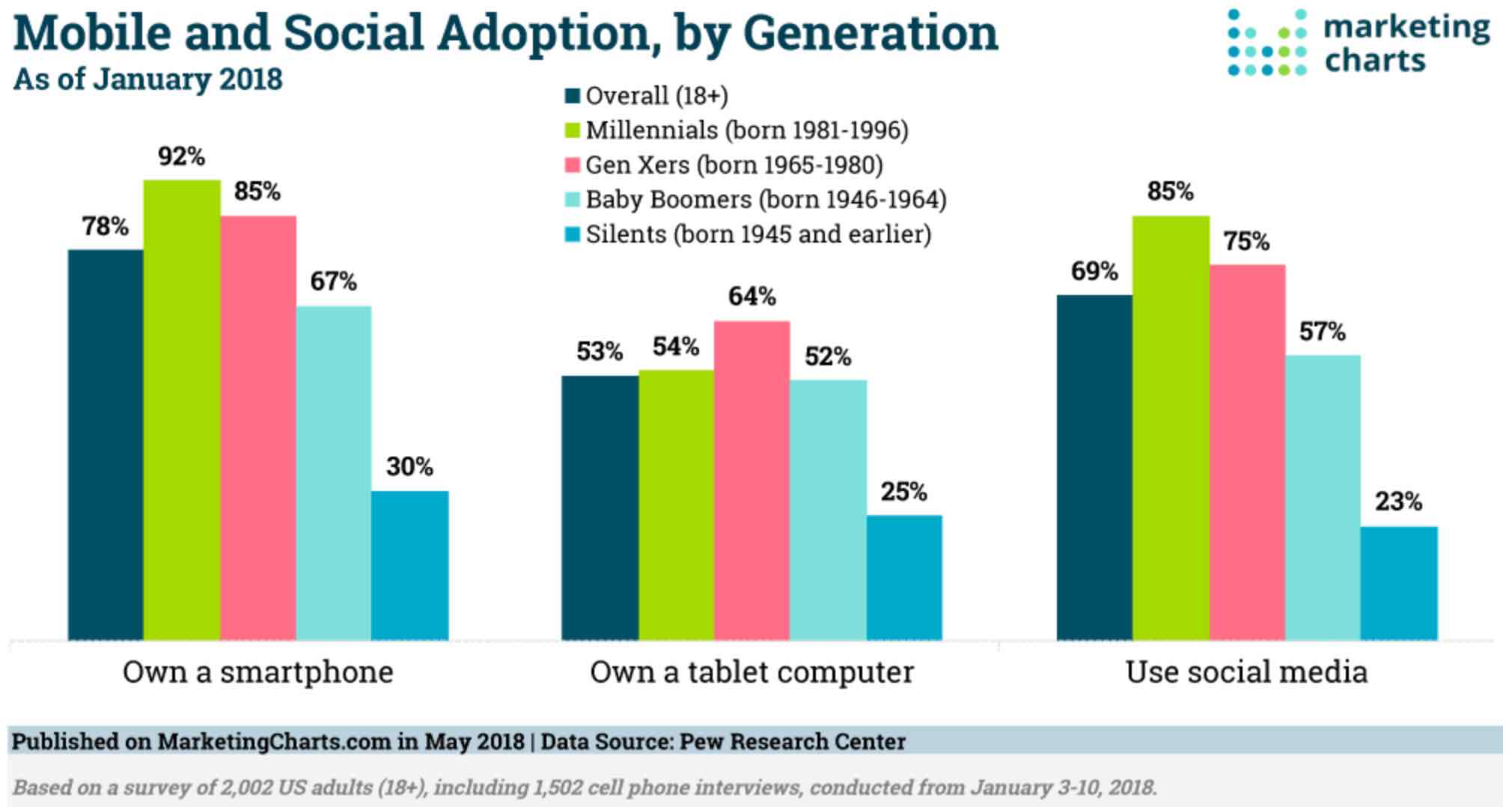

As proof of this, the fastest growing demographic of Facebook users are those aged 65 and older. The largest user group is the millennial generation, as that generation was the one who was in college when Facebook was first launched (and originally only available to them).

Of course, it didn’t start out that way. Facebook used to only be available to college students and most parents thought it was the dumbest waste of time out there. Fast-forward ten years and Facebook is now starting to be used by the crowd of people who were originally the most critical of it.

Anyway, the point I’m trying to make here is that early adopters typically reap the largest rewards. These rewards are on a variety of levels, especially financial.

So, what’s the next big trend where you can be an early adopter?

Canada, a G7 country, just legalized recreational cannabis.

As a side note, the Group of Seven (G7) consists of the US, France, Germany, Italy, Canada, Japan, and the UK. These countries make up over 62% of global net wealth and over 42% of global GDP. And, not surprisingly, these countries also set global trends that eventually trickle down to the rest of the world.

If you have been on the fence about investing or at least paying attention to the cannabis market, do yourself a favor and start right now. Just start. Take a look. Educate yourself about the market.

Cannabis is set to disrupt alcohol, tobacco, pharmaceuticals, alternative medicines, and a variety of other markets. This won’t happen over night, but the trend is clear. Cannabis will become a bigger part of all of our lives.

And I’m not talking about the ‘stoner’ lifestyle that most associate with marijuana. Here are just three examples of ways that you will see cannabis in your future.

- Sleep aid. Forget melatonin and heavy duty pharma-drugs. Cannabis will be the choice for those looking to get some shut eye. Everyday more and more micro-dosed edible cannabis products are hitting the market, which are aimed at the individual who does NOT want to get high, but simply wants to relax or get some sleep.

- Pain management and anti-inflammatory. Just like the micro-dosed products used for sleep aids, there will be more and more products formulated to help those with mild pain management and/or those battling inflammation. There are already dozens of pet-related products on the market that provide fantastic results.

- Lotions and creams. This will be a big category. Do you know how much people spend on miracle creams that fight skin irritation and aging? Well, I don’t have an exact answer, but it’s a big number. As cannabis becomes more widely accepted, you will see many, many more companies adding cannabis components into their formulas.

I predict that one of these three cannabis related products will be in most households within the next ten years.

The safest way to invest in this trend is to just buy a bunch of the top cannabis companies. Be warned that most are trading at extremely high valuations right now, but most will probably be just fine in the long run. (Of course, there will be many that fail too.)

And don’t worry about charging into the market. Ease your way in. There is still plenty of time and there will be many great opportunities in this space.

Start looking now. Be the early adopter in a space that most are still waiting to enter.