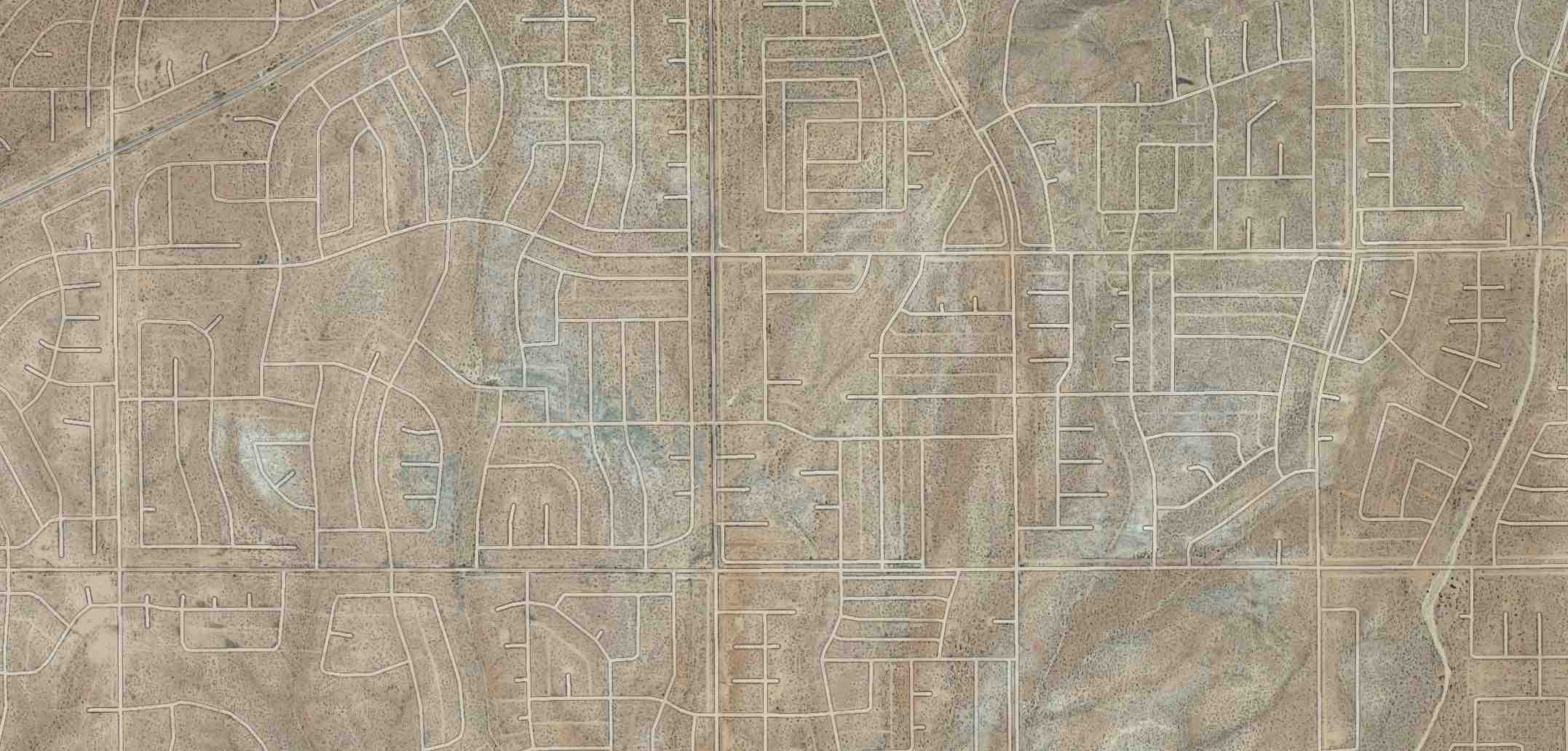

It’s all there. Stop signs, fire hydrants, storm drains, and paved roads for miles. The aerial view is hard to really comprehend. An endless maze of pre-planned streets that were built to be the backbone for the next utopian California community.

In total, over 80,000 acres were purchased to make this city a reality. That’s over 300 square kilometers of roads, parks, neighborhoods, and city infrastructure.

The plan was to capitalize on the rapid US urban expansion, which was fueled by the post WWII economic boom. Families were growing and they needed somewhere to live. Pleasantville type communities started to pop up all over the United States.

Build it, and they will come.

But, ‘they’ never did come to California City.

One of the main problems with the development of California City is that the first rule of real estate was broken: It’s all about the location.

Located in the California desert, the area can be beautiful. But, most of the time it’s either hot, dry, and dusty, or cold, dry, and dusty. Not exactly the place where people are flocking to.

How could someone make such a huge mistake? If you visit California City today, you can still see the massive amount of infrastructure that was installed. The miles of curbs, street signs, and sewer systems were all a massive waste. A complete failure.

That’s what happens when a vision neglects to consider reality. The vision becomes a failure.

Of course it’s easy to be judgmental in hindsight. The problem is that when you are making decisions in the moment, you tend to get caught up in the story that you want to hear… not the story that is real.

The entrepreneurs and investors who are the most successful have the ability to consider ideas and facts that conflict with their own vision. That’s unbelievably difficult to do.

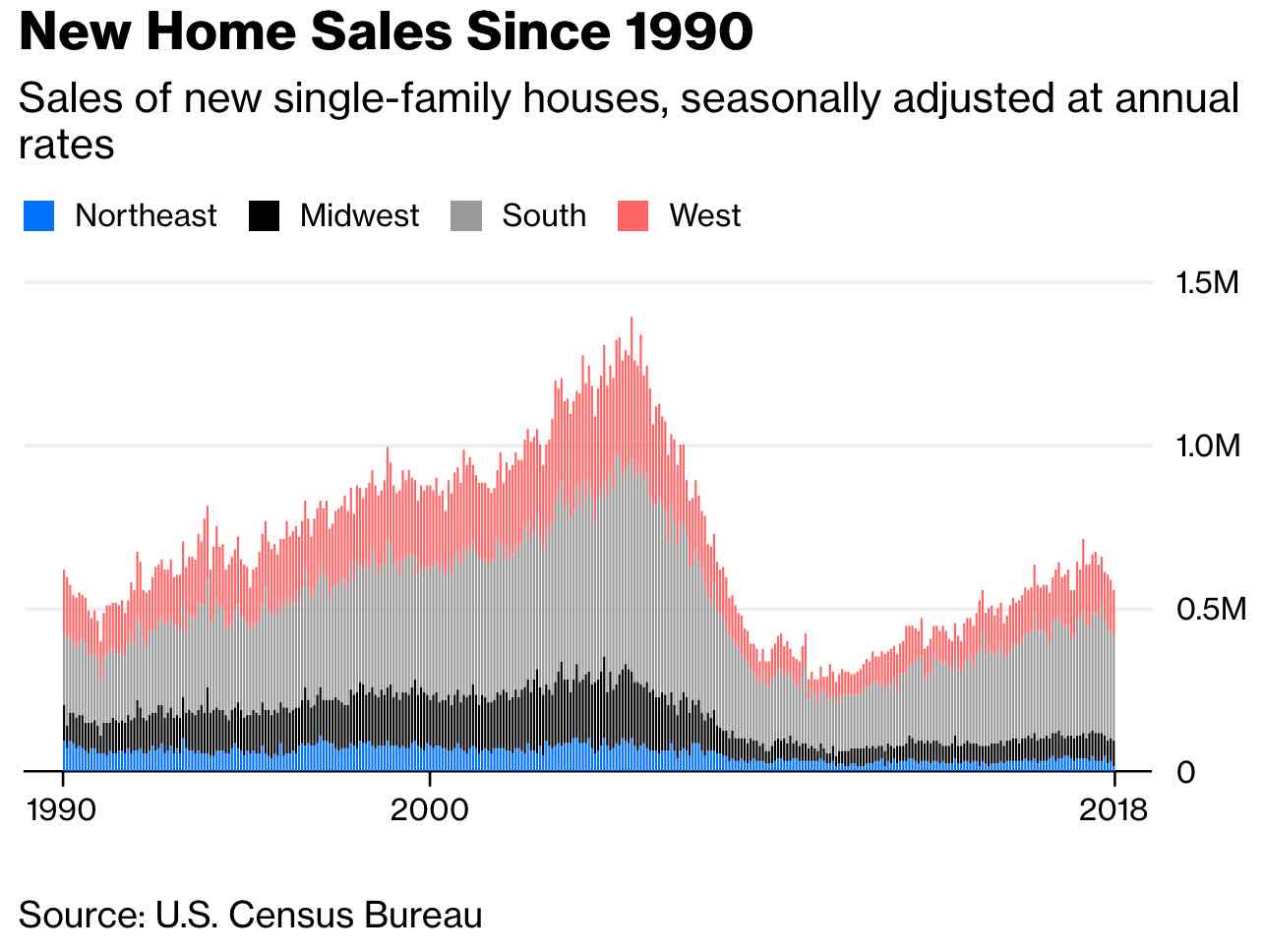

Today, another story is unfolding that is based upon the same assumptions as California City. People, mostly millennials, are just not buying homes.

In the past year, home sales are down a whopping 50% in the North East of the United States. This is the biggest decline since 2011, when the housing market was in its final crumbling stages.

Economists and researchers have made dozens of speculations, but most agree upon the main culprit being home prices. Their reasoning is that home prices are higher than ever before, even if you adjust for inflation.

A recent Bloomberg article assumed that increasing interest rates and the cap on SALT (State and Local Taxes) deductions have also slowed home sales.

However, this is an easy answer to a surprisingly complex issue.

Of course it’s easy to assume that people aren’t buying homes because they cost a lot. This happens in all economic equations. Prices go up, sales go down. Sales go down, prices go down. Prices go down, sales go up. It’s all cyclical.

But, what if something different is going on here? What if high home prices are just a small part of why home sales are going down?

What if – GASP – new consumers just don’t want to go into debt!?

Millennials, who seem to be a group of people that almost no one can effectively market to, grew up right in the middle of the last financial crisis. Some were just graduating college, while others were still in high school. Whatever their age was during 2008, this entire demographic learned one thing: The financial system is a house of cards that is run by a bunch of corrupt bankers.

Instead, millennials have chosen to spend their money on experiences and leverage the ‘sharing economy.’

This has left many speculators to believe that millennials are the dumbest group of selfish individuals to ever walk the earth.

Who would waste all of their money on experiences? Why wouldn’t you spend your money on actual assets?

The right thing that millennials should be doing is buying real estate that puts them into a 30 year loan, so they can be a debt slave be building equity.

But, millennials aren’t that dumb. In fact, right now in the US, it is financially more responsible to rent a home in 65% of the country versus buying. This number is determined by a variety of somewhat subjective data points.

Clearly there is no right answer here. We can, however, look at a few facts:

- Home prices across the US are starting to soften

- Interest rates are creeping up

- Younger generations of consumers are not traditional home buyers

You can play this trend a variety of ways, with the easiest just being a landlord to a millennial who will gladly pay you a rent check for years to come.

The bigger picture here is that we may be running into a new housing trend that is simply unimaginable for most people.

“What?! People don’t want to buy houses?! They only want to rent?!”

As implausible as that sounds, it’s a trend that is increasing. Investors are continuing to build their portfolio of single family homes that they can rent out to the growing renter market.