As I write this, or as you read this, the world’s population is passing the 8 billion mark. With so many humans on planet earth, why should we be looking to invest in longevity? Enabling people to live longer seems like a potentially dangerous endeavor, right?

There are numerous obvious risks with global overpopulation. But, I won’t be reviewing any of those potential problems, because they’ll likely never exist.

Instead, I’m going to show you why the world actually has a risk of declining population. And that’s why the opportunity to invest in longevity offers enormous rewards for both investors and humanity alike.

Invest in longevity, because “demography is destiny.”

“Demography is destiny” is a concept that was first identified during the 19th century to predict trends in politics. The assumption at the time was that certain political parties would gain strength as trends in demographics evolved.

This assumption makes sense in theory. However, the concept hasn’t really played out in reality. Instead, political parties are often driven by large personalities who symbolize key social issues.

Instead of applying the concept of “demography is destiny” to politics, we (as a world) should apply this saying to longevity. That’s because when it comes to human aging and population trends, there are few forecasts that are more accurate.

The ‘Silver Tsunami’ on the horizon.

The technical definition of demographics is the, “statistical data relating to the population and particular groups within it.” Religion, politics, income, and occupation are all examples of different segments of demographics. But there is no more simple and obvious demographic category than age.

It doesn’t matter where you live, what you believe in, or even what your genetic background is – we all age. Time is an inescapable fact of life, and it’s a trend that we can track with relative pinpoint accuracy.

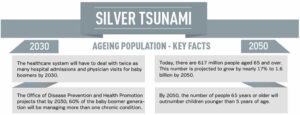

For example, the ‘Silver Tsunami’ is a demographic trend that is a certainty. Silver (being those over 65 years old) and tsunami (a huge incoming wave) is a bit of a cheeky term, but the broader meaning is still very important to understand.

This incoming wave of seniors is especially important for investors and entrepreneurs who want to target a future opportunity that is guaranteed to happen.

It’s obvious that the number of seniors (those over the age of 65) is growing globally as our total population grows. What’s not obvious is that the senior’s proportion of the total population is growing in many countries.

Source: HealthManagement

In the United States, those over 65 went “from 12.4% in 2000 to 16.0% in 2018” of the total country’s population. This is likely to keep increasing as improved living standards, access to better healthcare, and medical breakthroughs are coupled with declining birth rates.

Kids: expensive and inconvenient.

Similar to the Silver Tsunami trend, global birth rates have also established a direction which we can forecast with relative certainty.

Birth rates around the world have been declining for nearly 100 years. But it was only around the turn of the millennium when population growth really began to contract. (Birth rates need to be above 2.1 children per woman in order to sustain population growth.)

Source: macrotrends

As displayed above, our population growth trends are already in contraction. This trend is expected to remain until at least 2100.

The reality is that it’s very difficult to raise children in today’s world. This is especially true in developed nations where emphasis has been placed on individual success and career development. Family values, supportive communities, and infrastructure to foster child bearing families has often been neglected.

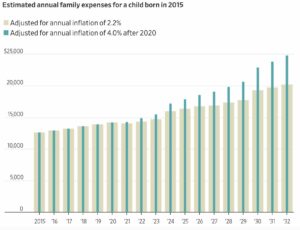

For example, in the United States, “a married, middle-income couple with two children would spend $310,605—or an average of $18,271 a year—to raise their younger child born in 2015 through age 17.” –WSJ

To be clear, that’s over $300,000 to raise a single child. And this doesn’t even take into account the societal pressure that has been put on both men and women to have some sort of business oriented career.

Source: WSJ

These stressful and unrealistic social expectations make declining birth rates obvious. It’s no wonder that, “one out of every five people in the United States has received mental health treatment in the past year.”

So, when will the breaking point come?

Peak global population.

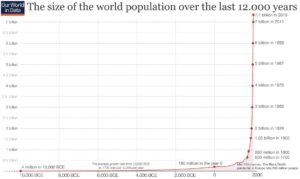

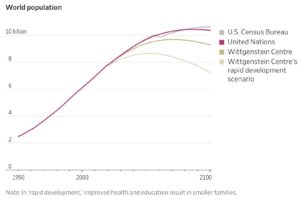

The growth pattern of the human species over time is shocking. If I took all the labels away from the chart below, you may think you were looking at a chart for a meme stock or crapto-coin.

Source: Our World in Data

Now, I am not projecting a ‘crash’ in the global population. (Although, I do have to admit that there are some alarm bells ringing in the back of my head from just looking at this chart. Maybe it’s some instinctual feeling based on seeing similar charts in the past…?)

Instead, the point of showing this chart is to demonstrate our future expectations based on history. If you’re reading this right now, you have never met anyone who has not experienced rapid progress.

Your parents, your grandparents, and even your great-grandparents have all been a part of the meteoric rise of humanity. The culmination of abundant food, energy, technology, and globalization have enabled humans to progress at warp speed.

However, this progression was, for the most part, centered around population growth fueling humanity’s advances. We have basically been throwing people at problems.

Now, with the ability to leverage and scale with technology, progress can happen without the need to proportionally increase the number of people on earth.

Source: WSJ

As recently reported by multiple different organizations, including the graphic above, there is a general consensus that global population will peak within the 21st century. Some predict that this could happen as soon as 2050.

Our world is nowhere near prepared.

The biggest opportunity, ever: Invest in longevity.

It doesn’t take a demographic expert to understand the world’s coming changes. Aging baby boomers, declining birth rates, and exponential technology advancements all point towards a declining global population.

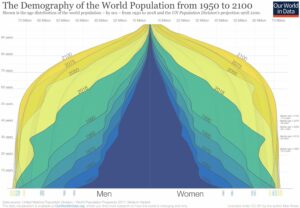

And it’s not just a declining population, it’s a changing one too. The actual number of older people will start to increase compared to the amount of younger people. This shift in demographics will change everything from our financial systems to our consumption habits.

Source: OWiD

But this is a slow, boring trend. It’s something that will take time and won’t materialize over night. That’s why investing in longevity is the biggest opportunity investors will ever see in their lifetime (how ever long their lives might be!).

The fact that this is a slow trend means that most investors and entrepreneurs won’t target this opportunity. Most people are looking to make a quick trade. Most people don’t have the patience and foresight to leverage this opportunity.

Still, despite this trend taking time to develop, one can point to the well known statistic in the United States, where over 10,000 people reach retirement age each day. This is not only overloading senior services, but also opening up large gaps in labor markets.

Savvy, patient entrepreneurs and investors can easily target this trend by investing in everything from senior care facilities to automated labor technologies.

But for those who want to play a more active role, biotech is where you should be looking.

Longevity Biotech: How big money is starting to invest in longevity.

Billionaires, small investors, entrepreneurs, and scientists who have noticed the enormous opportunity in longevity are now focused on biotech. This isn’t necessarily a new trend, when it comes to research focused on human aging. However, the trend of investors bringing big money to the field is starting to accelerate at an impressive pace.

For clarity, longevity biotech is not just about extending a human’s lifespan. Biotech companies that are currently targeting longevity are also focused on extending people’s healthspans (the number of healthy years in one’s life). What’s the reason to live longer if you can’t enjoy a healthy lifestyle?

Of course it’s the goal of any healthcare product or service to extend healthspan. What differentiates most longevity biotech companies is that they are searching for preventative measures versus reactionary treatments. (This preventative versus reactionary strategy is what may be the catalyst for the future growth of longevity biotech.)

You might already know of several household names who have allocated significant amounts of capital to longevity biotech.

Here are five companies associated with some of the world’s wealthiest people:

- Altos Labs: Launched in early 2022, Altos Labs announced $3 billion (!) in funding out of the gate, with backers including Jeff Bezos.

- Calico: Founded in 2013, Calico Labs is a Google launched company with direct connections to Sergey Brin. Calico has raised at least $2.5 billion and has joint ventures with pharma-giant AbbVie.

- NewLimit: Announced in late 2021 with over $100 million in seed funding, NewLimit was founded by Blake Byers (notable private investor) and Brian Armstrong (Coinbase Founder & CEO).

- Hevolution: The Crown Prince of Saudi Arabia (MBS) serves as Chairman of Hevolution, which is a foundation that has committed to investing up to $1 billion per year into ‘healthspan science.’

- Juvenescence: Founded by British billionaire, Jim Mellon, Juvenescence is structured as a DisCo and has raised hundreds of millions of dollars. (We invested in Juvenescence several years ago.)

Despite the enormous amount of funding that the above companies have raised, they are all still private and basically off-limits to small investors.

But that doesn’t mean there aren’t other great opportunities to invest in longevity…

Get involved or invest in longevity, now!

Approaching the longevity ecosystem as an outsider is not only intimidating, it’s also very risky. In addition to needing to know the landscape of the many companies operating within longevity, you need to have a solid understanding of aging science and biotech investing.

However, the rewards can be enormous – both monetarily and for humanity. That’s why you should look at how you can dip your toe into the longevity waters.

Four ways to invest in longevity.

(Note that investing can be with your time/effort.)

- Invest in public longevity companies.

- Invest in private longevity companies.

- Join a longevity company that is hiring.

- Start your own longevity company.

I’ll dive into each of these four methods to invest in longevity below. Before I do that, I want to bring your attention to something very important: understanding the science.

I’ll be the first to admit that most of longevity science is above my head. I am not a doctor, trained scientist, or professional researcher – I don’t even have a degree in a STEM focus.

I do, however, make sure that I’m relying on professional assistance. Just like any industry, before you invest or get involved somehow, it’s important to do thorough due diligence. The longevity industry is no different.

For example, I know of one longevity company that has raised several hundred million dollars, but is likely a complete scam. It’s not a company I’ve mentioned in this article, but one that is widely known about. They have very well known investors and are often in the media.

My point is that you should be very careful about navigating the world of longevity. There are lots of people selling dreams instead of real solutions that will extend healthspan and lifespan.

When it comes to investing in longevity, relying on trusted experts and sources of information will be just as important as your personal knowledge.

Invest in public longevity companies.

There are hundreds of publicly traded biotech companies. Of these companies, very few are actually focused on slowing, stopping, or reversing aging on a cellular level. So, if you’re looking to invest in public biotech companies that are specifically targeting longevity, you’ll need to create some sort of methodology.

Also, before investing in any one public longevity company, you should diversify your strategy. Biotech companies – especially those targeting longevity – often have a binary outcome. They are either successful, or they aren’t.

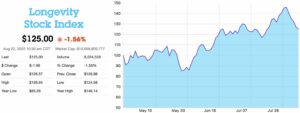

There are currently no public investment vehicles, like an ETF, that focus exclusively on longevity biotech. However, the company I founded recently launched the first index called the Longevity Stock Index. Since its inception earlier this year, the index has performed quite well.

Source: Spannr Longevity Stock Index

You can view the performance of all index constituents and replicate a similar basket of stocks in your personal portfolio. Perhaps we’ll work on making the index investable in the future… 🙂

Invest in private longevity companies.

As stated before, investing in longevity can be very risky. If you are an accredited investor and have the ability to invest in private companies, you should absolutely consider investing via a venture fund.

Venture funds focused in longevity biotech not only have unique access to exclusive deal flow, but they should also have some sort of scientific advisory board (SAB). This board of experts helps with the due diligence process required to analyze early stage private longevity deals.

A well rounded SAB combined with a seasoned team of early stage investors should be well worth the price of any fees that the fund charges.

If you’re looking to invest smaller sums of capital into a variety of deals, you should definitely apply to the Spannr Ventures syndicate. It’s free to join and will give you access to longevity investment opportunities that you won’t see anywhere else.

Other venture capital firms currently operating within longevity include:

- Healthspan Capital

- Apollo Health Ventures

- KIZOO Technology Ventures

- Longevity Tech.Fund

- R42

- Maximon

- The Longevity Fund

You can also gain exposure via a variety of crypto projects and DAO’s.

Join a longevity company that is hiring.

Despite the first half of 2022 being known for companies laying off employees, the longevity industry is actually hiring like crazy! That’s because in the first half of 2022 alone, billions of dollars have flowed into a variety of funding rounds. Much of this funding is going towards hiring new employees.

Although it’s true that many of the open positions require backgrounds in technical sciences, there are also many other opportunities. I’ve seen jobs available for writers, business development specialists, social media managers, and everything in between.

If you can land a job with a longevity company, you’ll basically be getting paid to learn about longevity!

Start your own longevity company.

If you haven’t noticed yet, this is the strategy that I’m pursuing. Because I am not a scientist and don’t have any kind of biology background, I have taken the picks and shovels approach. Instead of trying to make scientific breakthroughs, I’ve decided to support all of the companies that are doing the technical work.

I launched Spannr earlier this year with a great team of co-founders, and we’re already noticing the enormous opportunities that exist within longevity. We share many of those opportunities in our weekly newsletter.

One glaring problem that we’re noticing within longevity is how disorganized everything is. The entire ecosystem is nearly impossible to navigate for new comers. That’s where we believe much of the opportunity lies for entrepreneurs entering the industry. Simply making things simple. That’s what will bring new-comers to longevity.

What’s next for longevity?

I, of course, don’t have a crystal ball. But I constantly remind myself of two questions:

- How many people in the world want to live longer, healthier lives?

- How much money will people pay in order to live longer, healthier lives?

I have no idea what the correct answer is to either of those questions, but I believe they are numbers far larger than my brain can comprehend.

Beyond the profit potential within longevity for investors and entrepreneurs, there is an enormous benefit to society as a whole. Our world is entering a time where demographics will shift dramatically.

How will we adapt? Does increasing healthspan for our aging population alleviating burdens of a growing and potentially unproductive senior class? There are many more questions that have yet to be answered, but one thing is for sure…

It’s a mathematical certainty that the world’s population will both decrease in total numbers and also increase in average age. Does investing in longevity help solve these challenges?