“Our economy is going to crash, but real estate will probably be fine. Maybe 2024 real estate prices will go down a little bit. But nothing like the housing crash in 2008. That won’t happen again.”

I’ve heard that from at least three different people this past month. Of course, the opinions of three people is hardly an accurate way to forecast the future… but a similar sentiment is likely true across the US.

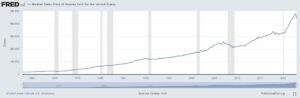

Housing prices have rocketed to nosebleed territory over the past several years. Cheap debt, stimulus money, and FOMO have fueled a housing boom that has somehow flown under the mainstream radar. Why are more people not concerned?

Of course, it’s no secret that home prices have gotten out of control. But instead of sincere concern for the precarious situation the real estate market is in, home owners are blinded by the equity they’re sitting on.

Everyone is a Genius in a Bull Market

Does that sharp increase starting in 2020 concern you?

Source: FRED

So what happens next? Are we doomed to repeat another housing crash, a la 2008? Or will our economy crumble around a robust real estate market that will sustain itself amid chaos?

Of course, no one knows for sure what will happen with real estate in 2024. Not I, not you, and especially not the talking heads in our government.

There could be an argument that real estate will be just fine, as buyers rush into safe haven assets in order to avoid crippling inflation that may very well persist into 2024 and beyond. Perhaps putting cash into real estate could be a savvy move to avoid the upcoming demise of the US dollar as it loses its global influence.

Personally, as someone who is in the market to buy a house, the pro/con ratio of purchasing in May of 2023 doesn’t feel good. When it comes to the pros of purchasing a home right now, there is really only one thing I can think of: Fulfill my housing needs.

When it comes to the cons of purchasing a home right now, the list gets quite lengthy. Here, in no particular order, are the cons that I am seeing right now:

Interest Rates Have a Lagging Effect

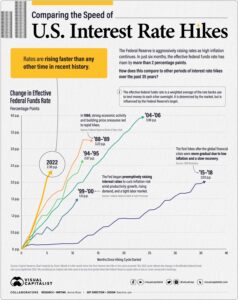

The US Federal Reserve has hiked interest rates faster than any other time in history.

Source: Visual Capitalist

While the actual level of interest rates may seem to be of most importance, it’s actually the speed in which rates have been hiked that matter most. That’s because interest rates have a notoriously long lagging effect, where the trickle down results are not known until many months or even years down the road.

There are dozens of academic papers and articles by economists that explain this reality. For example here is one from 1970 and another from 1995. The short explanation is that interest rates affect decisions on how and if consumers, businesses, and governments borrow money. These decisions then trickle down to real world metrics, like real estate prices. Human behavior, which takes time to play out, will cause the results of rate policy change.

Lateral to a Higher Payment?

I recently explained the problem with increased home borrowing costs:

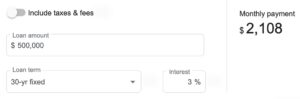

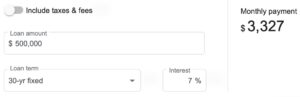

In the past year, mortgage rates have gone from just under 3% to now well over 7%. While a 4% change might not seem like much, let’s check out what this really means…

Assume that you are borrowing $500,000 to purchase a home, which is well below the jumbo loan threshold. Borrowing $500,000 at a 3% rate looks like this:

Now, what if we borrow the same $500,000 at a 7% rate?:

That’s a $1,219 per month difference, which equates to about a 60% increase in the cost to borrow the same exact amount of money.

This is very important to understand, because lenders issue mortgages based on the amount of money the borrower can afford to pay per month. Now that it costs 60% more than just a year ago to borrow money, most home buyers are completely priced out of the market they were originally in.

Why in the world would a current home owner sell their home, to purchase a new one, and enter into a new loan that costs 60% more?

Homes Are Still Too Expensive

Home prices across the US are already cooling in some areas, but there could be a lot more to come…

From 2020 to Q1 of 2023 home prices, on average, went up 32%. And within that same time period, borrowing costs have nearly doubled. How can housing prices keep going up if it’s getting more expensive for buyers to borrow money to make purchases?

Answer = housing prices cannot keep going up if rates stay high.

Something has got to give. Rates need to go down, or prices need to go down. Considering that the Fed just hiked rates to 5.25%, and is now talking about hiking even more, it’s looking like housing prices will break first.

Banks Are Going to Tighten Lending Standards

If increased interest rates aren’t bad enough, what is going to happen if banks just stop lending? That’s exactly what is happening with lenders across the US as, “economic uncertainty, a reduced appetite for risk, deterioration in collateral values and broader concerns about banks’ funding costs and liquidity positions” were cited in a recent Fed report.

Although lending standards have significantly tightened since the NINJA loan days, most banks have been happy to make a home loan to a well qualified buyer. That, however, is changing as more banks are reporting upcoming tightening standards for all lending to households.

Additionally, there will be a lagging effect, similar to what I mentioned above. Fed Chair Jerome Powell commented on these tightening standards by saying, “In turn, these tighter credit conditions are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain.”

Will Buyers Even Have Money?

Let’s not forget the most important ingredient for a booming market: buyers!

Even if all of the items I mentioned above are wrong, ask yourself this: Is the US economy going to be stronger or weaker in 2024?

Whether you ask Ernst and Young, JPMorgan, or even the Congressional Budget Office, the outlook over the next couple of years isn’t super bright. Nearly all analysts believe our economic situation is going to get worse before it gets better, which will impact consumers across the board. So far in 2023, the US consumer is already seeing, “a significant cooling of spending at the end of Q1.”

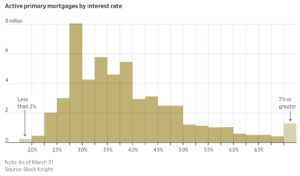

2024 Real Estate is Gonna Be Lit

There are some real concerns for the 2024 real estate market, as I’ve outlined above. However, it’s worth noting that 99% of US home loans are under 6%, and two thirds are under 4%. That means that many home owners are locked into a mortgage that they may not want to get out of for a long time.

Source: WSJ

This may cause a strange situation where many qualified buyers won’t want to leave their existing home that they own, and many new buyers will just continue to rent if interest rates stay high. A real estate market that may stagnant for several years is very possible, as there will be no incentive for buyers to purchase or sellers to sell.

That said, there will likely be some very interesting situations for savvy investors. Those who can figure out creative borrowing and lending schemes may be able to compete with banks, and those with cash to deploy could find great deals with desperate sellers.