If you’re reading this… thank you.

Thank you for having an open mind. For realizing that everything we are told in our lives may not be true. Thank you for having the guts to say, “Hey this isn’t right. Something else is going on here.”

If you’re a new reader (or you’ve been with me for a while now), here is what I mean…

I say some things that are not widely accepted. I give my opinion on certain topics and give my analysis on certain opportunities.

Am I right? Who knows… But, I always give you an opportunity to tell me if I’m wrong (my email is at the bottom).

Of course, I think I am right. I’m biased. I also see my personal investment returns – and I’m happy with them.

But in defense of myself, I use real data and information to form my ideas. I don’t simply communicate some dream I had…

That brings me back to bonds and the market in general. I’ve had an incredible amount of feedback with people asking what they should do when it comes to the stock market and bonds.

Here is the best answer I can honestly communicate: JUST WAIT.

Yes, that’s my answer. Just wait. I know that is not what you want to hear. You want to find out what you can do right now. It’s actually hard for me to say that… but I know that’s the right thing to do right now.

There are all kinds of things that we can do in the short-term, such as… read books, invest in unique assets, become better people, and concentrate on how to make ourselves more successful.

I also have some exciting resources I’m going to share with you over the next couple of weeks. There is one report that I am particularly excited about – it has to do with a potential law change in California this coming November that could end up being very profitable.

BUT, we should not be trying to invest in a market that is not offering opportunity, especially if it’s overly expensive.

And I can say this in general terms, across many different markets and countries.

Whether it’s the US, India, China, Japan, Europe, South America or Australia… most markets are very expensive. DO NOT ‘FORCE IT.’

Do not get burned. Do not chase value to the top.

The massive amount of credit that has been created by central banks and governments throughout the world has fueled an enormous bubble.

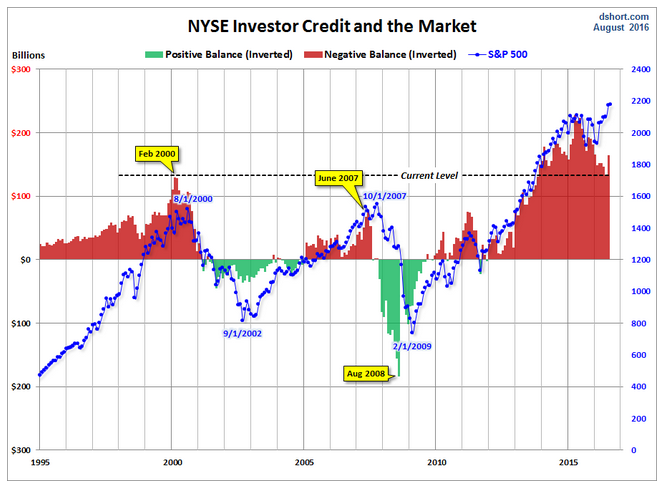

This is one of the best charts I’ve seen that illustrates the market highs fueled by credit. Of course, it’s important to note that much of this credit is in fact debt that investors have taken on.

So, instead of me trying to convince you of some concept or theory, I’ve compiled five quotes from five extremely sharp (and rich) individuals. These guys are all telling us to be careful. They’re all saying, “Hey! Do not invest here. There are huge consequences coming.”

I have already given you lots of ideas to increase your wealth across many different countries and markets. (Like investing in silver. Or currency arbitrage. Or foreign real estate. Or collectables. Or marijuana.)

But now I am giving the advice that SOMETIMES IT’S BEST TO JUST SIT STILL AND WATCH.

(In order to dodge the massive risk that is forming in our markets, the easiest thing to do is simply stand back. However, I will share some strategies to profit from this decline as events unfold. Things change on a weekly basis, so it’s near impossible to pick the right strategy today. I’ve spoke about the ideas here and given specific examples here.)

Here are those five quotes. They link to videos is you’re interested in hearing the entire interviews.

“If something is free, is it valuable, is it appropriately risked? … When you talk about interest rates being close to zero for a long time… I’m very concerned about the fact that we have desensitized our business community and people in general to the cost of capital. …That is the biggest concern.” – Sam Zell (interview on CNBC)

Alan Greenspan is also very concerned about the price of bonds. He explains here how interest rates have been pretty steady for thousands of years… except for the past several years. So he wonders if interest rates are changing permanently or are humans in for a rude awakening? He thinks the latter.

Bill Gross, known as the Bond King, says that record-low bond yields aren’t worth the risk. He also says, “If fiscal stimulus comes in, and we’ve seen it in Japan, China and ultimately in the US, after the elections I think we should be investing in real assets as opposed to financial assets.” He’s talking about gold.

Jeff Gundlach, known as the other Bond King, is also bearish on stocks and bonds – he says to buy gold too!

Carl Icahn says, “The reason I made a lot of money is that sometimes it just hits you over the head… that this is a great deal or this is s simple true… and you know it takes time to understand a simple true… it’s a simple true today that we are in major trouble in our economy. Now sometimes it takes years for that to come to fruition. But I will tell you that if you look at the numbers today with zero interest rates out there, we still can’t really make profits in our companies… the profits are manufactured by buy-backs; therefore sooner or later zero interest rates are causing all these bubbles…”