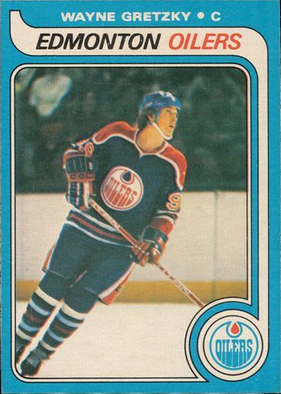

Last week, Wayne Gretzky’s rookie card, “which is graded a perfect 10 on the Professional Sports Authenticator (PSA) scale, sold for $465,000. The previous record was $94,000, set by the same card, in 2011. [“That’s a 395% price increase in just five years. It is astonishing, especially for a card that isn’t so old (1979) and isn’t so rare (there were tens of thousands printed from this series), and belongs to a player very much alive, who retired in 1999. (This particular card is the only known perfect 10 of its kind that has been PSA graded; there could certainly be many sitting in someone’s attic.)”

[“That’s a 395% price increase in just five years. It is astonishing, especially for a card that isn’t so old (1979) and isn’t so rare (there were tens of thousands printed from this series), and belongs to a player very much alive, who retired in 1999. (This particular card is the only known perfect 10 of its kind that has been PSA graded; there could certainly be many sitting in someone’s attic.)”

Think about that. Someone paid nearly a half million dollars for a tiny piece of cardboard.

I spoke about it a couple weeks ago, and it seems my timing couldn’t have been any better…

“It’s another example of how hot the market is,” says Ken Goldin, CEO of Goldin Auctions.

Of course, you and I know why this happened – why this little card was bought for so much money. It’s because of cheap money. Central bank policies have forced people to buy things that have value. Some are buying gold, while others are buying art… or hockey cards.

And…

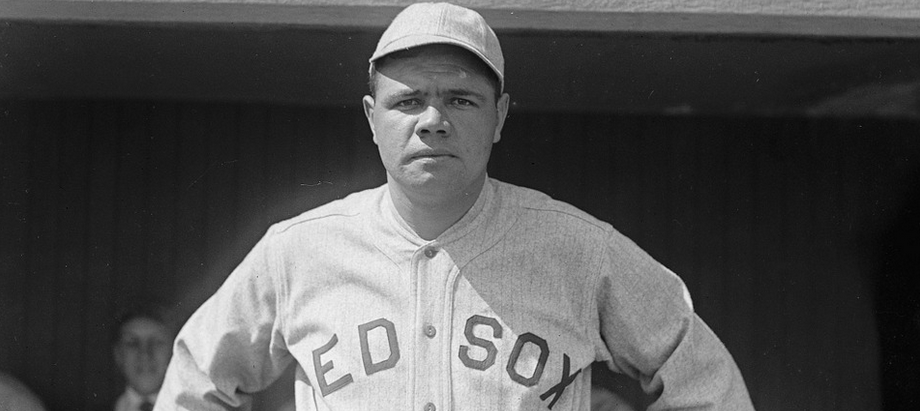

“It isn’t just trading cards that are fetching exorbitant prices right now from deep-pocketed collectors, but other sports memorabilia. Babe Ruth’s contract with the Boston Braves from 1935 (the original document) sold at the same auction on Thursday night for $360,000.” I wrote a quick guide last week on how to acquire weird assets that can explode in value. Just like that Wayne Gretzky card.

I wrote a quick guide last week on how to acquire weird assets that can explode in value. Just like that Wayne Gretzky card.

If you still want the guide, you have to send an email. There is no sign up page, or download form… it’s old school. If you email here: contact@codyshirk.com you will receive the guide for free (with the secret agreement that you’re going to help me. Let’s make it a hand-shake agreement. Over the internet. Everything over the internet is legit, right?).

In addition to me saying that asset prices are going to sky rocket… I’ll make another prediction… we’re going to see a lot more record sales prices of ‘one-off’ valuable assets.

I’d keep an eye on popular auctions starting now. We might see some eye-popping prices for famous works of art from Picasso, Warhol, Dali, and the like.

I’ll admit, I’ve been pretty negative on the market lately… and, that’s because I am. In general, there are not too many positive things to look at in our world.

There are serious problems in the EU right now. In fact, I don’t think the Eurozone will look anything like it does within the next ten to twenty years.

And major investors agree. They’re piling into gold and liquidating their stock holdings.

People like Carl Icahn, who’s “net position has never been shorter the market,” is preparing for something… Maybe he’s wrong… or maybe he’s right.

BUT… That is what everyone else is going to get sucked into. Negativity and doom.

Where there is huge change, there is huge opportunity.

And that is what we need to focus on – the opportunity.

Gold and silver saw a bit of a pullback last week… and we may see more in the coming days.

If you already own, don’t panic. This is a healthy sign and an opportunity for us to buy more.

The longterm trend is on our side in the metals space, so don’t get caught up in the weekly fluctuations.

Later this week, I’ll put together three different ways to give yourself exposure to precious metals – the least risky and most risky, with great returns and even greater returns.