Practice what you preach… right?

Many real estate investors, who derive the majority of their income from the actual properties that they own, don’t own the home that they live in.

Seems weird that someone who invests in real estate wouldn’t invest in their primary residence. What’s going on here?

Obviously this isn’t true in all cases, but you’d be surprised by how many wealthy people – both real estate investors and high income earners – choose to rent the homes that they spend the most time in.

Personally, I believe real estate is one of the best investments you can make. However, when it comes to your primary residence there is really only one circumstance where you should own your own house if you plan on making money from it. (I’ll reveal that at the very bottom.)

Other than this one circumstance, renting usually makes more sense from a financial perspective.

Let me break it down and show you how the numbers add up.

Let’s say you want to live in a million dollar home in Los Angeles. Believe it or not, this is not an outrageously priced home for the LA area.

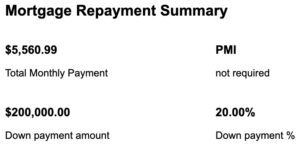

So… let’s look at the numbers if I buy a million dollar home:

- Purchase price = $1,000,000

- Down payment = 20%, which is $200,000

- Monthly mortgage payment on a 30 year fixed 4% rate on $800,000 (remember this is a jumbo loan with higher rates) = $3,819

- Annual property taxes (which is 1.25% of purchase price in LA County) = $12,500 (or $1,042 per month)

- Annual upkeep expenses (I’m talking capital expenses that include everything from landscaping, paint, roof, driveway, termites, windows, carpets, etc.) about $1,000 per month. It costs a lot to upkeep a $1,000,000 house.

- Annual property insurance (this depends on the region, but LA is known for wildfires and earthquakes, so insurance can be very high) about $500 per month.

- HOA dues (which is not applicable for every home, but if you have a million dollar house, there is a strong chance you live in a community that has some type of dues) = $200 / month

So here are the costs you’re looking at that are required to simply ‘operate’ the house:

- Mortgage = $3,819 / month

- Property taxes = $1,042 / month

- Upkeep expenses = $1,000 / month

- Property insurance = $500/ month

- HOA = $200 / month

Total = $6,561 / month

Remember, this does NOT include utilities like water, power, gas, sewer/septic, internet, cable/satellite, etc.

AND… you have to put down a minimum of $200,000 to make this all happen.

So, we’re looking at $6,561 in minimum monthly expenses (again, not including utilities).

You can rent many $1,000,000 homes in LA right now for less than $5,000, and you don’t have to come up with $200,000 for a down payment. (Hopefully you can use that $200,000 to invest in high yielding opportunities.)

Maybe you’re thinking something like, “Yeah, but that money is going towards paying off my loan.”

Well, let’s look at how much money is actually going to pay off that loan…

Mortgage = $3,819 / month… BUT, the way mortgage payments work is that in the beginning of the term, you are paying almost all interest. That means a very small portion of the payment is actually paying off your principal. The banks do this to ensure that they are getting paid first.

Source: Mortgage Calculator

On a $1,000,000 loan, you only pay off a small portion of your principal for the first 5 years. Yes, that interest is tax deductible, but it isn’t building equity into your home.

Property tax = $12,500 / year. That doesn’t go towards anything. You’re basically renting land from the government (which is a whole debate in itself!). You have to pay that every year no matter what, and it goes up every year.

Property maintenance = $12,000 / year. This doesn’t go away either. In fact, it can go up as your home gets older and needs more repairs.

Property insurance = $6,000 / year. Guess what? This doesn’t go away either! No matter what, you need to insure your home if it’s financed. The bank requires it.

HOA = $2,400 / year. Again, not going into the home equity. It’s always required and usually goes up over time.

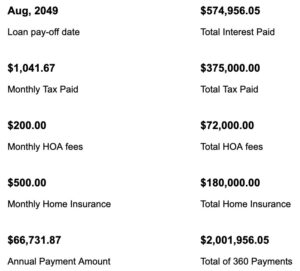

Check this out:

Above are the standard numbers that you see on the surface.

Below is a different story…

Source: MC

See the “Total Interest Paid,” the “Total Tax Paid,” the “Total HOA fees,” and the “Total Home Insurance?”

Those all add up to…. wait for it… $1,201,956 … that’s the total amount of money you will spend that does NOT go towards paying off that $800,000 loan.

In other words… look at the amount in the bottom right corner above… that’s over 2 MILLION dollars. That’s how much it would cost to buy a $1,000,000 house over 30 years.

You’re paying an extra million dollars to buy a million dollar house… AND when you’re done paying off the loan, you still have to pay property tax, property insurance, HOA dues, maintenance, etc. Furthermore, you’re tied to that home through ups and downs in the financial cycle and you have no way to physically move real estate if your personal life changes locations.

READ THE ABOVE PARAGRAPH AGAIN.

Now, the traditional argument is that your house is increasing in value and will at least match inflation. This is absolutely true.

However, if you are serious about investing, there are other ways to increase your wealth much faster and efficiently.

And one of those methods is by buying real estate to rent out to others. Yes, you need to have tenants that pay off your debt for you.

Make your tenants build your equity. Then you get all the tax benefits, you get all the free equity built up, and you get a property portfolio that can grow and grow. That’s the key. Make your tenants build your wealth.

–

The one circumstance where buying a personal residence makes sense:

If you can buy a home at a significantly discounted price at the bottom of a real estate cycle, then you can sell it two years later for what I call “the greatest tax break available to the average US home owner.” (Similar tax laws exist in many other countries as well.)

If you live in your primary residence for 2 or more years before selling, you can walk with $250k tax free for a single individual or $500k if you’re married. (Here is what the IRS has to say about this.)

That is the one circumstance where buying your primary residence makes cents!

–

Now, to be fair, I’ve left out a huge topic here: emotional connection and stability.

The reality is that we, as humans, become emotionally connected to inanimate things, like our home. In addition to all of the memories that are created in our homes, there is a sense of security and well-being that comes with home ownership. This is especially true if you have kids.

But, if we look at home ownership from a financial perspective, more often than not renting is the better decision.

So, if you do end up purchasing your primary residence, just look at it as an emotional purchase and be happy with the fact that you’ll probably never be able to justify it as an investment.