Over six years ago, I nailed the bottom in uranium prices. I say that half jokingly, but I’m also serious – I wrote about how uranium was one of the lowest risk investments in February of 2017:

Uranium is literally selling for less than the cost of production. Think about that.

That’s like a house that is selling for less than the cost of construction. It’s just not a longterm trend. Eventually, prices must increase.

So… this is a perfect investment. Limited downside risk with huge upside potential.

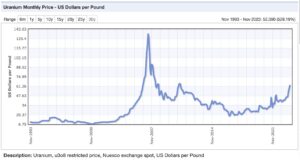

Well, here is what is going on with the price of uranium right now, in December 2023:

Source: IndexMundi

See that? It’s called a trend. And it still looks early compared to the last time uranium spiked in price.

But, the last time the price spiked was for different reasons. This time, it’s different.

Some investors may say something like, “Uranium prices may rise, but not by as much as last time. The last time this scenario happened, it was a different environment with different factors. Don’t think that uranium is going to go on another nearly 20x bull run, like last time. It’s different this time, man!”

Comparing the Last Uranium Bull Run

In January 2001, uranium was priced at $7.10 per pound. Then, by June 2007, uranium climbed all the way to $136.22 per pound. In just a little over 7 years, uranium increased in price by 1,918%.

Of course, that was the actual price of uranium in its raw form. The companies that were mining, refining, and handling uranium made a lot of investors very, very rich.

For example, from the same time frame as January 2001 until June 2007, Cameco ($CCJ) returned investors 1,833% (and that doesn’t include dividends and reinvestment).

But then, after uranium boomed, it popped. Over the next decade, the price of uranium fell. Uranium didn’t bottom until 2017. (Right when I recommended investing in the yellow metal.)

It was a classic case of boom-bust. There was no supply of uranium in the markets, so prices of uranium rose due to demand. As prices rose, more miners could afford to dig it out of the ground. Then, the miners made a lot more money, as prices went up, which made investors interested. Then, as investors poured money into the industry, stock prices rose, which attracted even more investment. Then, the miners were swimming in money and spending on expansion. Eventually, they expanded so much that the market became oversupplied with uranium. Then, the miners couldn’t sell uranium at the same high prices because buyers kept finding producers who would sell it for cheaper. Next, uranium companies started to go out of business because it wasn’t economically sustainable to keep mining. Finally, the uranium energy market had no where to buy cheap uranium. So, the cycle continues…

Uranium Companies Went Bust

If you look at many uranium companies being traded today, most are founded after 2008.

After the bust in uranium prices, many miners either went out of business, rebranded to a different type of mining, or were bought for pennies on the dollar by other mining giants.

And it wasn’t just uranium companies going out of business. The public lost interest in the investment class altogether, even in the biggest uranium mining company…

In June of 2021, Morningstar stopped covering Cameco. This is akin to an investment bank saying, “We don’t want to keep track of your company anymore because we’re not too confident about your near future.” (Ironically, Cameco is up over 60% since then.)

My Investment in Uranium

I invested in uranium in 2017, and have held ever since. Honestly, it has been a stubborn hold and I probably should’ve pivoted out for a while.

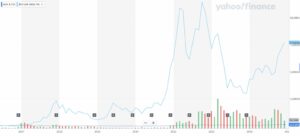

As of now, I am up a little over 100% in my position, which started in 2017. So, over the past ~6.5 years, I have a ~15% total return. Not horrible, but I could’ve done much better somewhere else. (Like, bitcoin! Here’s a chart below to see what performed better since 2017. $URA is up 110% and bitcoin is up 7,712%. Dammit.)

Back to uranium… I haven’t written about it for almost 5 years. I lost interest in the opportunity, but I also didn’t want to talk about an investment that wasn’t going as well as I thought it should.

It’s not fun when something happens that you don’t expect, or when things don’t go the way you bet on them.

In my gut, I knew it was a good investment. But there was a part of me that was embarrassed to talk about it. (Good lesson for me, to try to talk about the bad investment situations!)

Anyway, I knew the investment would work because I had actually spent a lot of time researching the whole opportunity.

My Uranium Research

At the time, it didn’t really feel like research. It felt more like some kind of adventure!

Over the course of a couple years, I spent a lot of time digging into the entire uranium industry. This, of course, involved understanding the nuclear power market.

In addition to visiting several mines throughout North America, I also went to Chernobyl in Ukraine. Here is a picture of me and my buddy Peter at the entrance to the city that has been abandoned since the 1986 nuclear power plant meltdown:

Here are several things I learned from my uranium research adventure:

- Determining uranium supplies available to the market is nearly impossible. First, because it’s just hard to keep track of everything accurately, and second, because there are a bunch of countries that produce and don’t tell what they’re producing. This includes Russia, who may ban uranium exports to the US. They’re hoarding for probably wise reasons.

- Never listen to the CEO of a uranium mining company (or any mining company, for that matter!). Just watch what they do.

- Planning out future consumption based on new nuclear reactors coming online is a mistake. Nearly every single nuclear reactor that is under construction or that is planned is running way over budget and timeline. That said, the long term trend is pretty clear – the world is moving towards more nuclear power.

- Don’t underestimate the geopolitical risks.

- Uranium is, by far, the best option for future energy generation.

How to Invest in Uranium

There are a lot of fancy ways to play the (likely) uranium boom. Here are three strategies:

- Hand your money over to a uranium themed hedge fund that will do all of the work for you.

- Subscribe to a stock picking newsletter that is focused on uranium miners.

- Do the research yourself, and get fully immersed into the industry so you can find the winners.

Each of the above three strategies are great options. However, if you want the easiest and lowest risk… just buy the Global X Uranium ETF ($URA). Yes, it has a 0.69% annual management fee, but I think that’s worth it so you can avoid the headache and expense of other strategies.

As a final note: No one has a crystal ball, so there is no certainty in any investment. However, it’s hard to imagine a world that moves away from nuclear power for the foreseeable future.