There’s a lot of problems with writing things on the internet.

First of all, it’s just risky in general. Not only are you exposing your level of (or lack of) intelligence, but you also make people believe that you are hardline on a certain idea.

For example, if I explain to you how I think this whole pandemic thing is going to play out, you, as the reader, would assume that what I write is the only thing I believe. Obviously I’m aware that there are tons of variables at play, but you might not know which variables I’m aware of, unless I specifically write out each one. And that would be A LOT to write.

Another risky thing about writing things on the internet is that everything you publish lives for-e-v-e-rrrrrrrr. That’s right… there is no way to hide all of those embarrassing ideas… all of those wrong predictions… and all of those stupid stories you wrote about. So whatever I forecast for this pandemic and resulting economic crisis is going to be laughed at in about two years.

However, there is one thing that I’m pretty sure will be accurate: We’ve still got a lot more pain to come.

I hope I’m wrong. I really do. Personally, I have all kinds of things going wrong right now. This is not a good time to be someone who is dependent on the economy. It’s a great time to be my dog. She’s getting a lot of attention right now! (Mostly from my 2-year-old, who currently likes to poke her in the eyeball.)

If we take a look at the past two weeks, the average person might think that the markets crashed because people realized that this pandemic would ruin our economy. And for the most part, that’s correct. However, the technical reason why our markets crashed is because investors got so scared that they just wanted to hold onto cash.

They took a look at their investments and just started throwing them overboard, trying to keep the companies that they loved the most. Unfortunately all kinds of smaller companies got throw off the boat first. The cannabis industry in particular got annihilated. (For your information, we have received numbers recently for one our portfolio cannabis companies and they are doing great. Proves that cannabis, just like alcohol, is recession resistant. More about opportunities in cannabis soon… there are a lot.)

Basically, it was a liquidity crisis. Everyone wanted to hold liquid capital, so they could redeploy that capital into great investments. The problem is that no one knows for sure what is a great investment right now. No one knows exactly how individual companies are doing or how the broader economy is doing.

This market crash happened so fast, there hasn’t even been enough time to report proper data to understand what is going on. By the time we figure something out, there are bigger, more complicated new issues to consider. Tomorrow will provide us with information that that will completely change our opinion of what we’re thinking now.

If you’re an investor, tomorrow is yesterday, so just wait.

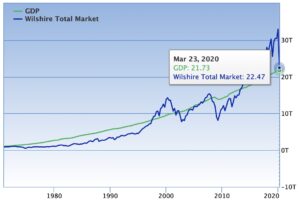

Have you taken a look at our (the United States) GDP to market cap ratio? That is Warren Buffett’s favorite economic indicator. I’ve written about it a lot; most recently in August of last year. Most of what I wrote is pretty damn accurate today, if I do say so myself! (Just don’t read anything else…)

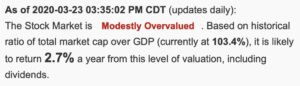

Today, March, 23, the ‘Buffett Indicator’ looks a lot different than just a couple weeks ago. The market is still ‘modestly overvalued’ but nowhere near where it was.

While our GDP has pretty much stayed the same, the market cap has completely crashed.

Source: GF

Using this chart, valuations all of a sudden look reasonable, as the market cap is no longer running away from GDP.

But there is a major problem with this chart. We don’t actually know what our GDP will look like for this quarter. Hell, we don’t even know how to make college students stop dry-humping each other on the beach in Miami.

Maybe this guy will run for office one day?

The reality is that we don’t know a lot of things right now. Unless you’re a major hedge fund that needs to average your way into the market over the next year, don’t be afraid to sit tight and wait.

‘Buy when there is blood in the streets’ does not mean ‘buy when there is a knife fight still going on’. Wait until there is just the blood.

Even though investors have been using the BTFD (buy the f-ing dip) strategy over the past ten years to fully exploit the longest bull market in modern financial history… that’s probably not the strategy to follow today.

There will be plenty of upside coming our way in the future. There will be more opportunities than you can shake a stick at. But if you don’t have the capital or entrepreneurial strategy to pursue those opportunities, you’ll just be watching from the sidelines.