Most quotes about hindsight are pretty stupid. Trust me, I just spent the past twenty minutes searching for a witty saying from some famous person about hindsight.

I found a bunch of quotes from authors, politicians, investors, and celebrities where they try to justify their past mistakes through some clever rationalization. But the truth is that hindsight is just that… our sight into the past, which is only clear after the fact.

Hindsight is just us looking back and saying,“Damn, that was stupid!”

Still, it’s human nature to want to predict the future and analyze the past. Ironically, the thing that we are usually the worst at is actually living in the moment. For some odd reason, our society has lost touch with being able make relevant observations about the present.

(We’ve also lost the ability to actually enjoy just being present, which is one of the reasons I am bullish on cannabis and psychedelics… which is a whole different story I’ll save for some other time… but yes, we’re investing in both!)

So, let’s take a moment to be in the moment. Let us just look at our surroundings and take note of what is happening in the second half of 2019. Of course, I mean this from an investor’s point of view. (We’ll tackle the existential topic another time.)

I’ve collected a variety of information nuggets, which I’ll list below in no particular order, that should be making you question the very state of our economy and even the intelligence of our society. That may sound rash, but if you really take a step back and look at all of this information, you shouldn’t be scratching your head… you should be running for safety!

Warren Buffett is currently sitting on the largest pile of cash he’s ever had.

To be fair, the actual quantity of cash is the most, but as a proportion of his total assets it’s actually the second most he’s ever had. In other words, Warren Buffett has only had a larger cash position once in his career: Right before Lehman Brothers filed for bankruptcy and the world slipped into recession.

Right now, Berkshire Hathaway has enough money to buy IBM, Starbucks, General Electric, or Goldman Sachs. And I don’t mean buy some shares… Berkshire could buy any of those ENTIRE companies. That’s a lot of cash. I wonder what he’s saving up for…?

Well, if we look at Buffett’s favorite economic indicator, we would know that he’s saving up for a huge fire sale, where he’ll be able to pick up assets for pennies on the dollar. That indicator is the comparison of the total market cap to GDP, which basically values the market compared to what it is producing.

That ratio, of market cap to GDP, was recently at 146%, which is second only to 148.5% – the peak of the 2000 dot com bubble.

Source: GF

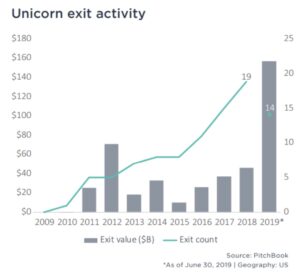

There is a herd of unicorns running for the exits.

I have a two year old daughter, so imagining a herd of unicorns running actually sounds plausible to me right now. Unicorn shirts, unicorn hats, unicorn stickers, and everything you can imagine in my house right now has a unicorn theme.

That said, I’m going to let you in on a little secret… unicorns are fake. They don’t exist. That’s why billion-dollar-private-startup-companies that are losing money faster than Venezuela can print their bolivar, are known as unicorns.

However, here we are half way through 2019 and there have been 14 unicorn companies that have gone public, with valuations exceeding a total of $150 billion.

Source: PB

Sounds exciting, right!? “Billion dollar unicorn companies” is the best four word combination that exists in the English language. Just saying those words in your head should bring a smile to your face… ‘billion dollar unicorn companies’….

Unfortunately, I’m going to stick a needle right into that thought bubble, because just like everything in life: If it sounds too good to be true, it probably is.

Ask yourself, why are these companies valued so high? Is it because they really have that much value? Is it because they really are going to hit all of their lofty revenue projections? Or is it that early stage investors want to get a large exit multiple on their investment!?

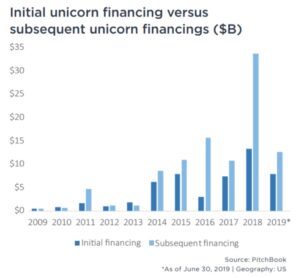

Just look at the financing in 2018:

Source: PB

This chart, which might be a little difficult to understand, is basically showing the amount of money that has been poured into these unicorn companies before going public. This chart demonstrates the publicly legal gambling platform known as Wall Street.

Now, don’t get me wrong. I’m a capitalist at heart and I’m all about survival of the fittest, making big profits, and rewarding investors who take big risks to get big gains. However, this is different… what we have here is pure speculation on unicorn companies with absolutely no fundamentals to back up these insane valuations.

Need proof? Well, I’ll just show you two upcoming unicorn IPOs. First: Peloton.

Peloton, which sells indoor bicycles in packages requiring memberships to access live and on-demand classes from home, was recently valued at $4.15 billion. However, the company revealed:

Source: SEC – you can view the entire filing here.

What!? The company said that it may not reach profitability in the future!? Who in the heck would invest in a company like that? Well, I’ll tell you. There are two different types of people:

1. Early investors, who bank on the company getting acquired or going public.

2. Public market retail investors who have no idea what they’re buying, except that the idea of an in-home exercise bicycle with an interactive computer screen sounds cool. (i.e. these investors are known as the ‘bag holders’… and those bags are full of dog poop.)

Hey, who knows… maybe Peloton will be the next big trend for fitness. Maybe their projections of not becoming profitable will be wrong. Whatever the future holds for Peloton, nothing compares to the next upcoming unicorn IPO…

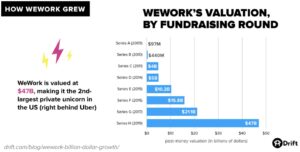

WeWork.

This one is insane. As one analyst says, “WeWork Is the Most Ridiculous IPO of 2019” and I couldn’t agree with him more. I can’t even explain the ridiculousness without going to bullet format:

– WeWork is currently valued at $47 billion.

Source: Drift

– The business often cited as WeWork’s closest comparison on the public market is IWG, which has more locations than WeWork and a market cap of less than $4 billion; that’s less than a tenth of WeWork’s valuation.

– Ever heard of Walgreens, Honda, FedEx, Delta Airlines, Ford, Hershey, Kraft Heinz, Motorola, Sprint, Hilton, United, or Kellogg? Well, all of those companies are valued LESS than WeWork.

– WeWork revealed that, as part of its rebrand to “The We Company” earlier this year, it paid $5.9 million to acquire the trademark related to the We name. The previous owner of those trademarks? None other than Neumann. –Pitchbook

– Speaking of the CEO, Adam Neumann, he has already liquidated about $700 million worth of shares before WeWork’s IPO. Talk about insider confidence in the company… not!

– Also, Neumann owns a significant amount of real estate that he then leases back to WeWork. Think about that.

– WeWork lost $2 billion in 2018. Billion.

– The company is currently burning about $200 million per month (which gives them about 6 months of runway) and has $47 billion worth of future lease obligations.

– I’ll say it again, WeWork has lease obligations that are higher than the company is valued.

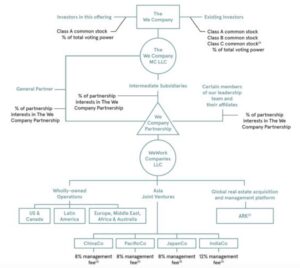

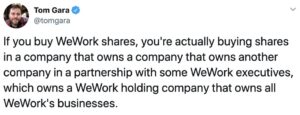

– Finally, for all of you quantum physics majors out there, here is their corporate structure:

Translation:

Shifting gears a bit, I’ll refocus on the topic of this article, which is, Hindsight of 2019.

The real estate craze is back in many markets.

If you don’t remember what was going on around 2007, let me take you on a short trip down memory lane…

Starting in late 2003, flipping single family homes became a very popular trend for both experienced and extremely inexperienced investors. Due to very lenient home mortgage practices, pretty much anyone could get a home with nearly zero money required as a downpayment.

Soon, people who could barely afford to rent a small apartment were able to buy houses, while taking on loans with variable interest rates. As long as these novice home buyers could remodel and sell for a profit within a couple of months, everything went great.

But, we all know how this story ends. Eventually, just like a game of musical chairs, there were no longer greater fools to sell to, and the carrying costs – with adjustable interest rates – became too much for these home flippers.

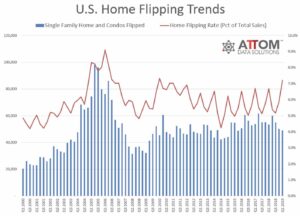

Source: Attom

Now, in 2019, home flipping rates just reached a nine year high. Personally, I don’t believe this is cause for major alarm, as there are not as many novice investors in this game compared to a decade ago. However, that doesn’t mean that there aren’t regional issues in certain markets.

A recent Bloomberg article demonstrated this exact issue, where home flippers are now selling to each other. This is literally selling to the greater fool.

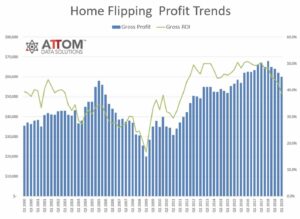

This exchange of properties from one flipper to another has compressed profit margins, for obvious reasons. The question quickly becomes: How long will this last?

Source: Attom

Eventually, margins will become lower, which will result in an ever decreasing pool of buyers. Then, supply will overwhelm demand, collapsing prices. Again, I don’t personally believe that we’ll see anything close to our last real estate crisis. However, the combination of this concerning real estate trend with the previous economic risks doesn’t paint a pretty picture for the near future.

The wealthy are already positioning themselves.

As mentioned in a CNBC article, “The rich have cut their spending on everything from homes to jewelry, sparking fears of a trickle-down recession that starts at the top.”

Let’s be honest, the reason why wealthy families stay in their position is because they know how to navigate challenging economic times. They know when to buy, when to sell, and when to tighten up their belt in preparation for coming uncertainty. And that’s exactly what they’re doing now.

2019 has been the worst year for luxury real estate since the financial crisis; high end retailers are suffering, with Barney’s filing for bankruptcy and Nordstrom filing three consecutive declines in revenue; car and art auctions have seen a steep decline with auction sales at Sotheby’s dropping 10% and Christie’s dropping 22%.

Incredibly, the top 10% of earners in the United States account for over half of all consumer sales. So, a decline in spending by the wealthy will have affects across the market for everyone.

Another interesting statistic is that this same demographic of wealthy people that have reduced their spending have also almost doubled their savings over the past two years. Additionally, they are reallocating their high growth investments towards value based assets, such as high yielding low end real estate, precious metals, and international investments that are undervalued or inversely correlated to overvalued markets.

How are you positioning yourself? What will be your hindsight of 2019?