Today is one of the most important holidays in the United States. It’s called “hotdog-fireworks-beer-bbq-day” and everyone loves to celebrate.

Of course, I’m joking – it’s actually the 4th of July, the day that the United States of America celebrates its independence from the British Empire.

But just like many holidays (Christmas, Easter, Valentines Day, etc.) the day has turned into an excuse to eat, drink, and party, instead of celebrating the actual significance of the holiday.

Don’t get me wrong… I’m all about eating BBQ-ed food, drinking beers, and getting sunburned. In fact, as you read this, I’m probably eating food off of a table with red, white, and blue decorations while holding an ice cold carbonated drink.

Unfortunately, the majority of people surrounding me most likely have no idea what the 4th of July is all about. They have no idea what year the US claimed independence, they have no idea why independence was claimed, and they have no idea who independence was claimed from.

As depressing as that may sound, this is a trend that has been repeated many times over throughout the history of the world. As time passes people forget. They forget the tough times, they forget what’s important, and they gradually slip back into bad habits. They forget where they came from.

The significance of the 4th of July is something that people from around the world can, and should identify with. That significance is the idea of independence – specifically financial independence, which is something that many have lost sight of.

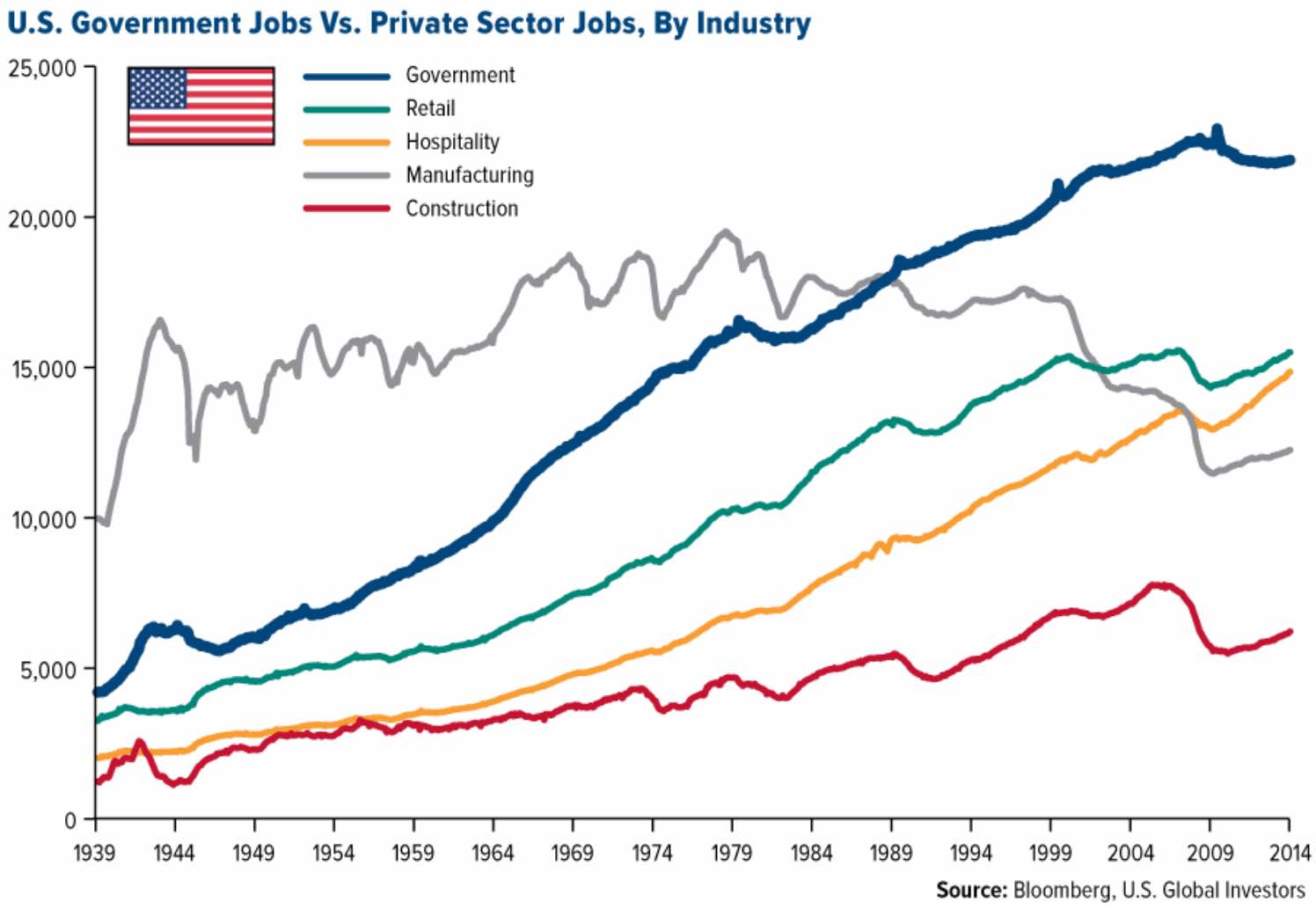

In today’s world, especially in Western economies, the general public is largely reliant on governments to provide money making and saving programs. This is evident by the ever-growing number of government funded jobs and retirement programs.

Of course, these jobs and financial structures are being handled by the one entity (governments) that has been proven REPEATEDLY to be completely incompetent when it comes to managing any type of money. Most governments only know how to do one thing: usurp its citizens wealth and then make it evaporate into thin air.

This shouldn’t be news to anyone. It’s a widely known and accepted fact that governments only know how to spend more money than they have. Then, they create more money, which causes inflation and in turn melts away the value of the government issued fiat currency.

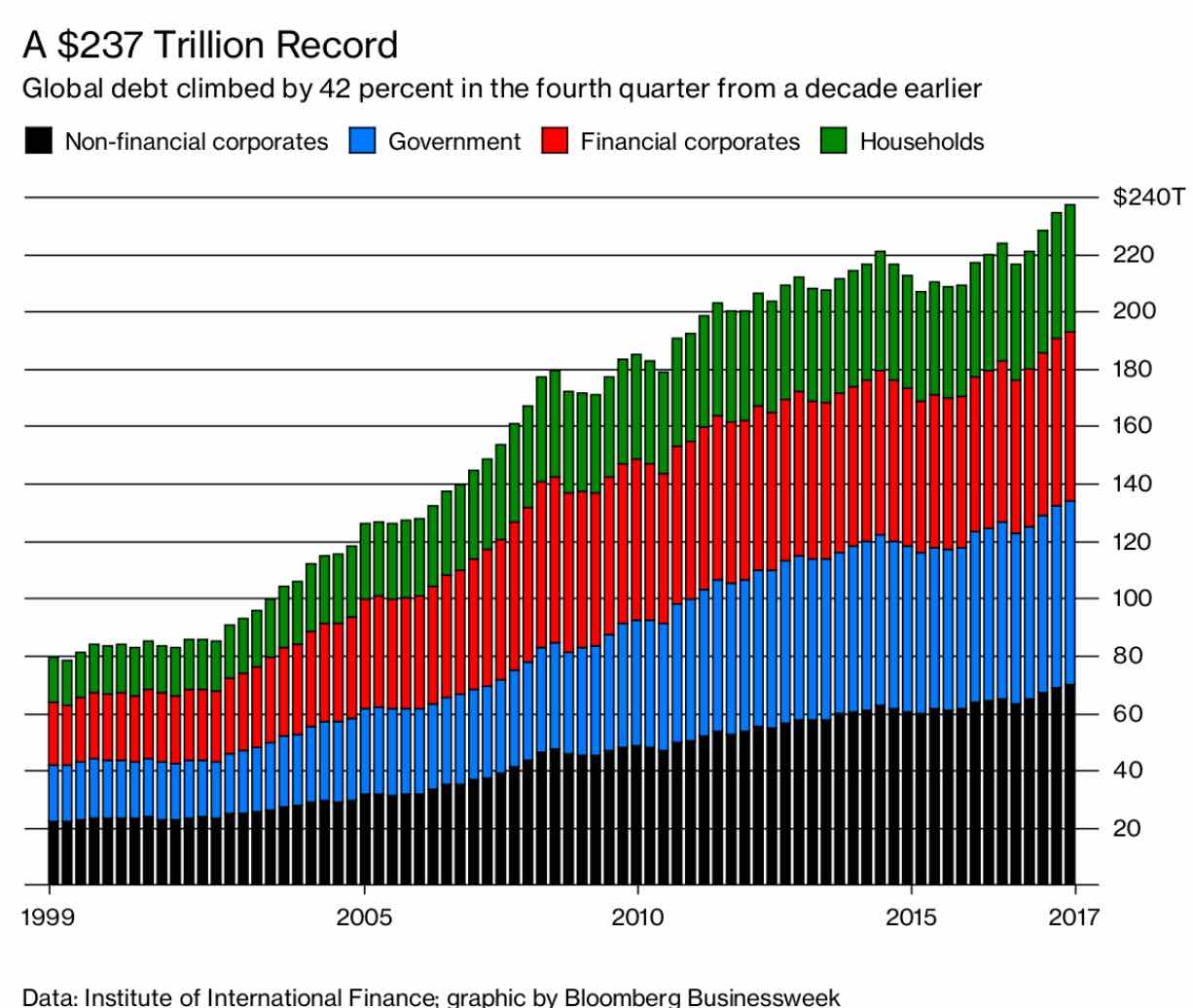

While all of this is going on, people continue to put themselves in one of the most vulnerable positions possible… which is neck-deep in debt.

Obviously, this is easier said than done. With sky-rocketing college tuition and insanely priced real estate, going in to debt is often the only option to pay for things.

But, when it comes to luxuries and non-essential expenses, limiting your debt exposure is one of the most empowering decisions you can make. The less that you owe to others means the more freedom you will have.

And isn’t that what growing your wealth is all about? It’s about affording freedom.