The World Owes You Nothing

(but take the help you can get)

If you don’t know me personally, then you’ve probably never heard me speak.

I don’t intentionally avoid speaking, I just prefer to write. However, I will be making an effort in the future to communicate through different mediums.

But first, I need you to do something. I need you to follow and like this page on Facebook.

I’m not much of a Facebook user, but I promise this will be worth it.

The reason why I need you to follow and like this page is because I am doing a live interview tomorrow at 5pm EST. In fact, this is the only reason why I made this page – for you.

Once you have followed and liked the page you will have access to watch tomorrow’s interview and all future interviews for free.

In most interviews, I can spew out way more content than just an article, so go follow and like that page. (Again, the link is here!)

Tomorrow, Saturday December 17th, I’ll be doing a Facebook Live event with Dandan Zhu at 5pm EST. Dandan was a top headhunter in New York for several years where she helped place executives in major US companies. However, she has recently branched out on her own and now has her own service.

Dandan was a top headhunter in New York for several years where she helped place executives in major US companies. However, she has recently branched out on her own and now has her own service.

We’ve had several conversations about everything from education to investing. But instead of keeping those conversations to ourselves, we’re going to live stream it for everyone to see and hear tomorrow.

She’s flying out from New York to meet me in Malibu for the interview.

There’s no catch here. Nothing to sell. Just a live conversation that you can watch. She wants to talk about “Investment Strategies for Millennials,” but I have no idea where the conversation will go.

I mean that in a good way, as I am intentionally not preparing anything. But, I’m not going to hold anything back in terms of my opinion of where I think people should be investing or what someone should be doing to build their wealth. So, you’ll definitely hear some interesting things.

–

Speaking of giving away free information…

On Wednesday, I sent out an article about investing in Colombia. It’s my most valuable article I have ever written.

What I mean by ‘the most valuable article I have ever written,’ is that I spent an unbelievable amount of money and time to figure out all of the information I wrote – and then sent it to you for free.

However, in the article I said that I might start charging for my information in the future.

Just to be clear, I will always keep the Explorer Report free. So, don’t worry, I’m not pulling a bait and switch on you.

The information I may charge for is for a separate service that is much more in depth. Something that will go above and beyond a simple article. Something that will give you step-by-step actionable opportunities, and maybe even some special events.

But, before I go any deeper there (because nothing is ready yet), I want to talk about the ‘free’ thing for a moment…

I received at least five emails yesterday that basically attacked me for even bringing up the idea of charging a fee. These were readers who have been subscribed for a while and called me a “sell out” and a “fake.”

I realize that this is not what the majority thinks, but I just want to touch on this for a moment.

First off, it takes an incredible amount of time to put out this type of content. That’s why so few people actually do it, especially on a consistent basis.

Second, it’s expensive. To pay for hosting, newsletter fees, tech issues, etc. literally costs hundreds of dollars a month. I pay for this all out of pocket. There are no ads, banners, sponsors or anything else to harasses you. It’s just me paying for it all.

Again, I know that most people understand this.

But, for those who don’t… for those who think I’m a “sell out” for even the suggestion of charging… let me give you a little reality check…

The world owes you nothing.

If you expect people to give you what you need to succeed, then you are in for some serious letdowns.

If you expect the government, your family, your friends, or anything else to give you anything, then you’re already on the path to failure.

Of course, we should all take the help we can get. Many of us are fortunate to live in a place where a government, family, or friend will help us. And you should take that help to move forward.

But, if you are expecting that assistance, then you’ll never be able to truly become successful.

Ok, I’m done ranting.

–

A note on gold.

Gold was absolutely hammered yesterday. To the point where anyone who holds a significant amount in their portfolio might get a stomach ache.

And it might continue. I’m not much of a technical trader, but I’ve been reading many analysts writings about gold breaking through it’s downside support.

That translates to: Gold could keep going down in price.

For me, this isn’t a concern, at all.

The price of gold is influenced by the performance of other areas of the market. If the stock market is raging higher, gold will usually go down in price.

But, remember why you should be holding gold in the first place. Precious metals are a great hedge against inflation.

Precious metals also offer security from catastrophic market events.

(If you are still curious about buying precious metals and don’t know where to start, read this.)

So, if the market is doing very well, then it’s obvious why gold does poorly. We should expect the price of gold to decline in especially bullish markets.

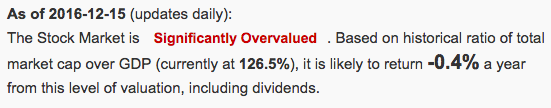

All of that said, let me refer to a valuation I check at least once a week: Market Cap to GDP ratio.

This is a measure of the total market capitalization compared to the US GDP. This means the ratio compares what the market is valued at in relation to how much output the market has.

Right now, the US is ‘significantly overvalued.’

Source: GuruFocus

So, even though we are seeing markets rise (and gold get beat down), we know that valuations are getting into bubble territory.

Could markets continue higher for a while? Sure. But, we know there is much more downside risk than there is upside potential.

Remember, go to this page to subscribe and like. The free and live interview will be tomorrow, with more to come.