One Wealth Building Idea For 2017

As 2017 approaches there are lots of changes that investors are preparing for and there are even more questions that have yet to be answered.

What will Trump do? What direction is Europe going? How is India going to handle this cash crisis? How will China react to changing US policies? What’s Russia going to do with the recent events?

The list could go on and on.

Regardless of the individual issues that may arise in various regions of the world, the one thing that may effect us all is interest rates.

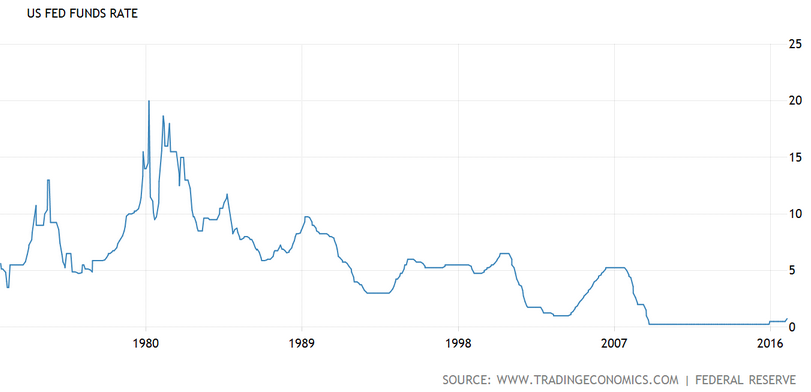

Interest rates in the US may be seeing a historical change – meaning that they have finally bottomed after thirty years of declining.

However as an individual, most investors are concerned about housing loans. So, if interest rates go up, then it will cost more to borrow money.

This idea creates the thought that home buyers should buy now, rather than later. If a buyer waits any longer, then it will cost more to borrow money to buy a home.

But if rates go up (and it costs more to borrow money), then housing prices should decline. Right?

This is a common debate in the real estate world right now – that housing prices are highly correlated to interest rates.

I can tell you from my experience that this is true. Higher interest rates depress home prices, while low interest rates allow houses to be priced higher.

It makes sense if you think about it. Most home buyers only care about their monthly payment. If the mortgage payment can easily be paid, then the total price of the house is secondary.

However, it’s not as simple as “Higher interest rates equal lower home prices. Or lower interest rates equal higher home prices.”

So let me explain…

Low interest rates essentially mean you can borrow money for cheap. When you can borrow large sums of money for a small cost, you can afford to buy more expensive things… like big expensive homes.

Home sellers understand this and jack up their prices to meet the capability of the market, which is that buyers can afford more.

But, just because interest rates are low does not always mean that it’s necessarily cheap to borrow money. You have to compare interest rates with inflation.

For example, in the 1980’s interest rates were in the mid-teens. But, so was the inflation rate.

This means that the actual cost to borrow money was about the same as today, because we currently have low rates AND low inflation.

For the US, this low inflation rate is a problem. It’s sending the value of the dollar higher and higher.

For US dollar holders, we all feel like rock stars. We can buy all kinds of stuff for cheap and travel the world with great exchange rates.

BUT, for other countries, it’s getting more and more expensive to buy US stuff. Eventually, it will become so expensive that countries will not want to do trade with the US. That is why the US wants a higher inflation rate, so they can stay competitive with the rest of the world.

In the US, if we look at the actual cost of borrowing we’ll see that interest rates change in an attempt to match inflation. That is what the Federal Reserve is trying to do (among other market manipulations).

The nominal interest rate is what you see in the news. The real interest rate is what we have when we compare inflation.

So if the real interest rate becomes more expensive, then the cost of real estate will go down, and vice versa.

Another great way to look at this (somewhat complicated) topic is to compare foreign real estate.

For example, in much of Latin America real estate loans can have a 1.5% rate PER MONTH. That makes for an annual rate of well over 15%! That’s crazy for people used to real estate loans for less than 5%.

These high borrowing costs make real estate much cheaper because the finance cost is so high. Now, these countries also have their own issues with inflation, but the point is that real estate in regions with high interest rates (high costs of borrowing money) see depressed real estate prices.

This is especially apparent today in countries that have had currencies that have been wrecked. Chile, Colombia, South Africa, and Mexico are just some examples.

Real estate in those countries is often less than the cost of construction. And if you look at the housing market in 2010 in the US, when there was a similar situation, we all know that this means there is tremendous value.

With all of this in mind, here are two take-aways for you to consider:

#1 Do not panic buy because you think interest rates will go up. Yes, it is likely that rates will go up and that it will cost more to borrow money. But that doesn’t mean you have to buy now to get ‘locked-in.’

#2 Higher interest rates usually depress housing prices. This is because humans naturally resist paying more to borrow money. But, it may in fact cost less in real terms to borrow money at a high rate if inflation is also high.

I understand that all of this may sound confusing, and that is why investing (and money in general) is a foreign concept to most.

This concept of interest rates and inflation is important to understand. Once you grasp this issue, you won’t panic buy or feel pressure to make any rash decisions.