In the Western world, London and New York are considered the two main financial hubs. New York serves the US and most of the Americas, while London serves the UK and most of Europe.

Cities like Toronto, Zurich, Chicago, and Frankfurt also serve these regions, but New York and London still stand on top.

Interestingly, both London and New York are each about 6,000 miles from the major Asian financial hubs of Beijing, Hong Kong, and Singapore.

Even though the world seems to be getting more and more connected, those Asian cities still seem so far away. Perhaps it’s because of the physical distance, or maybe it’s more due to the strange languages and unfamiliar currencies.

Whatever the reason, the truth is that most people in Western culture do not understand or even comprehend how important Asia is to the world, especially going forward into the future.

In today’s news, we are barraged with negative commentary about many Asian countries. Whether it’s trade deficits, sovereign debt, or currency manipulation, Westerners aren’t finding any new reasons to warm up to Asian economies.

That is an enormous mistake.

While it is true that many nations throughout Asia are facing troubling times, the question you should be asking yourself is: “Compared to what?”

Making a story to support a thesis is easy. For example, you could create two incredibly different stories for the United States:

Story #1

With over 20 trillion dollars of debt, crumbling infrastructure, and an incredibly divided political system, the US is on a path of failure that will accelerate as the aging population exits the workforce and begins to become only consumers, not producers. (That’s a scary story.)

Story #2

The US is home to the top five most valuable companies in the world, the top universities in the world, has the world’s largest economy, and has a line of millions of people waiting to get residency so they can live the American dream.

So, what story are we hearing about Asia? It’s probably something closer to Story #1 above, where we focus on the negative facts while disregarding the bigger picture.

Now, I could cherry-pick all kinds of data points and facts that would blow your mind about Asia. For example, Asia’s middle class is expected to grow to over 2 billion people by the year 2020.

That means that if you took the entire US and European population, and then multiplied that number by two, the Asian middle class would still be larger. (If you sell anything online, that should make you drool.)

But, instead of just throwing crazy facts at you, let’s look at some hard numbers that are used to value markets.

One of my personal favorite economic indicators is where you compare production to valuation. When you’re looking at a country, this usually means you compare GDP (gross domestic product) to an actual public market.

This valuation has also been dubbed the ‘Buffett Indicator’ as Warren has said that this is, “probably the best single measure of where valuations stand at any given moment.”

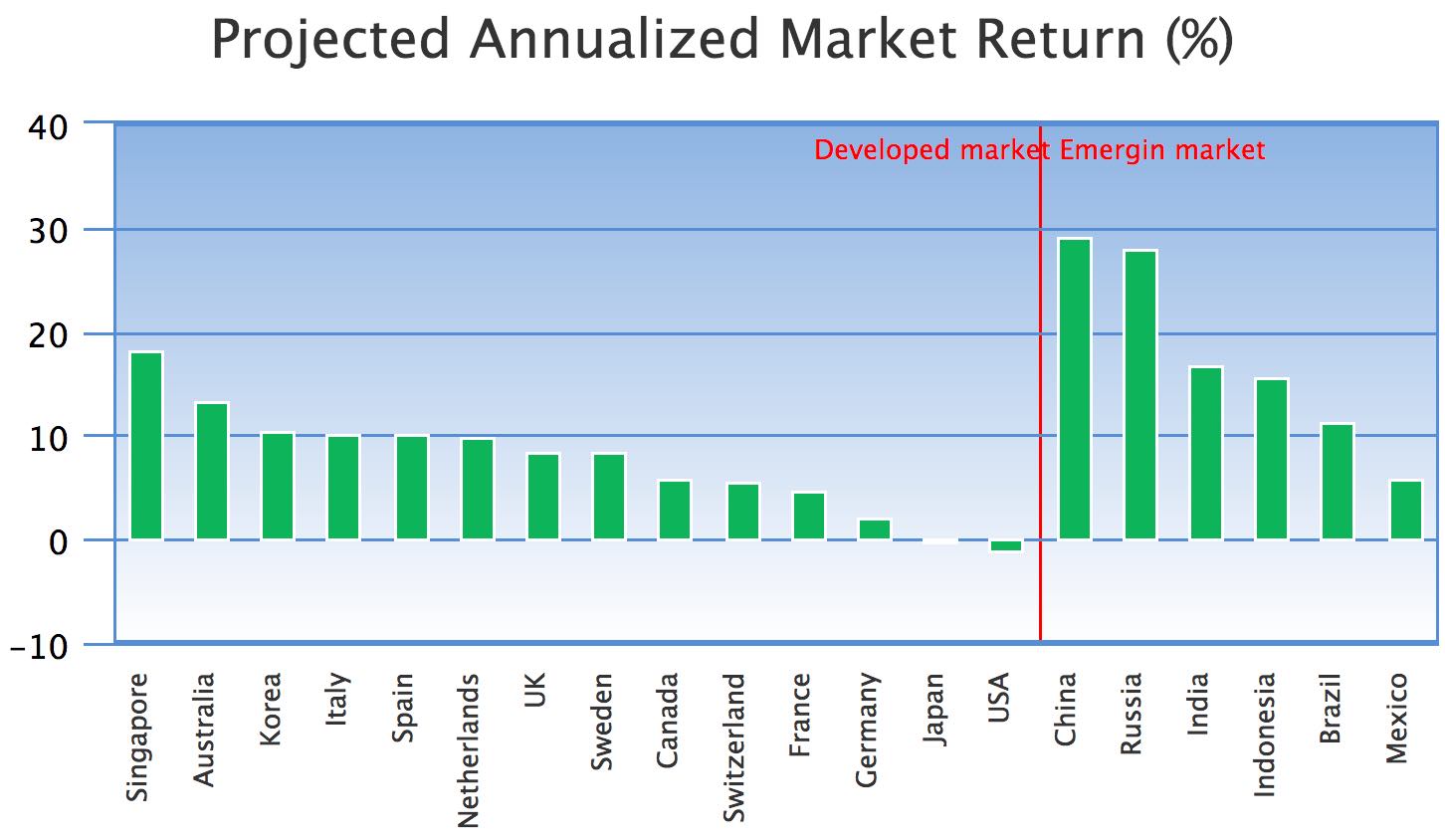

As you can see in this chart, Singapore has a nearly 20% annual projected return. Meanwhile, the US has a projected negative 1% return.

China, India, and Indonesia look very interesting as well. (To be fair, comparing the US directly to these economies is a little bit of an apples to oranges comparison. Not only are some of the numbers coming from emerging economies questionable, but there are also currency and political complications.)

What will the future hold for Asia? No one knows for sure.

But, as an investor, if you do not have some kind of exposure to this region, you may be missing one of the best investment stories of our lifetime.

We are living in a time where literally billions of people will be entering into a connected economy that will start to trade and consume faster than ever before. For those who position themselves correctly, there is a massive amount of wealth to be made.