“Baby-punching-mad.”

That’s the level of anger that traffic gives us. The wasted gas, the rude drivers and the wasted time – nothing is enjoyable about sitting in traffic.

Even without traffic, driving has become a chore and only seen as a means to get from point A to point B. Except for the rare weekend drive on the coast or up a canyon, sitting in the car is to be avoided at all costs.

On top of the inconvenience, driving is expensive. You have the cost of the car, insurance, fuel, registration and maintenance which can easily put you over $1,000 a month.

Some drivers (like myself, who is actually very into cars) have decided to sell their cars and switch to other options like ride sharing companies Uber or Lyft.

Although I commute a bit less frequently than the average 9-5’er, I still only rack up about $300 a month in Uber/Lyft fees. And the best part about it is when I am driving, or rather being driven, I can read, eat, sleep, talk on the phone or do whatever I want. I don’t have to worry about parking, filling up gas, paying car insurance or any of the nuisances that come with owning a car.

When I do find a need for a car, I can just rent one for the day or the week.

Another option is flying, which has also gotten very inexpensive in relation to driving an equal distance. A trip from Florida to New York or California to Oregon used to be a road trip that most people would take all the time. Now, you’d be crazy to not fly, unless you are looking for the experience of a multi-day adventure on the highway.

The auto bubble that I am talking about is that people are going to drift away from car ownership in favor of ride-sharing type options and other transportation methods that don’t require as much financial commitment.

I’m not saying that cars and driving are going to disappear, but rather we as a society have reached a peak in our commitment to car ownership. For some (like me) it does not make financial sense to own a vehicle. Others who live near everything that they need, may not see a need for a personal vehicle either.

The most important reason why I see auto ownership peaking is that driving is a pain in the ass, as depicted by a recent Lyft ad:In addition, the near future will bring us driverless cars that have implications that we haven’t even begun to understand. Things like parking, carpooling, filling up fuel, picking people up (getting yourself picked up), going to the market and whatever other reasons we use our cars for will be completely revolutionized.

Driverless cars will be able to drive more efficiently in traffic, speeding up the flow, minimizing the risk of accidents and allowing drivers, or rather passengers, to focus on anything but driving.

This auto bubble is more of a macro view and long term trend that we can keep our eye on and profit from making smart moves in relation to the new technologies that are coming to our vehicles and roads.

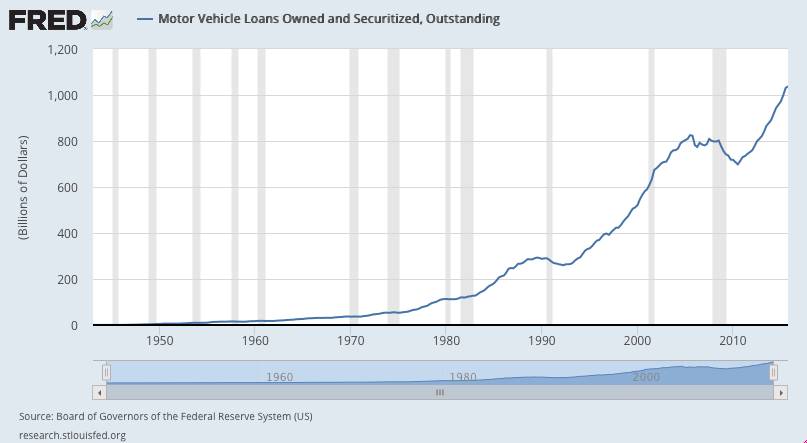

For the short term, there is a real auto financing bubble that is currently growing to an alarming size. It’s no secret as many financial experts have written at length about this and have even started to make money, like the short trade we put in for Santander Consumer USA.

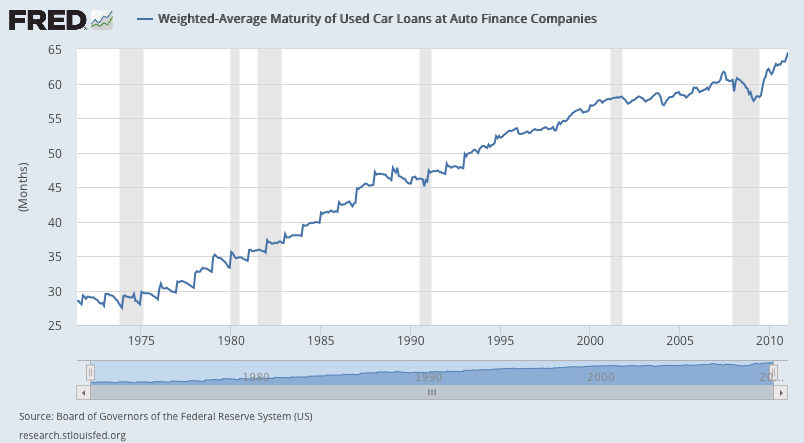

The average car loan is nearly 65 months, which is hard to fathom considering that most people don’t even own a car for that long, let alone carry a payment the entire time.

The average car loan is nearly 65 months, which is hard to fathom considering that most people don’t even own a car for that long, let alone carry a payment the entire time.

…Even if you are skeptic about this auto bubble trend that is approaching us, you can’t deny the working habits of our new workforce that often don’t commute at all.

The combination of transportation technologies and changing working habits are a trend that I will be keeping a close eye on, and sharing any opportunities along the way. Look for more information in future reports under the “Transportation Revolution” section.