On Wednesday I talked about China and how their currency is about to change.

If you hold US dollars, euros, pesos, pounds, Aussie dollars, or really any currency, then you should be aware of what is going on.

Essentially, what is happening with the Chinese yuan can impact the purchasing power of the currency that you hold. That means you are going to be able to buy less of what you want in the future.

As someone who wants to further increase their wealth, you should think of ways to ‘hedge’ this devaluation of your currency. So, you should take action now to ensure that the money you already have stays strong.

A simple way to do this is to buy gold, which has historically kept its value over thousands of years. The commonly used example is that a man’s custom tailored suit cost one once of gold one hundred years ago (around $35), and today a custom tailored suit will still cost you an ounce of gold (around $1,300).

But, I’m not going to tell you to go out and buy gold. I’ve already said that many, many times. (if you haven’t already, then you should. Buy some silver too!)

Another way to hedge your wealth is to transfer some of your money into a ‘beat down’ currency.

For example, if you have US dollars, you can exchange some of them into Colombian pesos.

If we take a look at the Colombian peso over the past several years, we will see that it has been absolutely brutalized. The Colombian peso is currently around 2,900 to 1 US dollar, but two years ago it was 1,800 to 1. That means that the Colombian peso lost almost 60% of it’s buying power in dollar terms. If you are a holder of US dollars, this means that almost everything in Colombia just went on sale.

That means that the Colombian peso lost almost 60% of it’s buying power in dollar terms. If you are a holder of US dollars, this means that almost everything in Colombia just went on sale.

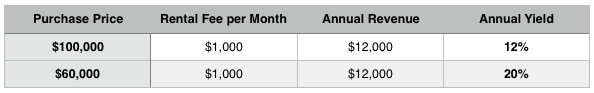

So… let’s use real estate as an example investment in Colombia. Let’s say that three years ago a two bedroom apartment cost $100,000, in US dollar terms. However, because the Colombian peso has lost value in US dollar terms, that same exact apartment now costs $60,000.

If that apartment rents for $1,000 per month, then we can see the difference in rental yield here: That’s an 8% difference in yield, which is enormous. In addition, this change in yield has nothing to do with the apartment or the state of Colombia. In fact, Colombia as a country has actually improved over the past several years.

That’s an 8% difference in yield, which is enormous. In addition, this change in yield has nothing to do with the apartment or the state of Colombia. In fact, Colombia as a country has actually improved over the past several years.

This style of investing is called currency arbitrage. It’s one of my favorites.

We can get higher yields on investments just by targeting currencies that are disproportionately valued.

A common and valid argument is, “But just because you are getting a deal doesn’t mean that the investment is safe.”

This is true. There are many places that have ‘beat down’ currencies that I would not invest in.

Colombia, in my opinion, is somewhere I would.

Furthermore, it’s worth mentioning, that much of the real estate in Colombia is selling for less than the cost of construction. Think about that. If something is selling for less than it costs to build, then those prices won’t last. It’s simply not possible.

If Colombia isn’t your thing, don’t worry.

Here is a short list of countries that have similar currency arbitrage opportunities (in relation to the US dollar):

- South Africa

- Turkey

- Mexico

- Chile

- Indonesia

- Britain (to a lesser extent)

You’ll notice that most of the countries that I listed are large commodity producers, which goes back to the point I was making in the article on Wednesday. A strong dollar will make commodities cheaper, and all currencies correlated to that commodity.

You could also say that countries that are large commodity producers will have a less valuable currency when commodity prices dip.

The next question is: When will those commodities get expensive?

Or maybe a better question is: When will the US dollar begin to lose it’s buying power?

However you look at the situation, a smart trade is to sell what is expensive and buy what is cheap.