It’s pretty hard to find inexpensive things these days. Everything just feels overpriced. Food, real estate, and especially the stock market.

The reason for this is pretty simple: Governments around the world printed money like crazy to prop up economies that shut down during the pandemic.

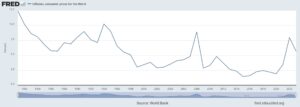

This resulted in massive spikes in inflation around the world.

Source: FRED

Although current inflation estimates seem to be cooling from 2022’s global high of 8.73%, the reality is that inflation is here to stay. That’s because there is just too much money in the system combined with high priced assets that were financed with fixed rate loans prior to the pandemic.

On top of all of that, the US economy is still growing and unemployment is still very low (according to published government reports, which often get revised to the downside several months after reporting rosy data).

This has caused a HOT environment for everything money can buy.

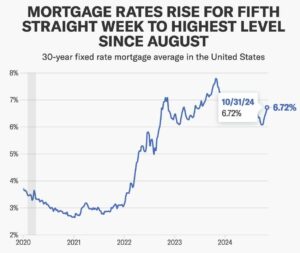

For example, even though the Fed just cut rates by 50 bps, US mortgage rates are now climbing! The ten year note is currently getting bid up by investors who understand the long term risk of holding cash. (The Fed only controls short term rates.)

Source: Yahoo!

I’ve been saying this for a couple years now…

Inflation is Here to Stay

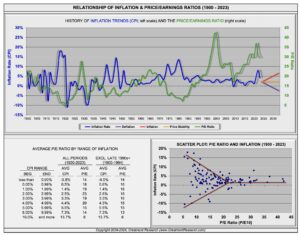

Despite this harsh reality, stock market valuations are continuing to march higher. This should be extremely alarming for investors, and the broader economy.

That’s because interest rates (which are higher, to combat inflation) should be inversely correlated to valuations. In other words, the more expensive money is to borrow, the less expensive valuations (multiples, not price) should be.

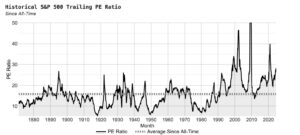

And if we look at what has happened historically, the data is stunning. Over the past century, there has never been a time where high rates have coincided with high valuations, at our current levels:

Source: Crestmont Research

Remember, US equity markets are trading at valuations second to only one other time in history!

As of November 1, 2024, US markets have a P/E of 28. The only other time this happened was in May of 1999, just prior to the Dot Com Bubble. (The spikes in valuation during 2002, 2009, and 2021 are due to distortions caused by rapid price fluctuations as markets reacted to the Dot Com Bubble, Housing Crash, and Pandemic, respectively.)

Source: SMPE

US Domination

Despite everything that you’ve read above, you still shouldn’t bet against the United States.

Sometimes markets are expensive for a reason… because they’re the best.

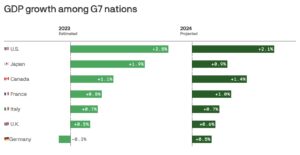

Yes, it’s true that the United States is a top contender in pretty much every metric you can think of: innovation, GDP per capita, richest cities, and growth are just a few examples.

Source: Axios

There’s a reason why the US has been the top destination for immigrants around the world since 1970.

But how much more upside is there, when it comes to valuation? Could we see valuations continue to climb higher?

Possibly. But that would also require record amounts of growth and consumption from not only US consumers, but the entire world. And that’s just highly unlikely.

The reality is that many countries around the world are starting to have stagnant economies with dire financial situations. On top of that, there is a growing trend of military conflict that is only increasing by the day.

For those who have ridden the incredible US led bull markets over past decade, now is a great time to reflect. There are many overlooked and undervalued opportunities that present compelling situations right now.

Recently, I’ve talked about natural gas, platinum, and even DeFi. These are all areas that most investors are completely ignoring (or unaware of). If those are too fringe for you, you should check out Greece.

A Greek Nightmare

It’s impossible to start talking about Greece without acknowledging the absolute economic disaster the country has faced since 2008.

I’m not going to dive into the topic, because there are so many details to discuss it would be impossible to summarize accurately. Instead, I’ll just say that Greece had way too much debt, which has resulted in their economy being completely obliterated. It’s likely to take well over 20 years for the Greeks to simply get back to where they started from, prior to 2008.

The reputation that Greece has acquired in the financial world is so bad that most investors consider the country a ‘no-go zone.’ It’s a place where money goes to die, which no investor wants to visit.

This has ultimately resulted in many Greek companies trading at ridiculously low valuations.

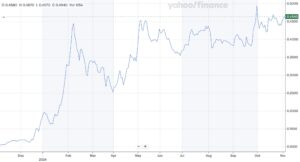

The Greece ETF ($GREK) is currently one of the cheapest country ETF’s you can currently buy. It’s even cheap in comparison to Greece’s 5, 10, and 20 year average:

If you look at Greek stocks that are trading on US markets, then you’ll see even lower valuations.

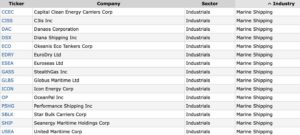

The reason why the US listed Greek companies are even cheaper is because they are mostly shipping industry companies, which happens to be the least expensive industry worldwide (in terms of US stock market valuations).

The combination of these two inexpensive markets – Greece and shipping – presents a very interesting situation for investors.

But, why now?

A Greek Catalyst

After the 2008 financial crisis, the word “austerity” became synonymous with Greece.

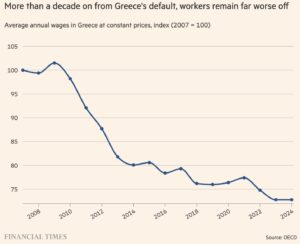

Over the past 15 years, the Greek government has passed well over a dozen different austerity packages aimed at reducing expenditures and paying off debt. This has hit Greek wage earners especially hard, resulting in significant decreases in quality of life.

Source: FT

While certainly impactful to the daily lives of the Greek population, the sacrifices they’ve been making are starting to pay off, literally…

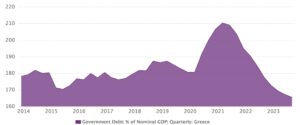

Not only are Greeks reducing their expenditures, they are also growing their economy. This has resulted in the lowering of the debt to GDP ratio, which is now on a very favorable track (especially when compared to other countries!).

Source: CEIC

Greece’s GDP has now been growing steadily over the past several years, and is projected to grow steadily until at least 2029.

Source: Statista

In addition to lowering their expenses and growing their GDP, Greece is also repaying its debt earlier than originally scheduled. This combination of aggressive measures by the Greek government has lead to credit rating agencies changing their outlook.

To highlight one opportunity that Greece’s turnaround presents, investors should look at the performance of a little known company called Cairo Mezz Plc:

Cairo Mezz holds mezzanine and junior Greek debt notes which have soared in value over the past year. Since December of 2023 this stock is up about 350%.

*NOTE: The Cairo Mezz investment opportunity was shared by Dimitri Chalvatsiotis of Hellenic Prosperity Fund during the Weird Shit Investing conference, hosted by Swen Lorenz. For access to 2025’s event (and beyond), please reach out here.

The improving situation within Greece’s economy is evident by multiple different financial metrics. But the potential change in Greece’s future doesn’t stop there…

Beyond Greek Debt

Greece and India

Geopolitically, Greece is also making a variety of notable plays.

First, and most recently, Greece has been strengthening ties to India.

As India’s economy continues to grow, fueled by tailwinds of a younger demographic and the world’s largest population, the country will need many strategic relationships to continue its growth, which includes Greece.

Specifically, Greece’s Piraeus port is set to play a major role in the newly established India-Middle East-Europe Economic Corridor (IMEEC). This trade route is intended to compete with China’s Belt and Road initiative.

Greece’s location on the map and long history in the shipping industry uniquely positions the country to benefit from the rise of India.

Greece and The United States

Second, and equally as notable, is the relationship that Greece has with the United States.

The US views Greece as an extremely important military ally, and has gone to great lengths to further strengthen this relationship.

Over the past year, the US State Department has released numerous statements that articulate developments between the two nations. One statement included, “their [the US and Greece] commitment to enhancing security cooperation through Greece’s military modernization efforts and looked forward to continued cooperation on the procurement of defense articles, such as the F35s and, as EDA grant transfers, C-130H aircraft and Littoral Combat Ships. The United States and Greece discussed possible mutual benefits of co-designing and co-producing Constellation class frigates, including the economic benefits for Greece’s shipyards and the cooperation between the defense innovation ecosystems of the two countries.”

Incredibly, Greece has more fighter jets than the UK or France, and more tanks than the UK and France combined. Greece’s geographic positioning, military arsenal, and shipyard infrastructure make the country a valuable partner for the US well into the future.

That’s why the US is currently pursuing a variety of investment packages surrounding infrastructure, energy, and military installations throughout Greece.

Getting Greek Gains

Despite the improving conditions within Greece, the future holds no guarantees. Still, with valuations so low it’s hard to ignore this country that has historically been a major power.

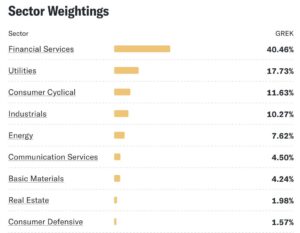

The easiest way to gain exposure to Greece is through the ETF $GREK, which holds a basket of Greek companies. Trading with a P/E of 8 and small yield of 2%, this ETF holds a relatively diverse set of industries.

If you really want to go bargain hunting, then you should be sniffing around Greek shipping companies. They are about as cheap as public markets get. Here are 15 Greek shipping companies trading on US markets:

If you’ve made it this far, let me know what you think.

Also, if you want the ‘video version’ of everything above, check out the video below: