“I have no desire to suffer twice, in reality and then in retrospect.”

– Sophocles

If we look back at nearly every single financial crisis in the world, we can clearly identify the cause.

The US housing crash in 2008 was the result of lending money to people who couldn’t pay back their loans.

Of course, there were a lot of other reasons for the 2008 financial crisis, but most people can sum up the entire disaster in one sentence – just as I did above.

Now, in 2017, we can look back to that time and say, “What were we thinking? How did we not see it coming? Why did we think housing prices would go up forever? And why the heck were banks lending money to people who clearly should not have been borrowing?”

Oh well, that’s the past. We move on.

But… does that mean we just run into the next crisis with our blinders on? What can we see happening right now that will end up in disaster?

Baby boomers.

(This is most apparent in the US, however, there are many countries throughout the world that are experiencing almost identical situations.)

They caused rampant inflation during the 1970s and 1980s as they flooded the job market.

They fueled the longest bull market run in history during the 1990s that eventually led to the 2000 market crash.

They ran home prices up in 2008 as they purchased their McMansions.

And now they are fueling another market bubble that has yet to explode.

If you’re offended by this attack on baby boomers, don’t worry, I’m not actually blaming baby boomers themselves.

Instead, I’m just pointing out the correlation of the baby boomer’s spending habits to the economy. And since the baby boomers are the largest portion of the population, they are the most influential.

So what are baby boomers doing now?

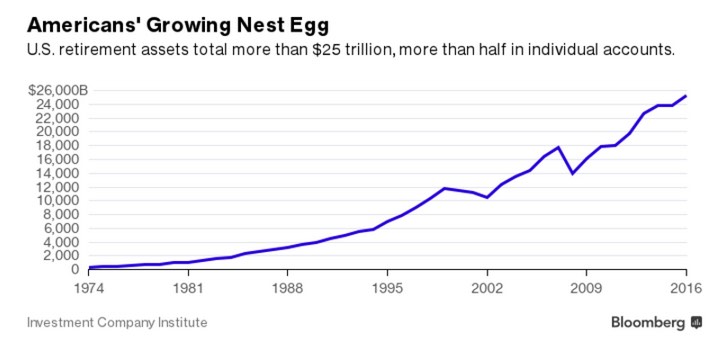

Source: Bloomberg

In practice, this is a very wise way to live. Save more than you spend, invest, and don’t live beyond your means.

But, for the larger economy, this can be disastrous for 2 main reasons:

#1 Less money is being spent in the local economy.

This is essentially a breakdown of the market. If the wealth of the boomers is not being transferred to the younger generations, how will the market continue to grow?

#2 Asset prices get further driven up.

Even though boomers aren’t spending money in their local economy, they are spending money to invest. That means that stock prices, real estate, and a variety of investment areas get bid up beyond reasonable valuations.

For all generations under the boomers, they are getting a ‘double whammy.’ Not only is money not being spent in the local economy, but things are getting expensive.

How are you supposed to buy things that are getting more expensive while your earnings are declining?

I can tell you how this story ends…

Eventually, things will come back to equilibrium. But the journey to that equilibrium will be rough. Real rough.

That’s also why I’ve recommended avoiding areas of the market that are overvalued.