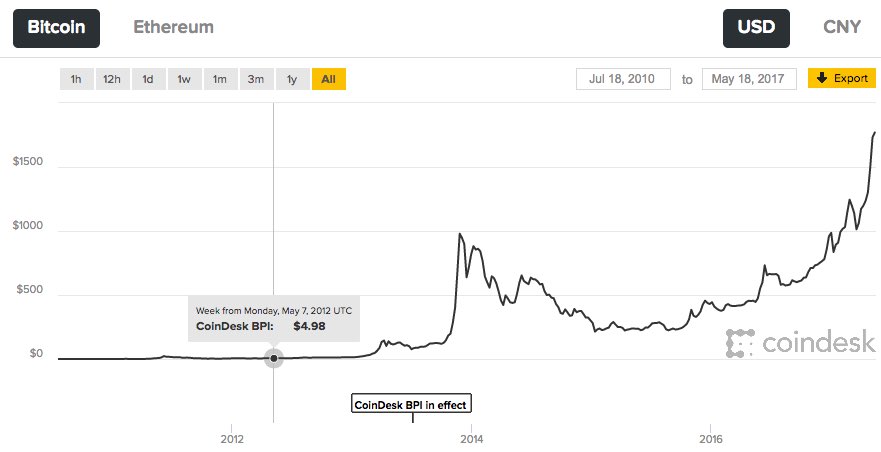

In 2012 I bought $1,000 worth of Bitcoin at an average price of $5.

Today, those 200 Bitcoins are worth about $360,000.

That’s a lot of money and a tremendous return on my original investment. It’s by far the best return of any investment I’ve ever made.

When I made that first investment, I barely told anyone. I wasn’t keeping a secret or anything, it’s just that at the time Bitcoin was virtually unknown. And if you tried to explain what the cryptocurrency was, you’d just get weird looks.

“So, you’re telling me you spent $1,000 on a currency that is held in a computer and isn’t recognized by any government?” That was the normal question I got when I rarely brought up the idea of using Bitcoin.

“Well, yeah. But, it’s much more than that. You see, Bitcoin is decentralized, so it can’t be manipulated by a government. It’s kind of like gold, but you can transfer it over the internet,” I’d tell people.

“So it’s gold on the internet?” They’d ask.

“Well, kind of. But, really the most important thing is the Blockchain. That’s the future. Bitcoin just uses the Blockchain,” I’d respond.

At this point, I’d get a blank stare. So, then I’d move the conversation onto a different topic.

I was very excited about Bitcoin in 2012. I knew it would have a bright future.

Then, in 2013 I started to trade Bitcoin. When I say “trade,” it’s not like I was trading baseball cards for bubble gum. I was trading Bitcoin on a cryptocurrency brokerage based out of a foreign country.

I did very well. I almost doubled my position.

Today I would have well over $500,000 worth of Bitcoin.

Source: Coindesk

Yes, I would have had.

Remember how I told you that I was trading Bitcoin on a foreign brokerage? Well the US government didn’t like that. Something about me being a US citizen trading cryptocurrencies on a foreign trading platform sounded weird to them.

The brokerage received a ‘notice’ to cease doing business with US citizens. With that threat, the brokerage froze my account which preventing me from making any trades.

Then, the brokerage went under.

I lost it all.

Poof! Gone.

I was devastated.

Keep in mind, this happened when the price of Bitcoin was still under $100. So, I lost a serious amount of money, but it wasn’t anywhere near what it would have been today.

At the time, I just chalked it up as a loss. In reality, I only lost my original $1,000. Little did I know that the price of Bitcoin would soar to over $1,800 and my potential holdings would have been worth over half a million dollars today.

So here is what I learned:

#1 Bitcoin is exciting. However, the Blockchain is even more interesting.

#2 Never put all of your assets into one account. That applies to regular fiat currencies, crypto currencies, and any other type of asset you hold. You must diversify where you hold your wealth.

#3 Never underestimate your vulnerability to an outside force. This doesn’t mean you should live in fear, but just be aware that you’re never 100% safe.

#4 Bitcoin is an excellent answer to fiat currencies that are highly controlled and manipulated. But gold, land, art, and collectibles are also great options. Bitcoin is NOT the ultimate solution.

#5 The Blockchain (which Bitcoin is built upon) will have a huge impact in the future. Many companies are developing technologies which utilize the Blockchain, so it’s important to learn about how it works now.

Clearly, I made a lot of mistakes.

However, hindsight is 20/20 and I would have never guessed what that original $1,000 investment could have turned into.

Despite this painful learning experience, there is one thing that I can take away more than anything:

Be open to new ideas and changes.

When I first invested in Bitcoin, a large majority of people assumed Bitcoin was just a big scam. I’d attribute this assumption due to lack of understanding.

Learning about Bitcoin and how the Blockchain works was very difficult in the beginning. But, if you take the time to look at the facts with an open mind, you’ll be amazed.

That’s how I try to approach any new investment.