Over the next several years, we are going to see an enormous amount of change around the world. Financial structures, economic relations, cultural priorities, and everything in between are going to be massively disrupted.

Much of this change will be fueled by years of global financial mismanagement and government short-sightedness. But people’s priorities will also be to blame for the coming transformations our world will experience.

The truth is that, relative to all of human history, the 21st century has been incredible. Human health is at all time highs, global crime and war is at all time lows, and economic equality is the best it’s ever been.

But we’ve gotten lazy. We’re undisciplined, distracted by irrelevant cultural conflicts, and have lost sight of the process that has gotten humanity to where it currently sits.

This doesn’t mean we’re destined for doom. It just means we have to get back on track. We need to reorganize and reprioritize the principles and processes that have led to past successes.

It’s not going to be easy. There will be a lot of pain along the way. But it needs to happen. And it’s already starting…

Countries First, Alliances Next

The largest global changes we’ll see in the coming years will result from global alliances being reshuffled. We’re already seeing the beginning of these changes as wars and regional conflicts continue to break out.

But before these global alliances settle back into their new structures, there will be massive change in individual countries. For some countries, these changes have already taken place or are currently underway. For other countries, transformation is on the near horizon.

Although it’s likely that every single nation around the world will be impacted by events in the coming years, there are three countries right now that are worth keeping an eye on. That’s because their immediate future could look drastically different than it has over the past several years. And with these changes comes massive opportunities.

New Zealand Swings Right

When asked to identify a location to ride out the next global conflict, wealthy individuals typically point to New Zealand first. That’s why there has been a mass wave of foreign property investors who have secured their bug out locations throughout the Land of the Long White Cloud.

Ironically, New Zealand was one of the worst places to ride out the pandemic. The left leaning government implemented some of the harshest lockdowns anywhere. “Snap lockdowns,” which required residents to remain in their homes for an entire week, were implemented in Auckland when a single person tested positive.

This resulted in enormous economic impacts to the country. Domestic productivity was essentially smothered while tourism and trade were also significantly impacted.

Now things are changing…

This past weekend, New Zealand overwhelmingly voted in a right-leaning government. Their platform promised to correct the past administrations policies which lead to “an increase in crime and wasted too much money on government bureaucracy and ideological projects.”

Along with electing its most conservative government in decades, New Zealand is much more likely to join the US, the UK, and Australia in the recently formed AUKUS partnership.

Specifically, New Zealand would be considering “the package known as AUKUS Pillar 2, which involves the sharing of advanced technologies, including artificial intelligence (AI), quantum computing, cyber, undersea capabilities, hypersonic weapons, information-sharing and electronic warfare.” –BD

With a relatively stable foundation to begin with, New Zealand is a country to keep a close eye on in the coming years.

Argentina Goes Anarcho-Capitalist

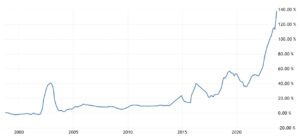

Last month, Argentina’s official inflation rate hit 138%. While that number is hard to comprehend, the past 25 years have been a complete disaster for Argentina’s currency. Here is what inflation has looked like since 2000:

Source: TE

Although Argentina was one of the richest countries in the world in the early 20th century, the nation has struggled under socialist agendas for the past century. Despite having enormous natural resource wealth and a sophisticated culture, the country just can’t get it together.

However, that may soon change as a new generation of frustrated Argentinians are looking to completely change the way the country is lead.

This coming Sunday is the Argentinian presidential election and the current front runner is Congressman Javier Milei. Although he’s most aligned with libertarian ideologies in the US, he also adheres to anarcho-capatalist ideals.

Regardless of what his specific political category he fits into, he’s by far the most opposite of any leader to be elected to lead Argentina in over 100 years.

He has committed to essentially overhaul the entire government – top to bottom. Ironically, he also wants to ditch the Argentina peso all together, and transition to a US dollar based economy (similarly to Ecuador, Panama, and El Salvador).

Will Milei be able to turn his country around and fight the assumedly powerful deep state that will be against him? Time will tell…

But, if he can impact the country in any positive way, foreign investors will be excited to enter a market that has traditionally been a money trap.

El Salvador Cleans House

Having personally traveled to El Salvador many times in the past, with several terrifying experiences, I never thought I’d be writing about the turn around of this tiny nation.

However, two major initiatives which have been led by 42-year-old President Nayib Bukele have had serious impacts.

First, starting in 2021, El Salvador adopted bitcoin as legal tender, making it the first country in the world to do so. This move has not only driven interest from outside investors and businesses, but it has also significantly strengthened the country’s financial reputation.

Second, Bukele has implemented one of the most serious crime crackdowns any nation has ever seen. Since March of 2022, over 73,000 alleged gang members have been arrested throughout the country. This has been achieved by military and local police executing raids throughout neighborhoods that were previously considered ‘no-go’ zones.

The adoption of bitcoin and crackdown or violent crime have had noticeable effects on the country’s economy, which expects to make a new deal with the IMF next year. Tourism has also seen a boost as more people are noticing the opportunities. Even more, 60% of Salvadorans who previously emigrated from the country due to crime and a failing economy, are considering returning to their home country.

Perhaps El Salvador should be on our list of future destinations…?

3 For Now, Many More to Come

The above three countries are just the tip of the iceberg when it comes to transitioning governments and shifting social priorities. It’s highly likely that many more nations will begin to change their directions towards policies and initiatives that are based in rationale and results.

For investors who are stuck in the mindset of the past decade, there will be some rude awakenings being served up. However, for those who are comfortable with change and embrace the opportunities that come with these transitions, there will be some incredible times to come!

The easiest way to play this trend is to invest in emerging markets. Here are two ETFs that do just that:

- iShares MSCI Emerging Markets ETF ($EEM)

- Vanguard Emerging Markets Stock Index Fund ($VWO)

Vanguard’s $VMO looks more attractive, as it only has a 0.08% management fee. This ETF currently trades at a P/E of 10 and yields about 3%.

For comparison, $SPY (S&P 500 ETF) has a P/E of 21 and yield of 1.5%. Meanwhile, $QQQ (NASDAQ ETF) has a P/E of 29 and yield of 0.6%.

Of course, US markets will likely always carry a premium and will likely have many more great days to come. But that doesn’t mean there won’t be some great opportunities in other parts of the world.