Fidel’s Dead, Invest in Cuba

For a lot of investors, Fidel Castro’s death looks like a buying opportunity.

Now that the communist leader is gone, there is money to be made… right?

Well… kind of.

Cuba actually passed a law two years ago to encourage foreign investment, and they are not exactly hitting their goals. Of the $2.5 billion per year they were aiming to get, they’ve only received $1.3 billion since 2014.

Germany, Spain, Canada, and even the US are among those initial investors. But, I’m staying far away.

Even though Cuba is clearly changing, there is far too much risk with not enough upside potential for me.

The fact is that Raul Castro (Fidel’s brother) is still in power and the island nation has a long road ahead of them.

However, I do know of one way to make money from Cuba’s (hopeful) transition. (And the best part is that this idea can be reproduced for any country in the world.)

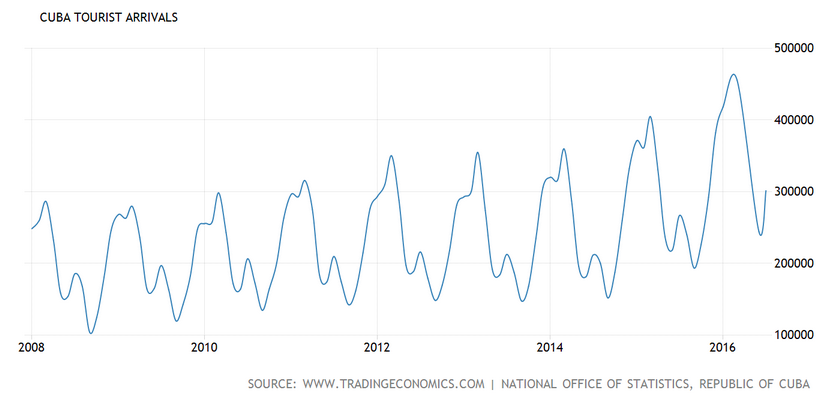

Over the past several years, tourism to Cuba has really started to increase. This is in large part to the change in US policy and the push that Cuba has been making to attract money.  We know that tourism is increasing and that many potential tourists are starting to get curious about traveling to the communist island. So why not profit from this opportunity?

We know that tourism is increasing and that many potential tourists are starting to get curious about traveling to the communist island. So why not profit from this opportunity?

Here is how you can do it… and it doesn’t matter where you live in the world.

#1. Go buy a domain. Something like www.way2cuba.com or some easy URL that suggests traveling to Cuba. (This URL was actually available when I looked.) #2. Create a simple website with content about Cuba. List some facts, write a couple articles, and show some beautiful pictures.

#2. Create a simple website with content about Cuba. List some facts, write a couple articles, and show some beautiful pictures.

#3. Throughout the website, list services such as travel agencies, airlines, cruises, tours, or visa services that cater to Cuba tourists. Ensure that each link you provide offers an affiliate profit sharing program. So basically, if you link to a travel agency service, you want to make sure that you get a small cut of every booking that is made through that link. Most major companies do this, with the most famous service being Amazon.

#4. Check into the site about once a week to post new content, work on your SEO, and find new affiliates. Really, you don’t have to do much once the site is up and running. The more traffic you have the more potential affiliate sales you can make. Of course, if you don’t have much traffic, you won’t make many sales. However, other than the initial set up of the site, the majority of income is made completely passively.

This exact strategy can be used for any country or destination. Just create a site and write content about whatever location you are familiar with. Cuba has been in the news lately, so you’d naturally get a lot of attention.

–

On the stock investing side, the ticker symbol $CUBA is an interesting play. This morning is seeing about a 10% bump fueled mostly by Fidel’s death.

However, if we take a look into their financials we can see that this is actually a good investment, as the stock is currently trading for less than their NAV (net asset value).

This means that if you add up the value of all the fund’s holdings and then you compare that number to the stock price, the stock price is less. You’d be buying the holdings for a discount.

Additionally, the fund is a closed-end management investment company. This means that they only issue a certain amount of shares, which prevents dilution. This can create a ‘price premium’ to these shares because no new shares will be issued.

Unlike most ETFs, which create new shares based on demand, a closed=end fund can trade for many times the multiple of the NAV. Right now, $CUBA is trading for less than the NAV of it’s holdings.

Finally, $CUBA doesn’t just invest in Cuba. In fact, most of it’s holdings are US companies and a variety of Caribbean and Central American corporations. So, really you’re investing in that region, not just Cuba. This region is largely fueled by commodity prices and political instability.

As I wrote about depressed commodity prices here and the fact that much of that area has reached rock bottom in political terms, this fund looks attractive.