How To Feed One Billion New Mouths

The solution is simple… the execution of that plan? That’s another story…

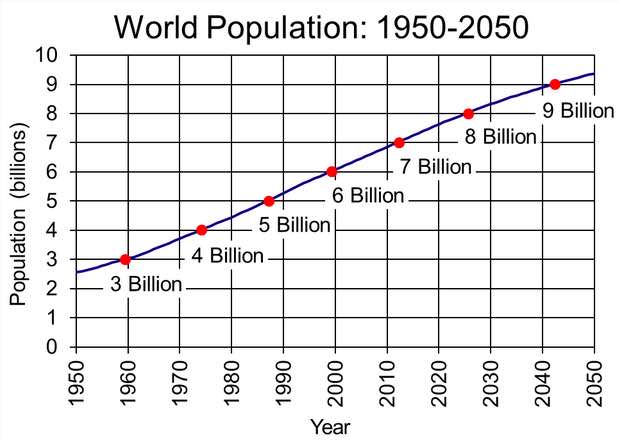

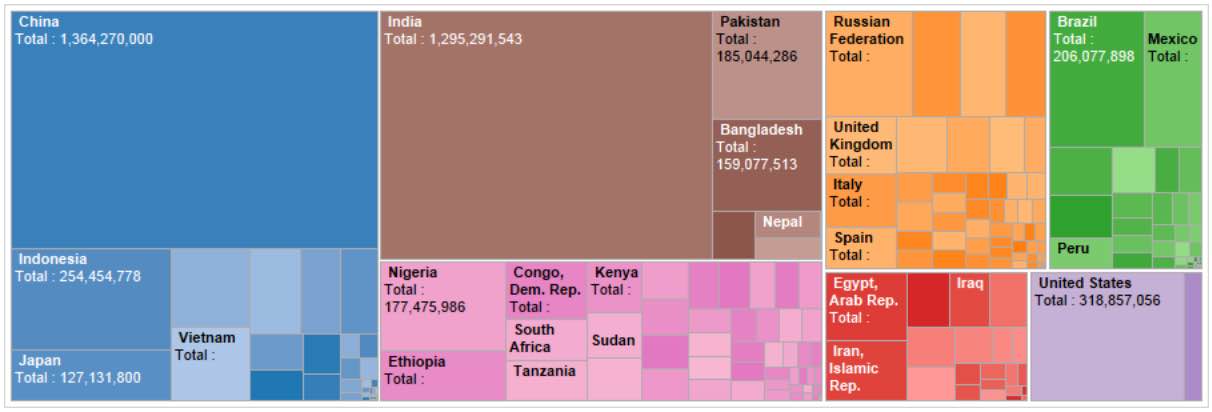

The UN just released an updated report on population growth, which projects that there will be 8.6 billion people on earth by 2030.

This is up from the previous estimate of 8.5 billion by 2030.

With the world’s current population at 7.6 billion, that’s 1 billion more people on earth in just over 10 years!

Oh, and that’s just the estimate.

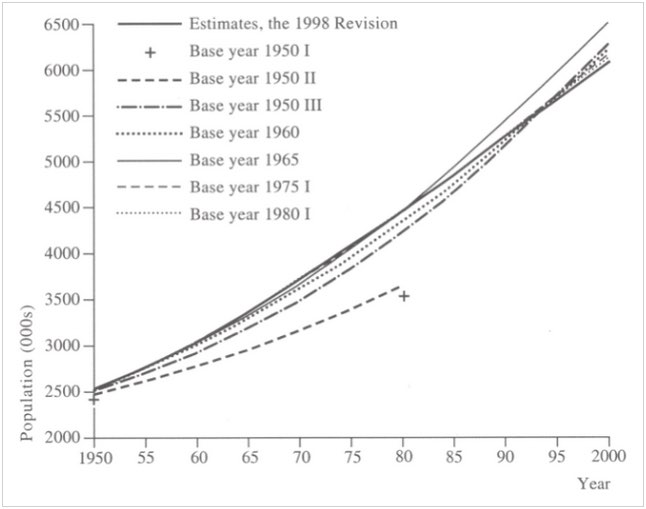

The UN has had a track record of consistently underestimating population growth since 1950.

Source: OWID

Source: OWID

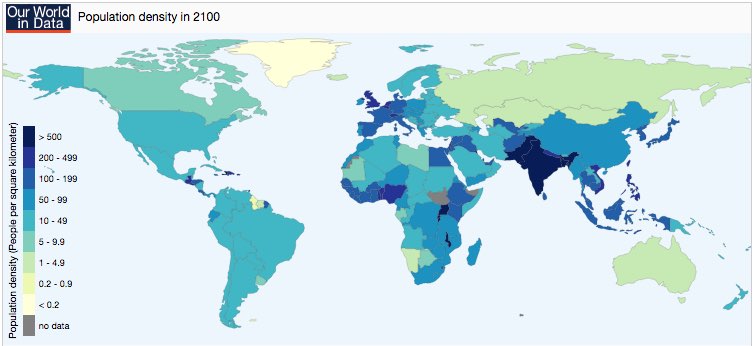

How are all of these mouths going to be fed?

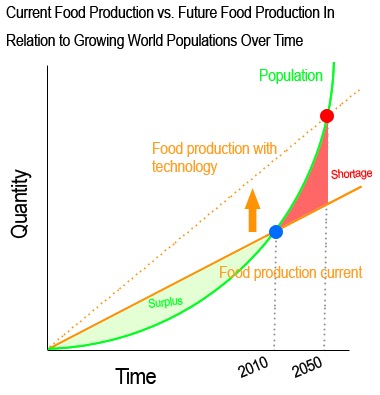

I think we all know the answer to that: We need to produce more food!

Source: AFW

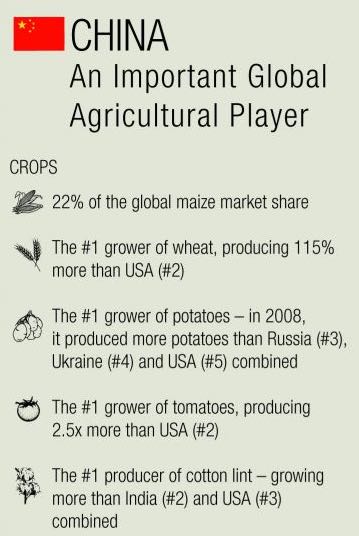

And that’s exactly what China is on a mission to do.

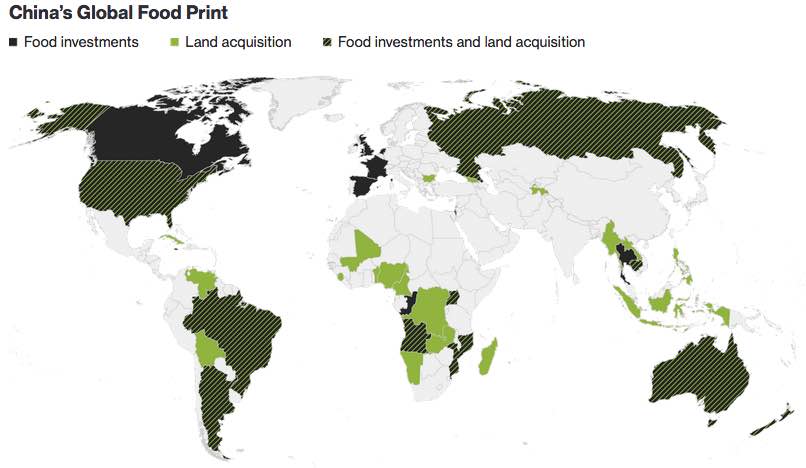

The Chinese have been acquiring agriculture land or investing in food production throughout the world. North America, South America, Europe, Africa, Australia, Asia, you name it and they have probably spent money there.

Source: Bloomberg

And that’s in addition to what is already being produced in China.

So, while China may be the first society to deal with this food crunch, the inevitable spread of food shortages to other growing nations is only a matter of time.

Source: DataTopics

Now, I have no doubt that we humans will overcome this challenge. We will figure out how to produce more food for our growing population.

To do this, there are several things that are inevitably going to happen:

- Farming must get more efficient. The actual process of growing and harvesting produce will become more streamlined with higher output and less waste.

- Food consumption must get more efficient. The transportation and consumption of food will become a bigger issue as waste will simply not be tolerated – it won’t be affordable.

- Agricultural land will become more valuable. This is simple supply and demand economics. Prices will go up as demand increases and supplies decrease.

From an investing standpoint, this is an area that you should start to expose yourself to.

Commodities are trading at historical lows, which has lowered the entry price of many agricultural investments.

A simple way to invest in this area is to look at agriculture ETFs $JJG and $DBA.

However, an even better way to invest in this area is to actually buy positions in operating farms. This will provide returns over 10% per year, even with current depressed prices. If (when) prices go up, the returns go up as well.

Next week I’ll have an actual agriculture investment that you can buy into.