In the early 1960s, flying from the US to Japan was a big deal. Japan Airlines had just started making transpolar flights the previous year with tickets being hard to come by and extremely expensive.

Traveling outside of the US at the time, let alone to Asia, was a very rare and unnecessary trip for most Americans. Why leave the US when you have a great economy, natural beauty, and opportunity around every corner?

Even though most people in the US weren’t leaving the comforts of their home, 24-year-old Phil Knight set off on an adventure that would eventually land him in Kobe, Japan. While there, he toured a factory that made ‘Tiger’ running shoes that were made better than what was available in the US and cost just a fraction.

Phil made an arrangement where he secured the distribution rights for the western United States for Tiger shoes. Because of the high quality and low cost of manufacturing, Knight was able to have success, as other companies couldn’t compete.

By now you know where this story leads… Nike was officially launched in 1971, which has subsequently lead to Phil Knight becoming the 21st richest person in the world.

There is no discounting Knight’s business acumen, persistence, and vision. But, there is something to be said about his early success correlating to his trip to Kobe, Japan. Would he have ‘stumbled’ across the opportunity with Tiger if he hadn’t traveled to Japan? Of course not.

To be clear, Phil didn’t just happen to find those shoes in Japan. He was on a search to find the best made shoes for the lowest prices, so he could create a business that was like no other. As a runner himself, he understood the demand and what consumers would pay for a shoe that would actually fit and work well.

Today, the practice of traveling to different countries to source products is totally normal. It doesn’t take a rocket scientist to understand that manufacturing products at a lower cost increases the profits of a company. That, in turn, allows the company to grow faster and become larger, which further allows for economies of scale.

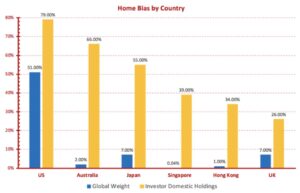

However, when it comes to our own personal investments, most investors have a strong ‘home country bias’ that prevents them from going where the opportunity sits. For example, Australians invest 66% of their portfolio in Australian based companies. However, the country of Australia makes up less than 3% of the global economy.

Source: LWM

Although the United States makes up more than 50% of the global economy, US citizens have nearly 80% of their wealth tied up in US based investments. In the event that the US experiences a downturn, the average investor there is almost guaranteed to lose money.

It makes sense for investors to have home country bias – it’s human nature to only get involved with things you understand and feel comfortable with. However, it’s highly unlikely that the best opportunities in the world are in your back yard, or even in your hemisphere.

That’s why it’s important to not only acknowledge that there may be better opportunities in far away locations, but more importantly, get comfortable with actually allocating your capital to those places.

But diversifying a portion of your investments to foreign location isn’t just about getting a higher return. It’s also about adding security to your wealth…

If you had to hold a million dollars worth of gold, would you bury the entire amount in your backyard?

Of course you wouldn’t. Sure, you might want to bury a little bit (or just hide it in the safest location in your house), but you would also choose several different locations to store the rest of that gold. You would do that because the threats of robbery, asset forfeiture, or a natural disaster are all real scenarios that could easily destroy one of the locations where your gold is stored.

Now, if we were to apply this concept to your broader portfolio – or, in simpler terms, your life savings – wouldn’t you want to protect what is yours by diversifying the locations of where your wealth is stored?

The easiest and best way to do that is to own foreign, cash-yielding real estate. Just like owning real estate in your home country, owning real estate in a far-away land can give you a passive income stream that is simple to understand. You invest in a property, you rent that property out to a tenant, you receive a return on your investment.

Adding to that, your investment is also outside of the country you live. That means that there is no way someone (or your government) can take that property from you – it’s in a different, sovereign country. There’s a reason why the ultra wealthy store so much of their wealth offshore!